-

EXECUTIVE SUMMARY 15

-

MARKET ATTRACTIVENESS ANALYSIS 17

- GLOBAL OUTDOOR FURNITURE MARKET, BY TYPE 18

- GLOBAL OUTDOOR FURNITURE MARKET, BY MATERIAL 19

- GLOBAL OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR 20

- GLOBAL OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY 21

- GLOBAL OUTDOOR FURNITURE MARKET, BY PRICING 22

- GLOBAL OUTDOOR FURNITURE MARKET, BY END USER 23

- GLOBAL OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL 24

- GLOBAL OUTDOOR FURNITURE MARKET, BY REGION 25

-

MARKET INTRODUCTION 27

-

DEFINITION 27

-

SCOPE OF THE STUDY 27

-

RESEARCH OBJECTIVE 27

-

MARKET STRUCTURE 28

-

RESEARCH METHODOLOGY 29

-

OVERVIEW 29

-

DATA FLOW 31

- DATA MINING PROCESS 31

-

PURCHASED DATABASE: 32

-

SECONDARY SOURCES: 33

- SECONDARY RESEARCH DATA FLOW: 35

-

PRIMARY RESEARCH: 36

- PRIMARY RESEARCH DATA FLOW: 37

- PRIMARY RESEARCH: NUMBER OF INTERVIEWS CONDUCTED 38

- PRIMARY RESEARCH: REGIONAL COVERAGE 38

-

APPROACHES FOR MARKET SIZE ESTIMATION: 39

- CONSUMPTION & NET TRADE APPROACH 39

- REVENUE ANALYSIS APPROACH 39

-

DATA FORECASTING 40

- DATA FORECASTING TECHNIQUE 40

-

DATA MODELING 41

- MICROECONOMIC FACTOR ANALYSIS: 41

- DATA MODELING: 42

-

TEAMS AND ANALYST CONTRIBUTION 44

-

MARKET BACKGROUND 46

-

COMPARISON FROM THE FURNITURE MARKET 46

-

MACROECONOMIC FACTOR IMPACTING THE GLOBAL OUTDOOR FURNITURE MARKET 47

- GLOBAL ECONOMIC GROWTH AND DISPOSABLE INCOME 47

- URBANIZATION AND REAL ESTATE DEVELOPMENT 47

- HOSPITALITY AND TOURISM INDUSTRY GROWTH 47

- RAW MATERIAL PRICES AND SUPPLY CHAIN DYNAMICS 47

- INFLATION AND INTEREST RATES 48

- ENVIRONMENTAL REGULATIONS AND SUSTAINABILITY TRENDS 48

- GLOBAL TRADE POLICIES AND E-COMMERCE EXPANSION 48

-

ONLINE BRAND LANDSCAPE 49

-

GLOBAL OUTDOOR FURNITURE BRAND LANDSCAPE 50

-

EVOLUTION OF GLOBAL OUTDOOR FURNITURE INDUSTRY 51

-

GLOBAL OUTDOOR FURNITURE MARKET STATISTICS 55

- REGIONAL PRICING IMPACT FACTORS 57

-

MARKET DYNAMICS 60

-

INTRODUCTION 60

-

MARKET TRENDS AND GROWTH AFFECTING FACTORS 61

-

GROWTH PARAMETERS MAPPED – DRIVERS 62

- INCREASE IN OUTDOOR LIVING SPACES 62

- GROWING CONSUMER INTEREST IN SUSTAINABLE PRODUCTS 63

- TRENDS IN HOME RENOVATION AND LANDSCAPING 63

