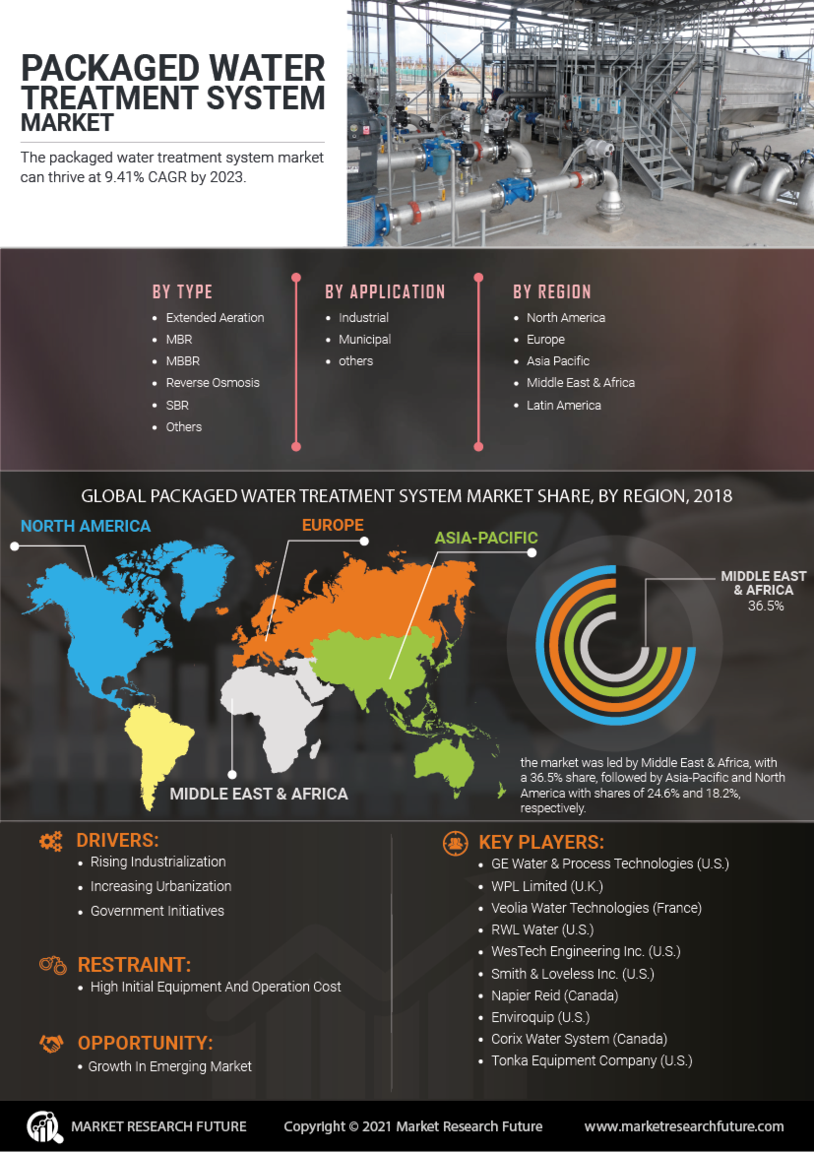

Market Growth Projections

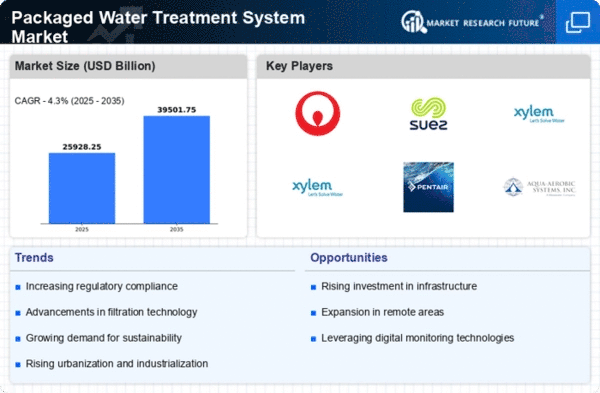

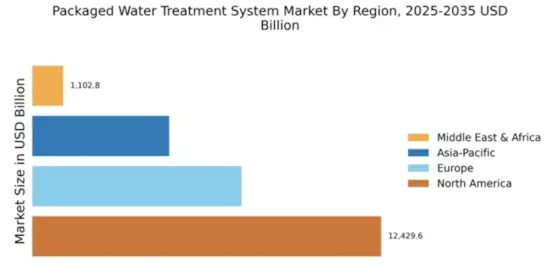

The Packaged Water Treatment System Industry is projected to experience substantial growth over the next decade. With a market value of 36.9 USD Billion in 2024, it is anticipated to reach 52.9 USD Billion by 2035. This growth trajectory indicates a compound annual growth rate of 3.34% from 2025 to 2035. The increasing demand for clean water, coupled with technological advancements and regulatory support, positions the market for continued expansion. These projections underscore the importance of packaged water treatment systems in addressing global water quality challenges.

Increasing Demand for Clean Water

The Packaged Water Treatment System Industry experiences a surge in demand for clean and safe drinking water. This trend is driven by growing urbanization and population expansion, particularly in developing regions. As more individuals migrate to urban areas, the pressure switch on existing water supply systems intensifies. Consequently, water and wastewater treatment, which offer efficient and reliable solutions, are becoming increasingly popular. The market is projected to reach 36.9 USD Billion in 2024, reflecting a robust response to the urgent need for improved water quality and accessibility.

Expansion of Industrial Applications

The Packaged Water Treatment System Industry is witnessing an expansion in industrial applications, which is driving market growth. Industries such as food and beverage, pharmaceuticals, and manufacturing require high-quality water for their operations. Packaged water treatment systems provide tailored solutions that meet the specific needs of these sectors, ensuring compliance with industry standards. As industries continue to expand and evolve, the demand for efficient water treatment solutions is expected to rise. This trend not only supports the growth of the market but also highlights the versatility and adaptability of packaged water treatment systems.

Rising Awareness of Health and Hygiene

The Global Packaged Water Treatment System Industry is significantly impacted by the rising awareness of health and hygiene among consumers. As individuals become more conscious of the quality of their drinking water, there is a growing preference for packaged water treatment solutions that ensure safety and purity. This trend is particularly evident in regions where waterborne diseases are prevalent. The demand for reliable and effective water treatment systems is expected to increase, as consumers prioritize health and wellness. This shift in consumer behavior is likely to contribute to the overall growth of the market in the coming years.

Technological Advancements in Water Treatment

Innovations in water treatment technologies significantly influence the Packaged Water Treatment System Industry. Advanced Recycling Water Filtration methods, such as membrane filtration and UV disinfection, enhance the efficiency and effectiveness of water treatment processes. These technologies not only improve water quality but also reduce operational costs, making packaged systems more attractive to consumers and businesses alike. The integration of smart technologies, such as IoT-enabled monitoring systems, further optimizes water treatment operations. As a result, the market is expected to grow steadily, with a projected value of 52.9 USD Billion by 2035.

Regulatory Support for Water Quality Standards

Government regulations and policies aimed at improving water quality play a crucial role in shaping the Packaged Water Treatment System Industry. Many countries are implementing stricter water quality standards, which necessitate the adoption of advanced treatment solutions. This regulatory environment encourages investments in packaged water treatment systems, as municipalities and industries seek compliance with these standards. The increasing emphasis on sustainable practices and environmental protection further drives the demand for efficient water treatment solutions. As a result, the market is likely to witness a compound annual growth rate of 3.34% from 2025 to 2035.