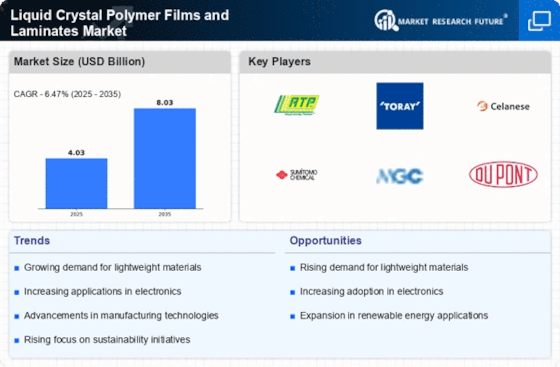

Rising Demand in Electronics

The Liquid Crystal Polymer Films and Laminates Market is experiencing a surge in demand driven by the rapid growth of the electronics sector. As devices become increasingly compact and sophisticated, the need for materials that offer high performance and reliability is paramount. Liquid crystal polymers (LCPs) provide excellent thermal stability, chemical resistance, and electrical insulation, making them ideal for applications in smartphones, tablets, and wearables. According to recent data, the electronics segment is projected to account for a substantial share of the market, with a compound annual growth rate (CAGR) of approximately 8% over the next five years. This trend indicates a robust future for LCPs as manufacturers seek innovative solutions to meet consumer expectations.

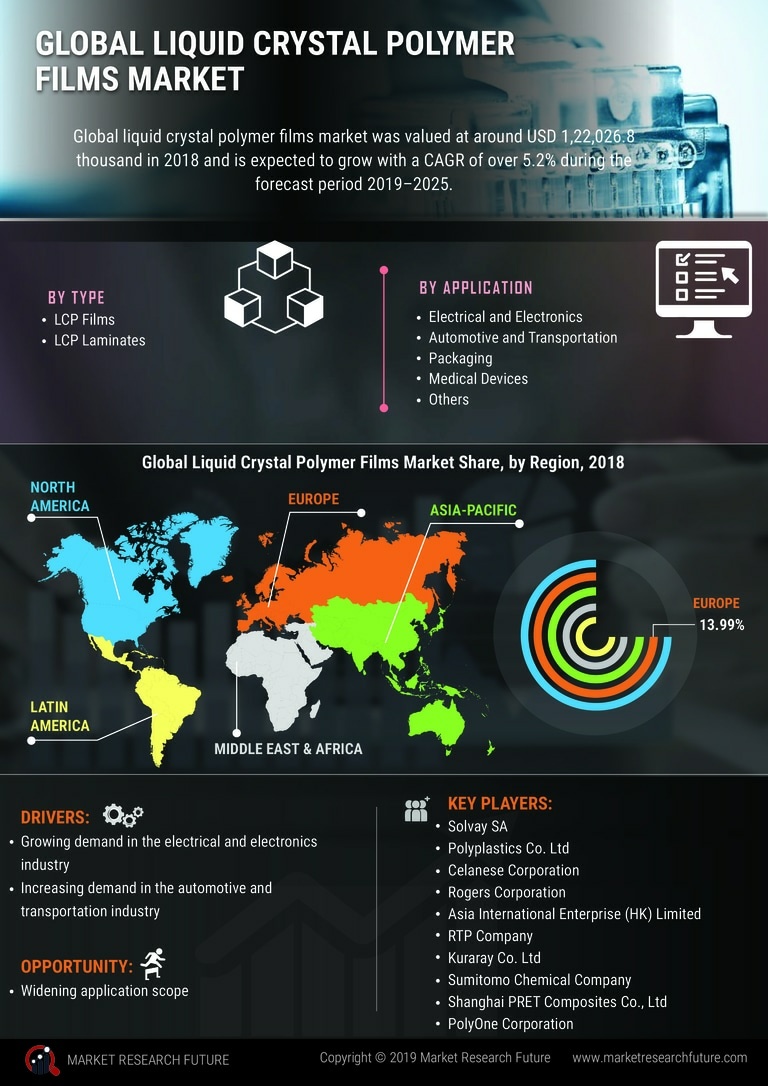

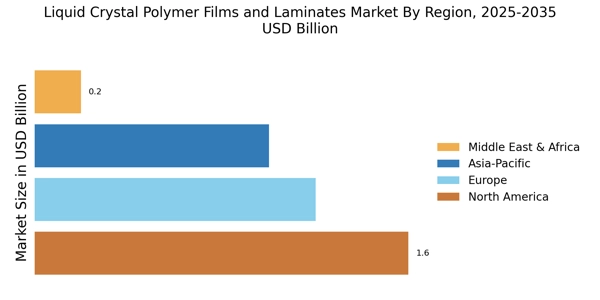

Emerging Markets and Economic Growth

Emerging markets are becoming increasingly important for the Liquid Crystal Polymer Films and Laminates Market, as economic growth in these regions drives demand for advanced materials. Countries in Asia and South America are witnessing a rise in manufacturing activities, particularly in electronics and automotive sectors, which are key consumers of LCPs. The expansion of these markets is likely to create new opportunities for LCP manufacturers, as local industries seek to adopt innovative materials to enhance product performance. Market forecasts suggest that the demand for LCPs in emerging economies could grow at a rate of 7% annually, reflecting the increasing integration of advanced technologies in various applications. This trend indicates a promising future for the LCP market as it adapts to the evolving needs of these dynamic regions.

Increased Focus on Telecommunications

The Liquid Crystal Polymer Films and Laminates Market is poised to benefit from the expanding telecommunications sector, particularly with the rollout of 5G technology. LCPs are essential in the production of high-frequency components, such as antennas and circuit boards, which are crucial for 5G infrastructure. The demand for faster and more reliable communication networks is driving the need for materials that can perform under high-frequency conditions without compromising quality. As telecommunications companies invest heavily in upgrading their networks, the market for LCPs is expected to grow, with projections indicating a potential increase in demand by over 10% in the coming years. This trend underscores the critical role of LCPs in supporting next-generation communication technologies.

Advancements in Manufacturing Techniques

Innovations in manufacturing processes are significantly influencing the Liquid Crystal Polymer Films and Laminates Market. Techniques such as injection molding and extrusion are evolving, allowing for the production of LCPs with enhanced properties and reduced costs. These advancements enable manufacturers to create thinner, lighter, and more durable films and laminates, which are essential for modern applications. Furthermore, the integration of automation and smart technologies in production lines is expected to streamline operations, thereby increasing efficiency and output. As a result, the market is likely to witness a shift towards more sustainable and cost-effective manufacturing practices, which could further bolster the adoption of LCPs across various industries.

Growing Applications in Automotive Sector

The automotive industry is increasingly recognizing the benefits of Liquid Crystal Polymer Films and Laminates Market, particularly in the context of lightweighting and performance enhancement. LCPs are being utilized in various automotive components, including connectors, sensors, and circuit boards, due to their superior mechanical properties and resistance to high temperatures. As the automotive sector moves towards electric and hybrid vehicles, the demand for materials that can withstand extreme conditions while maintaining performance is critical. Market analysis suggests that the automotive segment could see a growth rate of around 6% annually, driven by the need for innovative materials that support the transition to more efficient and sustainable vehicle designs.