- E -COMMERCE AND OMNICHANNEL RETAIL GROWTH 64

- RISING IMPORT DEMAND IN DEVELOPED ECONOMIES 65

- DRIVERS IMPACT ANALYSIS 66

-

GROWTH INHIBITORS MAPPED - RESTRAINTS 67

- HIGH RAW MATERIAL COSTS 67

- SEASONAL DEMAND FLUCTUATIONS 67

- INTENSE PRICE COMPETITION 68

- SUPPLY CHAIN DISRUPTIONS 68

- REGULATORY COMPLIANCE AND ENVIRONMENTAL STANDARDS 69

- RESTRAINTS IMPACT ANALYSIS 70

-

MARKET OPPORTUNITIES MAPPED 71

- EXPANSION INTO EMERGING MARKETS 71

- USE OF 3D PRINTING & ADVANCED MANUFACTURING 73

- MODULAR OUTDOOR FURNITURE BY MERGING STYLE AND FUNCTIONALITY 73

- FURNITURE WITH BUILT-IN GREEN FEATURES 74

- OPPORTUNITIES IMPACT ANALYSIS 75

-

MARKET CHALLENGES MAPPED 76

- HIGH INVENTORY MANAGEMENT COSTS 76

- CLIMATE VARIABILITY AND WEATHER-RELATED RISKS 76

- POST-PURCHASE MAINTENANCE ISSUES 77

- CHALLENGES IMPACT ANALYSIS 78

-

IMPACT ANALYSIS OF COVID – 19 79

- IMPACT ON OVERALL CONSUMER GOODS 79

- IMPACT ON GLOBAL OUTDOOR FURNITURE MARKET 79

- IMPACT ON SUPPLY CHAIN OF OUTDOOR FURNITURE MARKET 80

- IMPACT ON MARKET DEMAND OF OUTDOOR FURNITURE MARKET 81

- IMPACT ON PRICING OUTDOOR FURNITURE MARKET 81

-

MARKET FACTOR ANALYSIS 82

-

VALUE CHAIN ANALYSIS 82

- INPUT & DESIGN INTEGRATION (TECHNOLOGY, DESIGN, EQUIPMENT, PAINTS/ADHESIVES) 82

- CORE MANUFACTURING (MATERIALS PRODUCTION, SPARE PARTS PRODUCTION, ASSEMBLING) 83

- GO-TO-MARKET ENABLEMENT (MARKETING) 83

- DISTRIBUTION & CHANNEL MANAGEMENT (WHOLESALING AND RETAILING) 83

- END-USE & FEEDBACK LOOP (CONSUMERS) 83

-

SUPPLY CHAIN ANALYSIS 84

- STRATEGIC SOURCING AND SUPPLIER RELATIONSHIPS 84

- MANUFACTURING TO MULTI-CHANNEL DISTRIBUTION FLOW 85

- CUSTOMER FULFILLMENT, REVERSE LOGISTICS, AND RISK MANAGEMENT 85

-

PORTER'S FIVE FORCES MODEL 85

-

CONSUMER BEHAVIOR ANALYSIS 87

- INTRODUCTION 87

- OUTDOOR FURNITURE BEHAVIOUR ANALYSIS OF CONSUMER, BY FACTORS INFLUENCING FURNITURE PURCHASE 87

- OUTDOOR FURNITURE BEHAVIOUR ANALYSIS OF CONSUMER, BY GENERATION 88

- OUTDOOR FURNITURE BEHAVIOUR ANALYSIS OF CONSUMER, BY INCOME LEVEL 89

- OUTDOOR FURNITURE BEHAVIOUR ANALYSIS OF CONSUMER, BY GENDER 90

- OUTDOOR FURNITURE BEHAVIOUR ANALYSIS OF CONSUMER, BY SHOPPING BEHAVIOUR 91

-

REGULATORY UPDATE 92

-

STRATEGIC INSIGHTS 93

