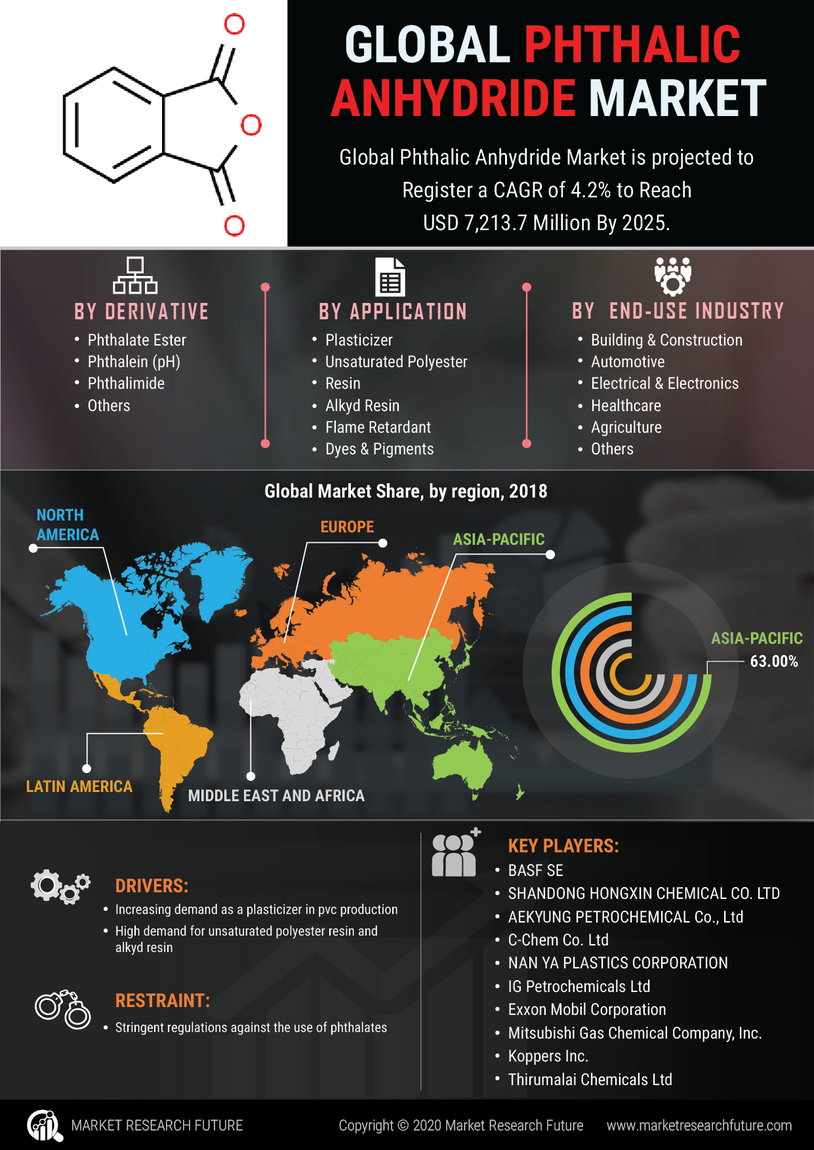

Rising Demand for Plasticizers

The Phthalic Anhydride Market is experiencing a notable increase in demand for plasticizers, which are essential additives in the production of flexible PVC. As industries such as construction and automotive expand, the need for high-performance plastic materials rises. In 2025, the demand for plasticizers derived from phthalic anhydride is projected to grow significantly, driven by the increasing use of PVC in various applications. This trend suggests that manufacturers are likely to invest in phthalic anhydride production to meet the escalating requirements of the plastic industry, thereby enhancing the overall market dynamics.

Expansion of the Textile Industry

The Phthalic Anhydride Market is also influenced by the expansion of the textile industry, where phthalic anhydride is utilized in the production of dyes and pigments. As fashion trends evolve and consumer preferences shift towards vibrant colors and high-quality fabrics, the demand for phthalic anhydride in textile applications is expected to rise. In 2025, the textile sector is likely to contribute significantly to the overall consumption of phthalic anhydride, suggesting a strong interdependence between textile innovation and phthalic anhydride supply.

Growth in Coatings and Paints Sector

The Phthalic Anhydride Market is poised for growth due to the expanding coatings and paints sector. Phthalic anhydride is a key ingredient in the formulation of alkyd resins, which are widely used in protective coatings and decorative paints. As construction activities and infrastructure development continue to rise, the demand for high-quality coatings is expected to increase. In 2025, the coatings sector is anticipated to account for a substantial share of the phthalic anhydride market, indicating a robust correlation between construction growth and phthalic anhydride consumption.

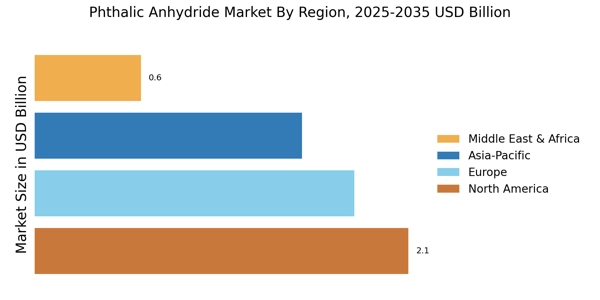

Emerging Markets and Economic Development

The Phthalic Anhydride Market is witnessing growth driven by emerging markets and their economic development. As countries industrialize, the demand for various chemical products, including phthalic anhydride, is on the rise. This trend is particularly evident in regions where infrastructure projects and manufacturing capabilities are expanding. In 2025, it is anticipated that emerging economies will play a crucial role in shaping the phthalic anhydride market, as increased industrial activity leads to higher consumption rates of this essential chemical.

Increasing Use in Unsaturated Polyester Resins

The Phthalic Anhydride Market is benefiting from the growing utilization of unsaturated polyester resins (UPR) in various applications, including automotive, marine, and construction. UPRs, which are produced using phthalic anhydride, are favored for their excellent mechanical properties and resistance to environmental factors. The automotive sector, in particular, is likely to drive demand for UPRs, as manufacturers seek lightweight and durable materials. Projections for 2025 indicate a steady increase in the consumption of phthalic anhydride for UPR production, reflecting the material's critical role in advancing modern manufacturing processes.