Environmental Regulations

The implementation of stringent environmental regulations in the United States is influencing the hdpe pipes market. Regulatory bodies are increasingly mandating the use of eco-friendly materials in construction and infrastructure projects. The hdpe pipes market is likely to see a surge in demand as these pipes are recyclable and have a lower environmental impact compared to traditional materials. Compliance with these regulations not only enhances the sustainability of projects but also encourages the adoption of hdpe pipes in various applications. As municipalities and companies strive to meet these environmental standards, the market for hdpe pipes is expected to grow, driven by the need for compliant and sustainable solutions.

Technological Innovations

Technological innovations in the manufacturing processes of hdpe pipes are contributing to the growth of the market. Advances in production techniques have led to the development of higher quality and more durable pipes, which are increasingly favored in various applications. The hdpe pipes market is benefiting from these innovations, as they enhance the performance characteristics of the pipes, such as resistance to impact and UV degradation. Furthermore, the integration of smart technologies in piping systems is emerging as a trend, allowing for better monitoring and management of water resources. This could potentially lead to increased efficiency and reduced operational costs, making hdpe pipes an attractive choice for both public and private sector projects.

Infrastructure Development

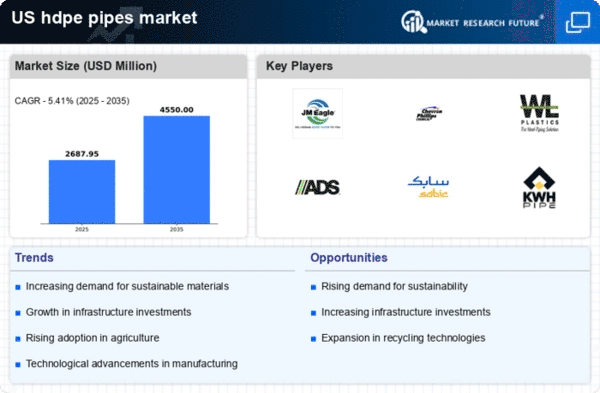

The ongoing infrastructure development in the United States is a primary driver for the hdpe pipes market. With the government investing heavily in upgrading water supply systems, sewage systems, and irrigation networks, the demand for durable and efficient piping solutions is increasing. The hdpe pipes market benefits from this trend, as these pipes are known for their resistance to corrosion and flexibility. According to recent estimates, the infrastructure sector is projected to grow at a CAGR of approximately 5% over the next few years, which could significantly boost the demand for hdpe pipes. Furthermore, the emphasis on replacing aging infrastructure is likely to create additional opportunities for manufacturers in the hdpe pipes market, as municipalities seek reliable solutions to enhance their water management systems.

Water Conservation Efforts

Water conservation initiatives are becoming increasingly critical in the United States, driving the hdpe pipes market. As drought conditions persist in various regions, there is a heightened focus on efficient water management practices. The hdpe pipes market is well-positioned to support these efforts, as these pipes are designed to minimize leakage and maximize flow efficiency. Recent studies indicate that the adoption of hdpe pipes in irrigation systems can reduce water loss by up to 30%, making them an attractive option for agricultural applications. Additionally, the growing awareness of sustainable practices among consumers and businesses is likely to further propel the demand for hdpe pipes, as stakeholders seek to implement solutions that align with water conservation goals.

Rising Demand in Construction

The construction sector in the United States is experiencing a resurgence, which is positively impacting the hdpe pipes market. As new residential and commercial projects emerge, the need for reliable piping solutions is becoming more pronounced. The hdpe pipes market is expected to benefit from this trend, as these pipes are favored for their lightweight nature and ease of installation. Recent data suggests that the construction industry is projected to grow by approximately 4% annually, which could translate into increased sales for hdpe pipes. Moreover, the versatility of hdpe pipes makes them suitable for various applications, including drainage, plumbing, and industrial uses, further expanding their market potential.