Technological Advancements

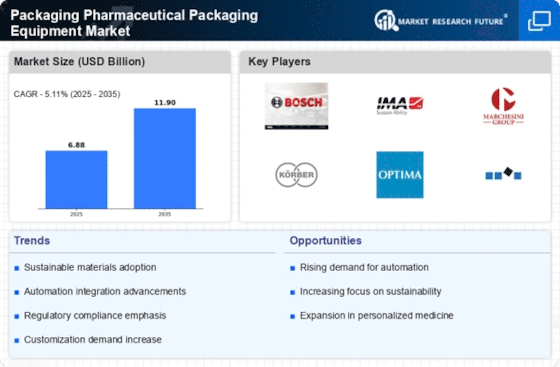

The Packaging Pharmaceutical Packaging Equipment Market is experiencing a surge in technological advancements that enhance efficiency and precision. Innovations such as smart packaging and IoT integration are becoming increasingly prevalent. These technologies not only streamline production processes but also improve traceability and compliance with regulatory standards. The market for automated packaging solutions is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 6% in the coming years. This growth is driven by the need for faster production times and reduced human error, which are critical in the pharmaceutical sector. As companies invest in advanced machinery, the Packaging Pharmaceutical Packaging Equipment Market is likely to witness a transformation that prioritizes both speed and accuracy.

Increased Focus on Patient Safety

Patient safety remains a critical concern within the Packaging Pharmaceutical Packaging Equipment Market. As healthcare providers and regulatory bodies emphasize the importance of safe medication delivery, packaging solutions must evolve to meet these standards. Innovations such as tamper-evident packaging and child-resistant designs are becoming essential features in pharmaceutical packaging. The market is witnessing a shift towards packaging that not only protects the product but also enhances user experience and safety. With an increasing number of recalls due to packaging failures, the industry is likely to see a rise in demand for equipment that can produce safer packaging solutions. This focus on patient safety is expected to drive growth and innovation within the Packaging Pharmaceutical Packaging Equipment Market.

Regulatory Changes and Compliance

The Packaging Pharmaceutical Packaging Equipment Market is heavily influenced by regulatory changes and compliance requirements. As governments and health organizations implement stricter regulations regarding packaging standards, manufacturers must adapt their equipment to meet these evolving demands. Compliance with regulations such as serialization and traceability is becoming increasingly critical, particularly in the context of combating counterfeit drugs. The market is expected to see a significant increase in demand for packaging solutions that ensure compliance with these regulations. This trend not only drives innovation in packaging technology but also compels manufacturers to invest in equipment that can accommodate these requirements. Consequently, the Packaging Pharmaceutical Packaging Equipment Market is poised for growth as companies strive to meet regulatory standards.

Rising Demand for Biopharmaceuticals

The Packaging Pharmaceutical Packaging Equipment Market is significantly influenced by the rising demand for biopharmaceuticals. As the biopharmaceutical sector expands, the need for specialized packaging solutions that ensure product integrity and safety becomes paramount. Biopharmaceuticals often require unique packaging materials and processes to maintain their efficacy, which drives innovation within the packaging equipment market. Recent data indicates that the biopharmaceutical market is expected to reach a valuation of over 500 billion dollars by 2026, further emphasizing the necessity for advanced packaging solutions. This trend compels manufacturers to adapt their equipment to meet the specific requirements of biopharmaceutical products, thereby shaping the future landscape of the Packaging Pharmaceutical Packaging Equipment Market.

Sustainability and Eco-Friendly Practices

Sustainability is becoming a pivotal driver in the Packaging Pharmaceutical Packaging Equipment Market. As environmental concerns grow, pharmaceutical companies are increasingly seeking eco-friendly packaging solutions. This shift is prompting manufacturers to develop equipment that can handle biodegradable and recyclable materials. Recent studies indicate that the market for sustainable packaging is projected to grow at a rate of approximately 7% annually. Companies are recognizing that adopting sustainable practices not only meets regulatory requirements but also appeals to environmentally conscious consumers. As a result, the Packaging Pharmaceutical Packaging Equipment Market is likely to see a rise in demand for equipment that supports sustainable packaging initiatives, thereby aligning with broader environmental goals.