Growth of E-commerce

The growth of e-commerce is a key driver in the Packaging Additive Market. As online shopping continues to expand, the demand for packaging solutions that ensure product safety during transit has surged. Additives that enhance durability and protection are becoming increasingly important in this context. Recent data indicates that the e-commerce packaging segment is expected to grow by 15% annually, highlighting the need for effective packaging solutions. This trend compels manufacturers to invest in innovative additives that can withstand the rigors of shipping and handling. As a result, the Packaging Additive Market is adapting to the evolving landscape of e-commerce, focusing on developing additives that enhance the performance and reliability of packaging materials.

Regulatory Compliance

Regulatory compliance is a significant driver in the Packaging Additive Market. Governments worldwide are implementing stringent regulations regarding the use of additives in packaging materials, particularly concerning food safety and environmental impact. Compliance with these regulations is essential for manufacturers to avoid penalties and maintain market access. The demand for additives that meet these regulatory standards is on the rise, as companies seek to ensure their products are safe and sustainable. Recent statistics suggest that the market for compliant additives is expected to grow by 8% annually, reflecting the increasing importance of regulatory adherence. Thus, the Packaging Additive Market is adapting to these challenges by developing innovative solutions that align with regulatory requirements.

Sustainability Initiatives

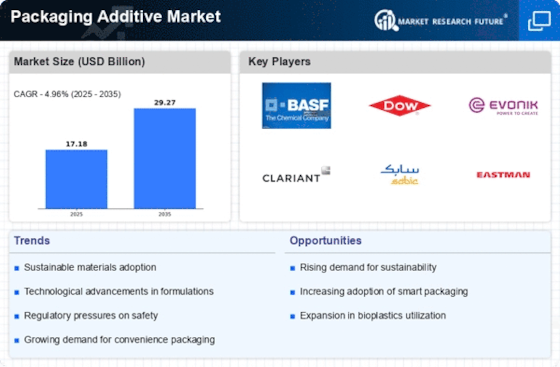

The Packaging Additive Market is increasingly influenced by sustainability initiatives. As consumers become more environmentally conscious, manufacturers are compelled to adopt eco-friendly practices. This shift is evident in the rising demand for biodegradable and recyclable additives, which enhance the sustainability of packaging materials. According to recent data, the market for biodegradable additives is projected to grow at a compound annual growth rate of 12% over the next five years. This trend not only aligns with consumer preferences but also helps companies comply with stringent regulations aimed at reducing plastic waste. Consequently, the Packaging Additive Market is witnessing a transformation, as businesses innovate to create sustainable solutions that meet both market demands and regulatory requirements.

Technological Advancements

Technological advancements play a pivotal role in shaping the Packaging Additive Market. Innovations in additive manufacturing and material science have led to the development of high-performance additives that enhance the functionality of packaging. For instance, the introduction of nanotechnology in additives has resulted in improved barrier properties, extending the shelf life of products. Market data indicates that the segment of functional additives is expected to account for over 30% of the total market share by 2026. These advancements not only improve product quality but also reduce waste, thereby appealing to both manufacturers and consumers. As technology continues to evolve, the Packaging Additive Market is likely to experience further growth driven by these cutting-edge solutions.

Consumer Demand for Customization

Consumer demand for customization is reshaping the Packaging Additive Market. As brands strive to differentiate themselves in a competitive landscape, the need for tailored packaging solutions has become paramount. Additives that allow for customization in terms of color, texture, and functionality are increasingly sought after. Market analysis reveals that the customization segment is projected to grow by 10% over the next few years, driven by consumer preferences for unique and personalized products. This trend encourages manufacturers to innovate and develop specialized additives that cater to specific market needs. Consequently, the Packaging Additive Market is evolving to meet these demands, fostering creativity and innovation in packaging design.