Health and Safety Regulations

The Packaging Laminates Market is also shaped by stringent health and safety regulations imposed by various authorities. These regulations necessitate the use of safe and compliant materials in packaging, particularly in the food and pharmaceutical sectors. As consumers become more health-conscious, the demand for packaging that ensures product integrity and safety is on the rise. The market for laminates that meet these regulatory standards is projected to expand, as manufacturers seek to comply with evolving guidelines. This regulatory landscape presents both challenges and opportunities for the Packaging Laminates Market, as companies innovate to meet these requirements.

Rising Demand for Flexible Packaging

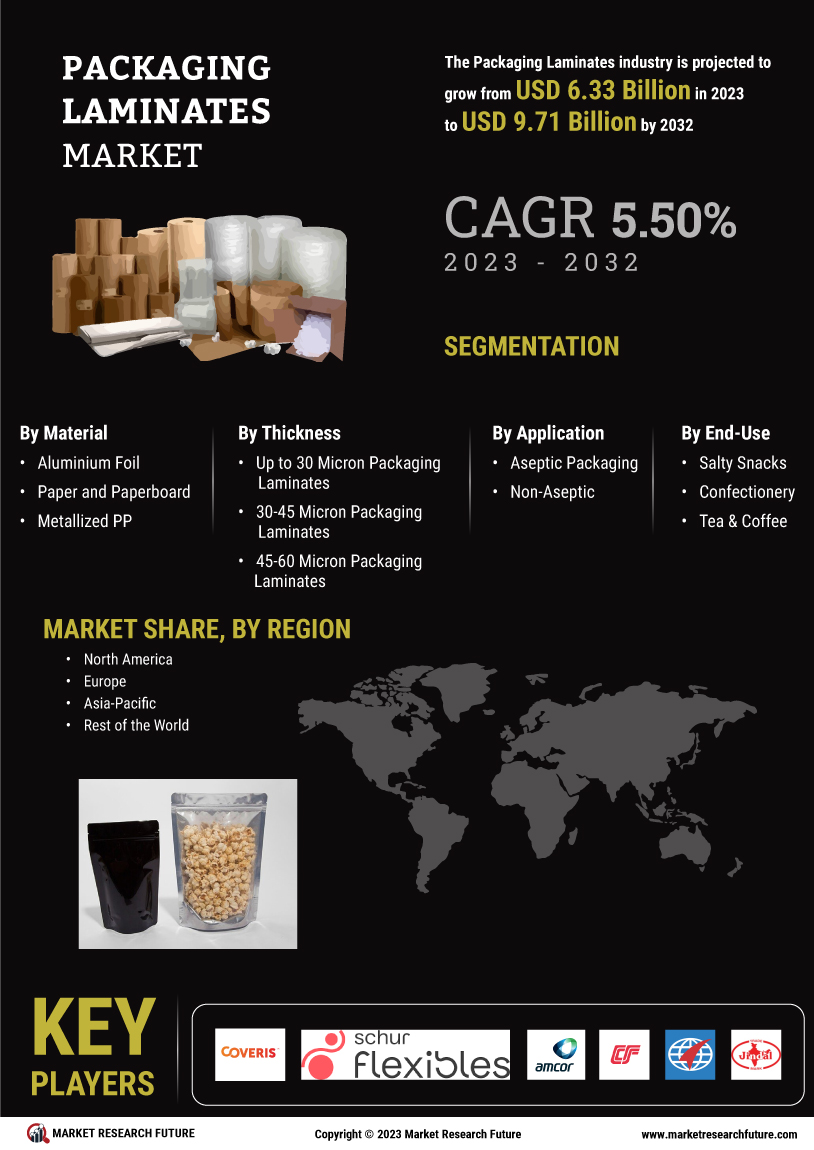

The Packaging Laminates Market experiences a notable increase in demand for flexible packaging solutions. This trend is driven by the growing preference for lightweight and space-efficient packaging options among consumers and manufacturers alike. Flexible packaging not only reduces material usage but also enhances product shelf life, which is crucial in sectors such as food and beverages. According to recent data, the flexible packaging segment is projected to grow at a compound annual growth rate of approximately 4.5% over the next few years. This growth is indicative of a broader shift towards more sustainable and efficient packaging solutions, positioning the Packaging Laminates Market favorably in the evolving landscape.

E-commerce Growth and Packaging Needs

The Packaging Laminates Market is significantly influenced by the rapid expansion of e-commerce. As online shopping continues to gain traction, the demand for durable and protective packaging solutions rises correspondingly. Packaging laminates play a critical role in ensuring that products reach consumers in optimal condition, thereby enhancing customer satisfaction. The e-commerce sector is expected to witness a growth rate of around 15% annually, which directly correlates with the increasing need for innovative packaging solutions. This trend underscores the importance of the Packaging Laminates Market in meeting the unique challenges posed by e-commerce logistics and distribution.

Technological Innovations in Packaging

Technological advancements are a driving force in the Packaging Laminates Market, leading to the development of smarter and more efficient packaging solutions. Innovations such as active and intelligent packaging technologies enhance product preservation and provide real-time information to consumers. These advancements not only improve the functionality of packaging but also cater to the growing consumer demand for transparency and traceability. The integration of technology in packaging is expected to propel the market forward, with a projected growth rate of 5% in the next few years. This trend highlights the Packaging Laminates Market's adaptability to changing consumer preferences and technological capabilities.

Sustainability Initiatives and Eco-friendly Materials

The Packaging Laminates Market is increasingly influenced by sustainability initiatives and the shift towards eco-friendly materials. As environmental concerns gain prominence, manufacturers are exploring biodegradable and recyclable laminate options to reduce their carbon footprint. This shift is not merely a trend but a necessity, as consumers are more inclined to support brands that prioritize sustainability. The market for sustainable packaging solutions is anticipated to grow at a rate of 6% annually, reflecting the rising demand for environmentally responsible products. This evolution within the Packaging Laminates Market indicates a broader commitment to sustainability and responsible consumption.