Palliative Care Market Summary

As per Market Research Future analysis, The Global Palliative Care Market Size was estimated at 5.47 USD Billion in 2024. The palliative care industry is projected to grow from 5.875 USD Billion in 2025 to 12.0 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 7.4% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Global Palliative Care Market is experiencing significant growth driven by evolving healthcare practices and demographic shifts.

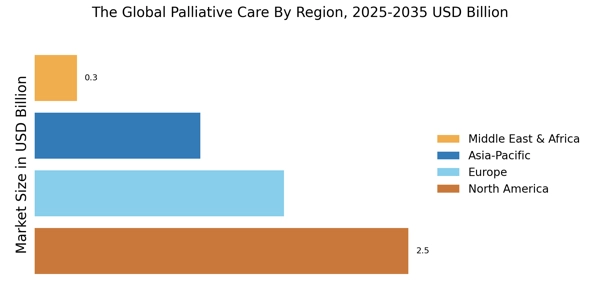

- The integration of palliative care into standard practice is becoming increasingly prevalent in North America, the largest market.

- Technological advancements in service delivery are enhancing patient experiences, particularly in the Asia-Pacific region, which is the fastest-growing market.

- A focus on patient-centered approaches is reshaping care delivery, especially in homecare settings, which represent the largest segment.

- The rising prevalence of chronic diseases and an aging population are major drivers propelling the demand for hospice inpatient care, the fastest-growing segment.

Market Size & Forecast

| 2024 Market Size | 5.47 (USD Billion) |

| 2035 Market Size | 12.0 (USD Billion) |

| CAGR (2025 - 2035) | 7.4% |

Major Players

Bristol-Myers Squibb (US), Roche (CH), Novartis (CH), AstraZeneca (GB), Pfizer (US), Merck & Co. (US), Teva Pharmaceutical Industries (IL), Amgen (US), Eli Lilly and Company (US)