Market Growth Projections

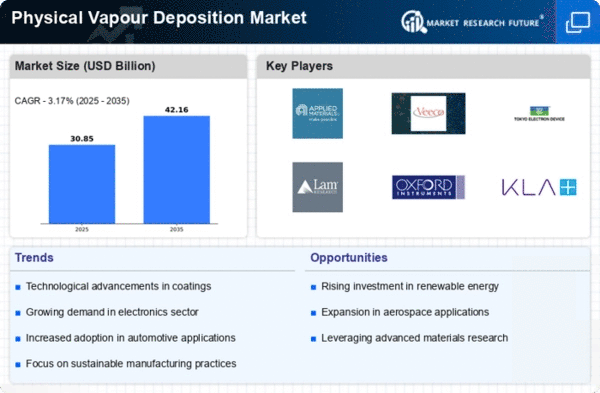

The Global Physical Vapour Deposition Market (PVD) Market Industry is projected to experience substantial growth in the coming years. With a market value of 29.9 USD Billion in 2024, it is expected to reach 42.2 USD Billion by 2035, reflecting a CAGR of 3.17% from 2025 to 2035. This growth trajectory indicates a robust demand for PVD technologies across various sectors, driven by advancements in technology and increasing applications. The market's expansion is indicative of the critical role that PVD plays in modern manufacturing processes, highlighting its importance in achieving high-performance coatings.

Automotive Industry Growth

The Global Physical Vapour Deposition Market (PVD) Market Industry benefits from the expanding automotive sector, where PVD coatings are increasingly utilized for enhancing the durability and aesthetics of vehicle components. With the automotive industry focusing on lightweight materials and improved fuel efficiency, PVD coatings provide an effective solution for reducing wear and tear on parts. The integration of PVD technology in automotive manufacturing is likely to contribute to the market's growth, as manufacturers seek to improve vehicle performance and reduce maintenance costs. This trend aligns with the overall market trajectory, which is projected to reach 29.9 USD Billion in 2024.

Technological Advancements

The Global Physical Vapour Deposition Market (PVD) Market Industry is experiencing rapid technological advancements that enhance deposition processes and improve coating quality. Innovations such as atomic layer deposition and magnetron sputtering are gaining traction, allowing for precise control over film thickness and composition. These advancements not only improve the performance of coatings but also expand their applications across various sectors, including electronics and aerospace. As a result, the market is projected to reach 29.9 USD Billion in 2024, reflecting a growing demand for high-performance materials that can withstand extreme conditions.

Growing Demand in Electronics

The Global Physical Vapour Deposition Market (PVD) Market Industry is significantly driven by the increasing demand for advanced coatings in the electronics sector. PVD techniques are essential for producing thin films used in semiconductors, displays, and photovoltaic cells. The rise of consumer electronics and the push for energy-efficient devices are propelling this demand. As the market evolves, it is expected to grow at a CAGR of 3.17% from 2025 to 2035, potentially reaching 42.2 USD Billion by 2035. This growth underscores the critical role of PVD in enhancing the performance and longevity of electronic components.

Diverse Applications Across Industries

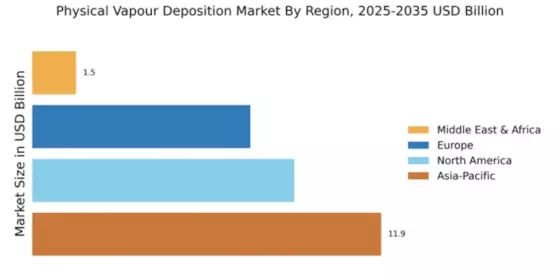

The Global Physical Vapour Deposition Market (PVD) Market Industry is characterized by its diverse applications across various sectors, including aerospace, medical devices, and optics. PVD coatings enhance the performance and longevity of components in these industries, providing solutions for wear resistance, corrosion protection, and aesthetic appeal. The versatility of PVD technology allows it to cater to specific industry needs, thus broadening its market reach. As industries continue to seek advanced materials that offer superior performance, the demand for PVD coatings is likely to increase, supporting the overall growth of the market.

Sustainability and Environmental Regulations

The Global Physical Vapour Deposition Market (PVD) Market Industry is influenced by the growing emphasis on sustainability and stringent environmental regulations. PVD processes are often favored for their lower environmental impact compared to traditional coating methods, as they typically require fewer hazardous materials and generate less waste. This shift towards eco-friendly manufacturing practices is prompting industries to adopt PVD technology, thereby driving market growth. As companies strive to meet regulatory requirements and consumer expectations for sustainable products, the demand for PVD coatings is expected to rise, contributing to the market's anticipated growth.