Focus on Sustainability

Sustainability has emerged as a critical driver in the Packaging Automation Market. Companies are increasingly seeking eco-friendly packaging solutions that minimize environmental impact. This shift is prompting manufacturers to adopt automated systems that utilize recyclable and biodegradable materials. Recent studies indicate that over 70% of consumers prefer brands that demonstrate a commitment to sustainability. Consequently, businesses are investing in packaging automation technologies that not only enhance efficiency but also align with sustainable practices. This focus on sustainability is likely to shape the future of the Packaging Automation Market, as companies strive to meet regulatory requirements and consumer preferences.

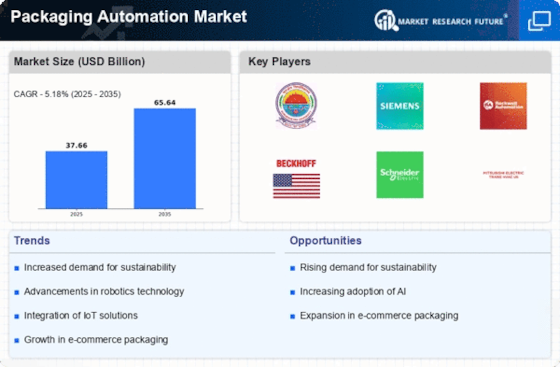

Technological Advancements

The Packaging Automation Market is experiencing a surge in technological advancements that enhance efficiency and productivity. Innovations such as robotics, artificial intelligence, and machine learning are being integrated into packaging processes, allowing for faster and more accurate operations. For instance, the adoption of robotic arms for packing and palletizing has shown to increase throughput by up to 30%. Furthermore, smart packaging solutions that utilize IoT technology are gaining traction, enabling real-time monitoring and data collection. This technological evolution not only streamlines operations but also reduces labor costs, making it a compelling driver for the Packaging Automation Market.

Rising Demand for E-commerce

The Packaging Automation Market is significantly influenced by the rising demand for e-commerce. As online shopping continues to grow, the need for efficient packaging solutions becomes paramount. E-commerce businesses require packaging that is not only protective but also visually appealing to enhance customer experience. According to recent data, the e-commerce sector is projected to reach a valuation of over 6 trillion dollars by 2024, driving the need for automated packaging systems that can handle high volumes and diverse product types. This trend is pushing companies to invest in packaging automation technologies to meet consumer expectations and improve operational efficiency.

Customization and Personalization

The demand for customization and personalization in packaging is becoming a prominent driver in the Packaging Automation Market. Consumers are increasingly seeking unique packaging solutions that reflect their individual preferences and brand identity. This trend is pushing manufacturers to adopt flexible packaging automation systems that can accommodate small batch sizes and varied designs. Data suggests that personalized packaging can increase customer engagement and brand loyalty, making it a strategic focus for many companies. As a result, the Packaging Automation Market is witnessing a shift towards technologies that enable rapid changeovers and customization capabilities, allowing businesses to respond swiftly to market demands.

Labor Shortages and Cost Efficiency

Labor shortages are presenting a significant challenge in the Packaging Automation Market. As companies face difficulties in hiring and retaining skilled labor, there is a growing emphasis on automation to maintain productivity levels. Automated packaging systems can operate continuously, reducing reliance on human labor and minimizing operational disruptions. Furthermore, the implementation of automation can lead to substantial cost savings in the long run. Recent analyses indicate that businesses can achieve a return on investment within two to three years by automating their packaging processes. This trend underscores the importance of automation in addressing labor challenges while enhancing efficiency in the Packaging Automation Market.