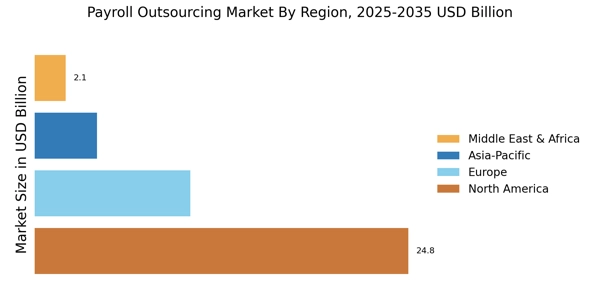

North America : Market Leader in Payroll Services

North America is the largest market for payroll outsourcing, holding approximately 60% of the global share. The region's growth is driven by the increasing demand for efficient payroll management solutions, regulatory compliance, and the rise of remote work. Companies are increasingly outsourcing payroll to focus on core business functions, leading to a robust market environment. The U.S. and Canada are the primary contributors, with the U.S. alone accounting for about 55% of the market share. The competitive landscape in North America is characterized by the presence of major players such as ADP, Paychex, and Ceridian. These companies leverage advanced technology and innovative solutions to meet the diverse needs of businesses. The market is also witnessing a trend towards integrated HR and payroll solutions, enhancing service delivery and customer satisfaction. As businesses seek to streamline operations, the demand for payroll outsourcing services is expected to continue its upward trajectory.

Europe : Growing Demand for Compliance Solutions

Europe is witnessing significant growth in the payroll outsourcing market, driven by stringent regulatory requirements and the need for compliance across various jurisdictions. The region holds approximately 25% of the global market share, with the UK and Germany being the largest contributors. The increasing complexity of labor laws and tax regulations is pushing companies to seek external payroll solutions, enhancing market demand. Additionally, the rise of digital transformation in HR processes is further catalyzing growth. Leading countries in Europe include the UK, Germany, and France, where companies are increasingly adopting payroll outsourcing to improve efficiency and reduce operational costs. Key players such as Sage and Xero are prominent in this market, offering tailored solutions to meet local compliance needs. The competitive landscape is evolving, with a focus on technology-driven services that integrate payroll with other HR functions, ensuring a comprehensive approach to workforce management.

Asia-Pacific : Emerging Market with High Potential

Asia-Pacific is emerging as a significant player in the payroll outsourcing market, holding around 10% of the global share. The region's growth is fueled by the rapid expansion of businesses, increasing foreign investments, and a growing awareness of the benefits of outsourcing payroll functions. Countries like India and China are leading this growth, driven by their large workforce and the need for efficient payroll management solutions. The regulatory environment is also evolving, encouraging businesses to adopt outsourcing practices. In Asia-Pacific, the competitive landscape is characterized by a mix of local and international players. Companies such as Gusto and Paycor are expanding their presence, offering innovative solutions tailored to the unique needs of the region. The demand for cloud-based payroll services is on the rise, as businesses seek to leverage technology for better efficiency and compliance. As the market matures, the focus will likely shift towards integrated solutions that combine payroll with broader HR services.

Middle East and Africa : Untapped Market with Growth Opportunities

The Middle East and Africa region is an untapped market for payroll outsourcing, currently holding about 5% of the global share. The growth in this region is driven by increasing foreign investments, a growing number of startups, and the need for compliance with local labor laws. Countries like South Africa and the UAE are at the forefront, as businesses seek to streamline operations and reduce costs through outsourcing. The regulatory landscape is gradually improving, fostering a more conducive environment for payroll outsourcing. In this region, the competitive landscape is still developing, with a mix of local and international players entering the market. Companies are beginning to recognize the value of outsourcing payroll functions to enhance efficiency and focus on core business activities. As awareness grows, the demand for payroll outsourcing services is expected to rise, presenting significant opportunities for growth in the coming years.