- SUSTAINABILITY AS A COMPETITIVE DIFFERENTIATOR 93

- OUTDOOR LIVING AS A LIFESTYLE TREND 93

- RISE OF MODULAR AND MULTI-FUNCTIONAL DESIGNS 94

- REGULATORY COMPLIANCE AS MARKET ENTRY GATEKEEPER 94

- E-COMMERCE AND OMNICHANNEL ACCELERATION 94

- GEOPOLITICAL SHIFTS DRIVING SUPPLY CHAIN DIVERSIFICATION 94

- INNOVATION IN WEATHER-RESISTANT AND SMART MATERIALS 94

- URBANIZATION CREATING DEMAND FOR COMPACT SOLUTIONS 95

- HOSPITALITY AND COMMERCIAL SECTOR RECOVERY BOOSTING DEMAND 95

- BRAND POSITIONING AND DESIGN-LED STORYTELLING 95

-

PRICING ANALYSIS 96

-

MARKET TRENDS 97

- “GREEN IS THE NEW LUXURY”: THE SHIFT TOWARD SUSTAINABLE OUTDOOR LIVING 97

- FROM BACKYARD TO BOARDROOM: THE RISE OF MULTI-FUNCTIONAL OUTDOOR SPACES 98

- SUBSCRIPTION LIVING: RENTAL MODELS REDEFINE FURNITURE OWNERSHIP 98

- HIGH-PERFORMANCE AESTHETICS: WEATHER-RESISTANT MATERIALS MEET PREMIUM DESIGN 98

- CONTRACT COMEBACK: HOSPITALITY SECTOR DRIVES BULK DEMAND FOR DURABLE DESIGNS 99

-

SEASONAL TRENDS AND GROWTH DYNAMICS 100

- SEASONAL DEMAND FLUCTUATIONS 100

- PEAK BUYING PERIODS 101

- SALES TRENDS BY REGION 102

-

LIFESTYLE PATTERNS AND USGE BEHAVIOR 104

- FREQUENCY OF OUTDOOR SPACE USGE 104

- FUNCTIONAL DEMANDS (STORAGE, PORTABILITY, COMFORT) 105

- PREFERRED FURNITURE TYPES FOR OUTDOOR SETTINGS 106

-

CLIMATE IMPACT ON PRODUCT DESIGN AND MATERIAL CHOICE 107

- WEATHER-RESISTANT MATERIAL PREFERENCES 107

- CLIMATE-SPECIFIC DESIGN CONSIDERATIONS 107

- MAINTENANCE AND DURABILITY EXPECTATIONS 107

- STORAGE AND CONVENIENCE REQUIREMENTS 108

-

REGIONAL CONSUMER BEHAVIOR AND PREFERENCES 109

- NORTH AMERICA 109

- EUROPE 110

- COMMONWEALTH COUNTRIES 111

- SOUTH AMERICA 112

- MEA 113

-

VALUE VS. PREMIUM STYLE PREFERENCE ANALYSIS 114

-

ANALYSIS OF MATERIAL AND FUNCTIONAL PERFORMANCE FEEDBACK 115

- HIGH-PERFORMANCE MATERIALS PREFERRED 115

- UV & MOISTURE RESISTANCE IS CRUCIAL 115

- FUNCTIONALITY ENHANCES SATISFACTION 115

- COMFORT IS EQUAL TO HIGHER SATISFACTION 115

- LOW-QUALITY MATERIALS RECEIVE NEGATIVE FEEDBACK 115

- EASE OF MAINTENANCE MATTERS 115

-

PRODUCT LINE STRUCTURE OVERVIEW 116

- FEATURE COMPARISON ACROSS PRODUCT LINES 116

- TECHNOLOGY INTEGRATION 117

-

DISTRIBUTION CHANNELS 118

-

