Market Analysis

In-depth Analysis of Phenolic Antioxidant Market Industry Landscape

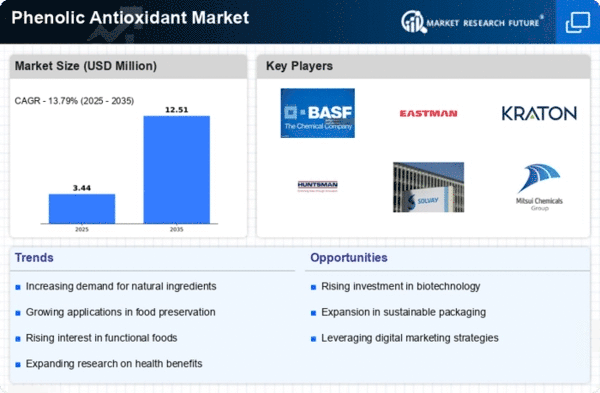

This section depicts various aspects like drivers behind demand, supply-side challenges, and overall trends that affect demand/supply dynamics for such chemicals as phenolic antioxidants (PA) within different industries, including polymers processing or lubrication production chain (economy). They extend the life expectancy of products by inhibiting oxidative rancidity, hence their use on materials such as plastics, lubricating oils, and polymers, among others. Global supply-demand equilibrium is highly expressed in the Phenolic Antioxidant market. Both global and domestic economic conditions are significant determinants regarding the demand for these antioxidants within different sectors. This implies that during the economic downturn, the usage of phenolic antioxidants may drop due to reduced industrial activities, while increased application in various industries arises from economic growth. The investment decisions, production volumes, and pricing strategies are all significantly affected by the health of the world economy. Environmentally-based considerations have increasingly impacted how dynamics in the Phenolic Antioxidant market develop. With more focus now placed on sustainability and other forms of ecological consciousness, there is a growing need for antioxidants that will have a minimal negative impact on the environment. Manufacturers have been under pressure to improve their ecological profiles by incorporating greener techniques for making phenolic antioxidants. The Phenolic Antioxidant Sector as Competitive Market Competition among phenolic antioxidant compounds is fierce because these agents play an important role in extending the life of different materials. To stand out, manufacturers should concentrate on product quality, cost-effectiveness, and innovation. Gaining Market Share through Differentiation Strategies: Specializing Concentric Circle Phenolic Antioxidant Formulations Continuous research & development (R&D) activities are mandatory for enterprises competing within this industry as they seek to meet ever-changing customer requirements and outdo rivals' products offered today. Geopolitics and trading policies give direction to how the Phenolic Antioxidant market moves. They can be affected by tariffs, import/export regulations, or even geopolitical tensions, which may influence the global supply chain, causing differences in the availability and pricing of phenolic antioxidants in different regions. Regulations and standards heavily influence the Phenolic Antioxidant market. Market acceptance requires manufacturers to adhere to safety standards, environmental requirements, and quality regulations, among others. Consumer preferences and trends also influence the dynamics of the phenolic antioxidants market. The demand for phenolic antioxidants might change quite significantly due to changes in consumer inherent needs that include issues such as health and safety concerns, sustainable sourcing practices, and other relevant industrial activities.

Leave a Comment