Performance Coatings Size

Performance Coatings Market Growth Projections and Opportunities

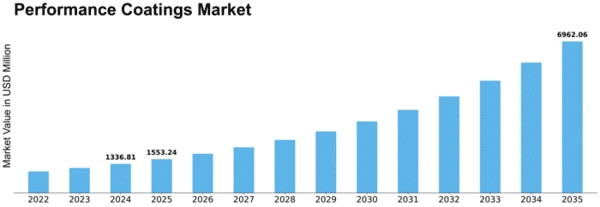

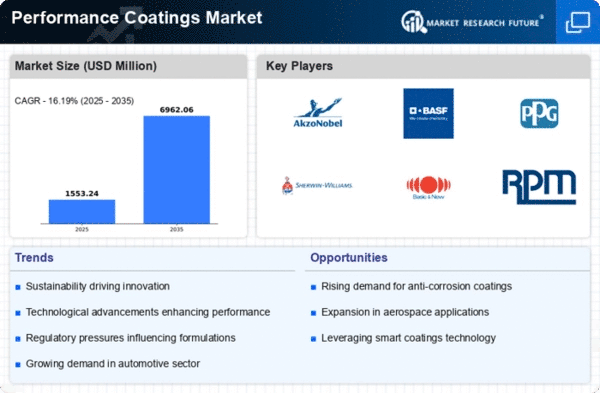

The Performance Coatings Market owes its dynamism and growth to the interplay of various market factors. One key determinant is the auto industry, which is a great consumer of performance coatings. Thus, with the continued global expansion of the automotive industry, there is an increasing demand for coatings that enhance corrosion protection, durability, and aesthetics. Further estimates given by MRFR analysis on this point indicate that this market will Register a CAGR of over 5.11% to become about USD 62.58 billion by 2028 end year. Besides, the construction business has had a significant influence on the performance coatings sector. The reason for such a consistent need is that as urbanization continues and more infrastructural projects are coming up in different parts of the world, there is a demand for coatings aimed at safeguarding surfaces from harsh environmental conditions like ultraviolet light, extreme climates, and pollutants, among others. Actually, the architectural landscape benefits greatly from the application of performance coatings since they help protect structures or buildings and enhance their aesthetic appeal, thus retaining beauty. On another note, the electronics and aerospace sectors also require a considerable amount of performance coatings supplies. In these cases, the provision may be necessary either to shield electronic part from rusting or corroding or even aircrafts' surfaces against weather elements such as rain water droplets or some salt sprays among other things capable of eroding them away slowly but surely through time until they cannot fly anymore without crashing down due lack sufficient structural integrity support system from those found within walls molecules where air flows through gaps between atoms just like any other liquid does not cover surface thin skin only few nanometers thick; but rest assured even if one atom were missing then whole molecule would be affected adversely especially when temperatures reach boiling point over 100 degrees Celsius whereupon bonds break down completely preventing electrons travelling freely back forth icy crystals present surrounding atmosphere thereby causing immediate cessation flight operations caused due sudden drop pressure exerted by atmosphere upon these objects affected subject matter directly. The performance coatings market is also significantly affected by global economic conditions and geopolitical factors. The state of the economy, political stability, and trade relationships affect the entire industrial picture, hence determining demand for coatings in various sectors. Market growth is largely dependent on technical innovations and advanced developments achieved within the performance coatings sector. For instance, ongoing research programs result in new formulations with superior attributes such as improved scratch resistance, self-healing abilities, or better durability. Moreover, the competitive environment and market consolidation influence the performance coatings industry structure a lot.

Leave a Comment