RECOMMENDATIONS 119

- RECOMMENDATIONS FOR TYPE OF PRODUCTS 119

- STRATEGIC ALIGNMENT RECOMMENDATIONS 121

- MATERIALS 122

-

PRICING ANALYSIS 123

- NORTH AMERICA 123

- EUROPE 123

- COMMONWEALTH 123

- SOUTH AMERICA 123

- MIDDLE EAST & AFRICA 124

-

KEY FEATURE OR FUNCTIONALITY TRENDS 125

-

MODULARITY 125

-

MULTIFUNCTIONABILTY 126

- INTEGRATED STORAGE 127

- BUILT-IN-SHADE OR CANOPY OPTIONS 127

-

EASY TO CLEAN MATERIALS 128

-

WHETHER RESISTENCE 129

-

UV PROTECTION 130

-

RUST RESISTENCE (ESP.METAL FURNITURE) 131

-

DATA CITATIONS 134

-

GLOBAL OUTDOOR FURNITURE MARKET, BY TYPE 34

-

INTRODUCTION 34

-

SEATING 37

- CHAIRS 38

- BENCHES 40

- SOFAS 41

- SWINGS AND HAMMOCKS 46

- ROCKING CHAIRS 47

- POUFS AND OTTOMANS 49

-

TABLES 50

- DINING TABLES 52

- COFFEE TABLES 53

- SIDE TABLES 55

- BAR TABLES 56

- FIRE PIT TABLES 58

-

DINING SETS 59

- 2-SEATER SETS 61

- 4-SEATER SETS 62

- 6-SEATER SETS 64

- 8-SEATER SETS 65

- BISTRO SETS 67

-

LOUNGERS AND DAYBEDS 68

- SUN LOUNGERS 70

- CHAISE LOUNGES 71

- RECLINERS 73

- DAYBEDS 74

-

UMBRELLAS AND SHADE PRODUCTS 76

- PATIO UMBRELLAS 77

- CANTILEVER UMBRELLAS 79

- GAZEBOS 80

- PERGOLAS 82

- AWNINGS 83

-

GLOBAL OUTDOOR FURNITURE MARKET, BY MATERIAL 85

-

INTRODUCTION 85

-

ALUMINIUM 87

-

PE RATTAN 88

-

STEEL 90

-

SOLID WOOD 91

- TEAK 93

- ACACIA 94

-

FABRIC 96

- POLYESTER FABRIC 97

- OLEFIN FABRIC 99

-

TEMPERED GLASS 100

-

WICKER (SYNTHETIC OR RESIN WICKER) 102

-

OTHERS 103

-

GLOBAL OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR 105

-

INTRODUCTION 105

-

MODERNEARTHY NEUTRALS (BEIGE, TAUPE, SAND, STONE) 107

-

MATTE BLACK AND CHARCOAL 109

-

GREENS AND OLIVE TONES 110

-

TERRACOTTA AND RUST 112

-

WHITE AND OFF-WHITE 113

-

NAVY AND DEEP BLUES 115

-

NATURAL WOOD FINISHES 116

-

SOFT PASTELS 118

-

GLOBAL OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY 120

-

INTRODUCTION 120

-

MODULARITY 122

-

MULTIFUNCTIONALITY 123

- INTEGRATED STORAGE 125

- BUILT-IN SHADE OR CANOPY OPTIONS 126

-

EASY TO CLEAN MATERIALS 128

-

WEATHER RESISTANCE 130

-

UV PROTECTION 131

-

RUST RESISTANCE 132

-

GLOBAL OUTDOOR FURNITURE MARKET, BY PRICING 134

-

INTRODUCTION 134

-

ECONOMY 135

