Advancements in Nanotechnology

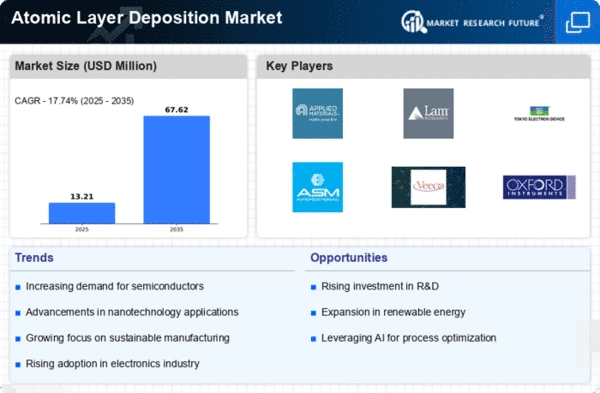

The Global Atomic Layer Deposition Market (ALD) Market Industry is propelled by advancements in nanotechnology, which require precise control over material properties at the atomic level. ALD enables the deposition of ultra-thin films with uniform thickness, essential for applications in nanostructured materials and devices. This technology is increasingly utilized in various sectors, including healthcare, electronics, and materials science. The growing interest in nanotechnology applications suggests a sustained demand for ALD processes, as industries seek to leverage the unique properties of nanoscale materials. The anticipated CAGR of 7.33% from 2025 to 2035 underscores the potential for growth in this sector.

Rising Demand for Advanced Electronics

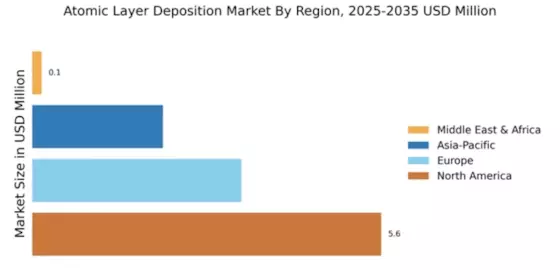

The Global Atomic Layer Deposition Market (ALD) Market Industry experiences a surge in demand driven by the rapid advancement of electronic devices. As manufacturers strive for miniaturization and enhanced performance, ALD technology provides the precision needed for atomic-scale control in thin film deposition. This is particularly evident in the semiconductor sector, where ALD is utilized for high-k dielectrics and metal gate applications. The market is projected to reach 5.67 USD Billion in 2024, reflecting the increasing reliance on ALD for producing next-generation electronic components. The trend indicates a robust growth trajectory, as the industry adapts to the evolving needs of advanced electronics.

Growth in Renewable Energy Technologies

The Global Atomic Layer Deposition Market (ALD) Market Industry is significantly influenced by the expansion of renewable energy technologies. ALD plays a crucial role in the fabrication of thin-film solar cells and energy storage devices, where precise material properties are essential for efficiency. The increasing global focus on sustainable energy solutions drives investments in ALD processes, enhancing the performance of photovoltaic cells and batteries. As the market evolves, the integration of ALD in these technologies is expected to contribute to a notable increase in market size, potentially reaching 12.34 USD Billion by 2035, highlighting the synergy between ALD and renewable energy advancements.

Regulatory Support for Advanced Manufacturing

The Global Atomic Layer Deposition Market (ALD) Market Industry is positively impacted by regulatory support aimed at promoting advanced manufacturing technologies. Governments worldwide are increasingly recognizing the importance of ALD in enhancing manufacturing capabilities and competitiveness. Initiatives that encourage the adoption of ALD processes in various industries, including electronics and energy, are likely to foster innovation and drive market growth. This regulatory environment creates a favorable landscape for companies to invest in ALD technologies, potentially leading to increased production efficiency and product quality. As a result, the market is expected to thrive in response to supportive policies and funding opportunities.

Increased Investment in Research and Development

The Global Atomic Layer Deposition Market (ALD) Market Industry benefits from heightened investment in research and development across various sectors. As industries recognize the advantages of ALD in producing high-quality thin films, funding for innovative applications and process improvements is on the rise. This trend is particularly evident in the semiconductor and materials science fields, where R&D efforts focus on enhancing deposition techniques and expanding the range of materials that can be processed using ALD. The influx of investment is likely to accelerate technological advancements, further solidifying ALD's position in the market and contributing to its growth trajectory.