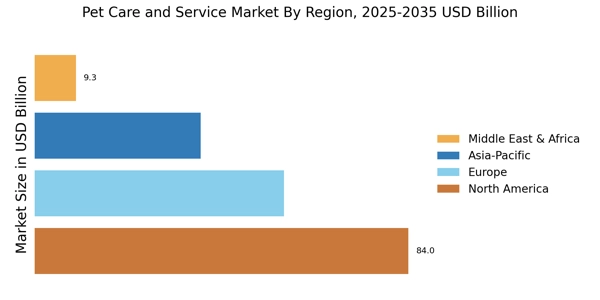

North America : Market Leader in Pet Care

North America is the largest market for pet care and services, accounting for approximately 45% of the global market share. The growth is driven by increasing pet ownership, rising disposable incomes, and a growing trend towards premium pet products and services. Regulatory support for pet welfare and health standards further catalyzes market expansion. The U.S. leads this region, followed by Canada, which holds about 15% of the market share. The competitive landscape in North America is robust, featuring key players such as Mars Petcare, Nestle Purina, and PetSmart. The presence of e-commerce platforms like Chewy and Petco has transformed the retail landscape, making pet products more accessible. Additionally, innovative services like pet insurance from Trupanion and subscription boxes from BarkBox are gaining traction, enhancing customer engagement and loyalty.

Europe : Emerging Market Dynamics

Europe is witnessing significant growth in the pet care market, holding approximately 30% of the global share. The demand is fueled by increasing pet ownership, particularly in countries like Germany and the UK, where pet humanization trends are prominent. Regulatory frameworks promoting animal welfare and safety standards are also pivotal in shaping market dynamics. The region's second-largest market, France, contributes around 10% to the overall share, reflecting a growing consumer base. Leading countries in Europe include Germany, the UK, and France, with a competitive landscape featuring major players like Nestle Purina and Spectrum Brands. The market is characterized by a mix of traditional retail and online platforms, with a notable rise in e-commerce. Innovative products and services, including organic pet food and health supplements, are increasingly popular, catering to the evolving preferences of pet owners.

Asia-Pacific : Rapid Growth and Innovation

Asia-Pacific is rapidly emerging as a significant player in the pet care market, accounting for about 20% of the global share. The growth is driven by rising disposable incomes, urbanization, and changing lifestyles that favor pet ownership. Countries like China and Japan are leading this trend, with China being the largest market in the region, holding approximately 12% of the global share. Regulatory improvements in pet care standards are also contributing to market growth. The competitive landscape in Asia-Pacific is diverse, with both local and international players vying for market share. Key players include Mars Petcare and local brands that cater to regional preferences. The rise of e-commerce platforms is transforming the retail environment, making pet products more accessible. Additionally, innovative services such as pet grooming and training are gaining popularity, reflecting the growing investment in pet care.

Middle East and Africa : Untapped Market Potential

The Middle East and Africa represent an emerging market in the pet care sector, holding approximately 5% of the global share. The growth is driven by increasing urbanization, rising disposable incomes, and a growing awareness of pet care. Countries like South Africa and the UAE are leading this market, with South Africa accounting for about 3% of the global share. Regulatory frameworks are gradually evolving to support pet welfare and safety, which is crucial for market expansion. The competitive landscape is still developing, with a mix of local and international players. Key players include Mars Petcare and local brands that cater to regional needs. The market is characterized by a growing trend towards premium products and services, including pet grooming and health care. E-commerce is also gaining traction, providing consumers with easier access to a variety of pet care products and services.