-

MID-RANGE 137

-

PREMIUM 138

-

GLOBAL OUTDOOR FURNITURE MARKET, BY END USER 140

-

INTRODUCTION 140

-

RESIDENTIAL 141

-

COMMERCIAL 143

- RESORTS 144

- RESTAURANTS 146

- CAMPSITES 147

- HOTELS 149

-

GLOBAL OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL 151

-

INTRODUCTION 151

-

ONLINE 152

- BRAND WEBSITE 154

- E-COMMERCE 155

-

OFFLINE 157

- SUPERMARKETS AND HYPERMARKETS 158

- SPECIALTY STORES 160

- HOME IMPROVEMENT STORES 162

- OTHERS 163

-

GLOBAL OUTDOOR FURNITURE MARKET, BY REGION 165

-

OVERVIEW 165

-

NORTH AMERICA 166

- US 175

- CANADA 182

-

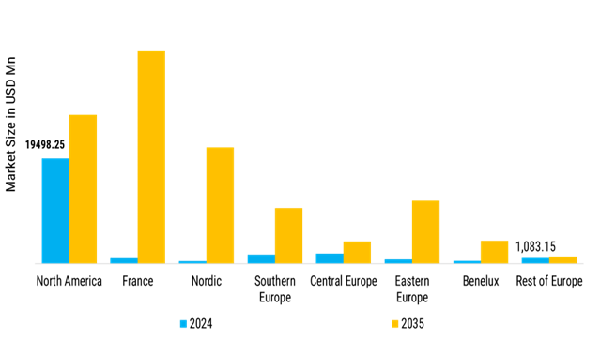

EUROPE 189

- FRANCE 201

- NORDIC 208

- DENMARK 215

- SOUTHERN EUROPE 250

- CENTRAL EUROPE 299

- EASTERN EUROPE 347

- BENELUX 389

- REST OF EUROPE 417

-

COMMONWEALTH COUNTRIES 425

- INDIA 434

- UNITED KINGDOM 441

- AUSTRALIA 448

- SINGAPORE 455

- BANGLADESH 462

- MALAYSIA 469

- SOUTH AFRICA 476

- PAKISTAN 483

- NEW ZEALAND 490

- NIGERIA 497

- SRI LANKA 504

- KENYA 511

- TANZANIA 517

- GHANA 524

- GABON 531

- REST OF COMMONWEALTH COUNTRIES 538

-

SOUTH AMERICA 545

- BRAZIL 555

- MEXICO 562

- ARGENTINA 568

- REST OF SOUTH AMERICA 575

-

MIDDLE EAST 582

- GCC COUNTRIES 591

- TURKEY 598

- REST OF MIDDLE EAST 606

-

COMPETITIVE LANDSCAPE 19

-

INTRODUCTION 19

-

COMPETITION DASHBOARD 20

- PRODUCT PORTFOLIO 21

- REGIONAL PRESENCE 22

- STRATEGIC ALLIANCES 22

- INDUSTRY EXPERIENCES 22

-

MARKET SHARE ANALYSIS, 2024 22

-

WHO ARE THE MAJOR DISRUPTORS & INNOVATORS 22

-

KEY DEVELOPMENTS & GROWTH STRATEGIES 23

- PRODUCT LAUNCH 23

- MERGER & ACQUISITION/ JOINT VENTURES 24

-

COMPANY PROFILES 26

-

VONDOM 26

- COMPANY OVERVIEW 26

- PRODUCT PORTFOLIO 27

- KEY DEVELOPMENTS 28

- SWOT ANALYSIS 29

- KEY STRATEGY 29

-

GANDIA BLASCO GROUP 30

- COMPANY OVERVIEW 30

- FINANCIAL OVERVIEW 30

- PRODUCT OFFERED 31

- SWOT ANALYSIS 33

- KEY STRATEGY 33

-

PEDRALI 34

- COMPANY OVERVIEW 34

- FINANCIAL OVERVIEW 34

- PRODUCTS OFFERED 35

- KEY DEVELOPMENTS 36

- SWOT ANALYSIS 37

- KEY STRATEGY 37

-

EMU GROUP S.P.A 38

- COMPANY OVERVIEW 38

- FINANCIAL OVERVIEW 38

- PROUCTS OFFERED 39

- KEY DEVELOPMENTS 39

- SWOT ANALYSIS 40

- KEY STRATEGY 40

