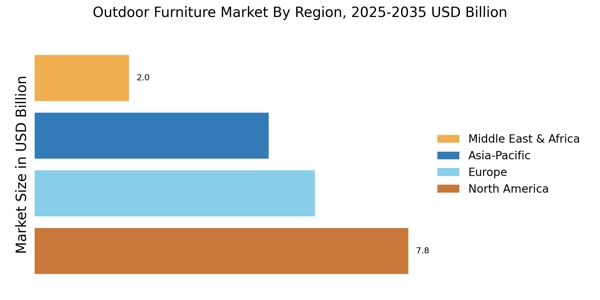

North America: Largest and Lifestyle-Driven Outdoor Furniture Market

North America represents the largest regional market for outdoor furniture, supported by strong outdoor living culture, high disposable income, and continuous home renovation activity. Backyards, patios, decks, and poolside areas are integral parts of residential design, driving consistent demand for seating sets, loungers, dining sets, and shade solutions. The hospitality industry further strengthens market volumes through resorts, restaurants, and outdoor dining spaces.

Consumers in this region prioritize durability, weather resistance, and premium aesthetics, leading to high adoption of aluminum, PE rattan, and treated wood furniture. Sustainability, modularity, and multifunctional designs are gaining importance, especially among urban homeowners. Online furniture sales are growing rapidly, supported by visualization tools and home delivery services.

Although the market is mature, steady growth continues due to renovation cycles, lifestyle upgrades, and hospitality expansion. North America remains a high-value, innovation-oriented, and design-led outdoor furniture market.

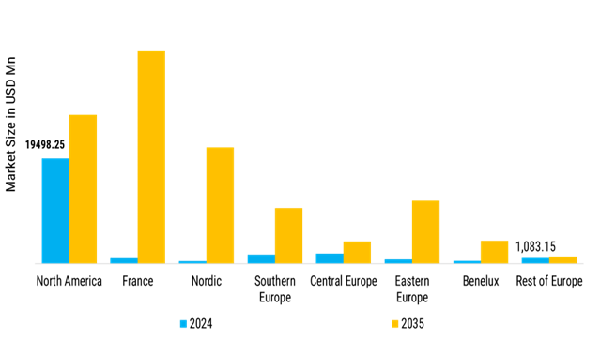

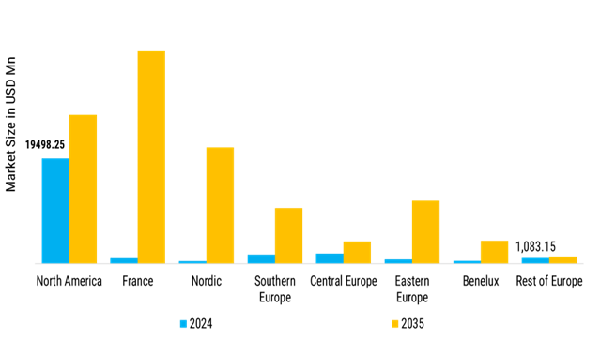

Europe: Sustainability-Focused and Design-Oriented Market

Europe represents a mature and regulation-driven outdoor furniture market, strongly influenced by sustainability standards, environmental regulations, and circular economy principles. Consumers show high preference for certified wood, recyclable metals, eco-friendly coatings, and long-lasting product quality. Design aesthetics play a crucial role, with minimalist and contemporary styles dominating purchasing decisions.

Outdoor cafés, restaurants, and terrace culture across France, Southern Europe, and Central Europe continue to support strong commercial demand. Residential buyers increasingly invest in compact balcony furniture and modular solutions due to urban living constraints. The Nordic region contributes through premium, functional, and climate-resistant furniture designs.

Growth in Europe remains moderate but stable, supported by tourism recovery, renovation activity, and premium product adoption. While price sensitivity exists in Eastern Europe, Western and Central Europe continue to drive value growth through high-quality and sustainable outdoor furniture solutions.

Commonwealth Countries: High-Growth Residential and Mid-Range Market

Commonwealth countries represent one of the strongest growth contributors to the Outdoor Furniture Market, driven by expanding urban housing, rising disposable incomes, and lifestyle transformation. Countries such as the UK, Australia, and India show increasing adoption of outdoor living spaces in both independent homes and apartments.

Residential demand dominates, supported by balcony furniture, garden sets, and affordable modular seating. Hospitality projects, including hotels, cafés, and resorts, further enhance commercial demand. Consumers in this region prefer mid-range products that balance durability, comfort, and affordability.

E-commerce plays a major role in product accessibility, especially in urban centers. Climate diversity across Commonwealth countries also encourages demand for UV-resistant, waterproof, and low-maintenance materials. With strong construction activity and lifestyle upgrades, this region continues to offer high long-term growth potential for outdoor furniture manufacturers.

South America: Emerging Demand and Expanding Lifestyle Market

South America is an emerging outdoor furniture market, supported by improving economic conditions, growing middle-class populations, and strong outdoor social culture. Warm climates across major countries encourage frequent outdoor gatherings, driving demand for dining sets, chairs, loungers, and shade products.

Brazil leads regional demand due to its population size, hospitality sector growth, and active lifestyle preferences. Residential construction and tourism recovery are key growth drivers. Consumers remain price-sensitive, leading to strong demand for economy and mid-range furniture categories.

Local manufacturing is gradually expanding to reduce import dependency and improve product availability. Although the market size remains smaller compared to developed regions, South America demonstrates consistent growth momentum. Over the forecast period, rising urbanization and lifestyle spending are expected to significantly strengthen the outdoor furniture market in this region.

Middle East: Premium Hospitality-Driven Outdoor Furniture Market

The Middle East represents a premium and climate-driven outdoor furniture market, primarily supported by hospitality, tourism, and luxury real estate developments. Resorts, hotels, beach clubs, cafés, and restaurants create strong demand for high-quality, weather-resistant, and UV-protected outdoor furniture.

Extreme climatic conditions drive preference for aluminum, PE rattan, and specially coated fabrics. Customization, durability, and design elegance are key purchase criteria in this region. Residential demand is limited but growing in luxury villas and gated communities.

Government investments in tourism infrastructure, smart cities, and lifestyle transformation projects continue to support market growth. While overall market volume remains moderate, the Middle East offers high value opportunities in premium and customized outdoor furniture solutions, making it an attractive region for global manufacturers and designers.

Analyst Summary View: North America leads the Outdoor Furniture Market in value, while Europe maintains stable, sustainability-driven growth supported by strong design and regulatory standards. Commonwealth countries and South America offer the highest growth potential due to urbanization and lifestyle adoption, whereas the Middle East provides premium, hospitality-led expansion opportunities.