Increasing Pharmaceutical Expenditure

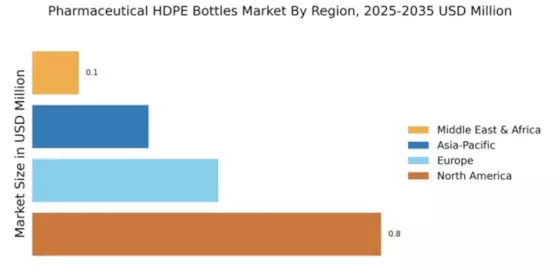

The Global Pharmaceutical HDPE Bottles Market Industry is benefiting from the rising expenditure on pharmaceuticals worldwide. Governments and private sectors are investing heavily in healthcare, leading to an increase in the production and consumption of pharmaceutical products. This surge in demand for medications directly correlates with the need for effective packaging solutions, such as HDPE bottles. As pharmaceutical companies strive to meet the growing demand, the market for HDPE bottles is expected to expand. The anticipated compound annual growth rate of 4.16% from 2025 to 2035 underscores the industry's potential for sustained growth.

Rising Demand for Sustainable Packaging

The Global Pharmaceutical HDPE Bottles Market Industry is experiencing a notable shift towards sustainable packaging solutions. As environmental concerns gain traction, pharmaceutical companies are increasingly opting for HDPE bottles due to their recyclability and lower carbon footprint. This trend is further supported by regulatory frameworks promoting eco-friendly practices. For instance, the European Union's directives on plastic waste management are likely to influence global manufacturers to adopt HDPE bottles, which are perceived as more sustainable compared to alternatives. This shift could contribute to the market's projected growth, with the industry expected to reach 17.0 USD Billion in 2024.

Growing Preference for Liquid Medications

The Global Pharmaceutical HDPE Bottles Market Industry is witnessing a growing preference for liquid medications, which are often packaged in HDPE bottles. This trend is influenced by the increasing incidence of chronic diseases that require liquid formulations for better patient compliance. As healthcare providers and patients favor liquid medications for their ease of administration, the demand for HDPE bottles is expected to rise correspondingly. This shift in medication preference is likely to contribute to the overall expansion of the market, as manufacturers adapt their packaging strategies to meet evolving consumer needs.

Regulatory Compliance and Safety Standards

Regulatory compliance plays a crucial role in shaping the Global Pharmaceutical HDPE Bottles Market Industry. Stringent safety standards imposed by health authorities necessitate the use of high-quality packaging materials that ensure the integrity and safety of pharmaceutical products. HDPE bottles are favored for their chemical resistance and ability to maintain product stability. Compliance with regulations, such as those set forth by the FDA and EMA, drives pharmaceutical manufacturers to select HDPE bottles as their preferred packaging solution. This adherence to safety standards is likely to bolster market growth as companies prioritize consumer safety and product efficacy.

Technological Advancements in Manufacturing

Technological innovations in the production of HDPE bottles are significantly impacting the Global Pharmaceutical HDPE Bottles Market Industry. Advanced manufacturing techniques, such as blow molding and injection molding, enhance the efficiency and quality of bottle production. These technologies not only reduce production costs but also improve the precision of bottle designs, catering to specific pharmaceutical needs. Moreover, the integration of automation and smart manufacturing processes is likely to streamline operations, thereby increasing output. As a result, the market is poised for growth, with projections indicating an increase to 26.6 USD Billion by 2035.