-

PAOLA LENTI 41

- COMPANY OVERVIEW 41

- FINANCIAL OVERVIEW 41

- PRODUCT OFFERED 42

- KEY DEVELOPMENTS 43

- SWOT ANALYSIS 44

- KEY STRATEGY 44

-

UNOPIÙ 45

- COMPANY OVERVIEW 45

- FINANCIAL OVERVIEW 45

- PRODUCTS OFFERED 45

- KEY DEVELOPMENTS 47

- SWOT ANALYSIS 48

- KEY STRATEGY 48

-

KINGSLEY BATE 49

- COMPANY OVERVIEW 49

- FINANCIAL OVERVIEW 49

- PRODUCTS OFFERED 50

- KEY DEVELOPMENTS 51

- SWOT ANALYSIS 51

- KEY STRATEGY 51

-

ROYAL BOTANIA 52

- COMPANY OVERVIEW 52

- FINANCIAL OVERVIEW 52

- PRODUCT OFFERED 53

- KEY DEVELOPMENTS 56

- SWOT ANALYSIS 56

- KEY STRATEGY 56

-

RODA SRL 57

- COMPANY OVERVIEW 57

- FINANCIAL OVERVIEW 57

- PRODUCT OFFERED 58

- KEY DEVELOPMENTS 59

- SWOT ANALYSIS 59

- KEY STRATEGY 60

-

TUUCI 61

- COMPANY OVERVIEW 61

- FINANCIAL OVERVIEW 61

- PRODUCT OFFERED 62

- KEY DEVELOPMENTS 63

- SWOT ANALYSIS 63

- KEY STRATEGY 64

-

FERMOB GROUP 65

- COMPANY OVERVIEW 65

- FINANCIAL OVERVIEW 65

- PRODUCT OFFERED 66

- KEY DEVELOPMENTS 67

- SWOT ANALYSIS 67

- KEY STRATEGY 68

-

SCAB DESIGN 69

- COMPANY OVERVIEW 69

- FINANCIAL OVERVIEW 69

- PRODUCT OFFERED 70

- KEY DEVELOPMENTS 75

- SWOT ANALYSIS 76

- KEY STRATEGY 76

-

SIFAS 77

- COMPANY OVERVIEW 77

- FINANCIAL OVERVIEW 77

- PRODUCT OFFERED 78

- KEY DEVELOPMENTS 79

- SWOT ANALYSIS 80

- KEY STRATEGY 80

-

B&B ITALIA SPA. 81

- COMPANY OVERVIEW 81

- FINANCIAL OVERVIEW 82

- PRODUCTS OFFERED 83

- KEY DEVELOPMENTS 85

- SWOT ANALYSIS 85

- KEY STRATEGY 86

-

OASIS S.R.L. 87

- COMPANY OVERVIEW 87

- FINANCIAL OVERVIEW 87

- PRODUCTS OFFERED 88

- KEY DEVELOPMENTS 89

- SWOT ANALYSIS 89

- KEY STRATEGY 90

-

EXTREMIS 91

- COMPANY OVERVIEW 91

- FINANCIAL OVERVIEW 91

- PRODUCTS OFFERED 92

- KEY DEVELOPMENTS 100

- SWOT ANALYSIS 101

- KEY STRATEGY 102

-

MANUTTI 103

- COMPANY OVERVIEW 103

- FINANCIAL OVERVIEW 103

- PRODUCTS OFFERED 104

- KEY DEVELOPMENTS 105

- SWOT ANALYSIS 105

- KEY STRATEGY 106

-

KETTAL GROUP 107

- COMPANY OVERVIEW 107

- FINANCIAL OVERVIEW 107

- PRODUCTS OFFERED 108

- KEY DEVELOPMENTS 109

- SWOT ANALYSIS 110

- KEY STRATEGY 110

-

DEDON 111

- COMPANY OVERVIEW 111

- FINANCIAL OVERVIEW 111

- PRODUCTS OFFERED 112

- KEY DEVELOPMENTS 113

- SWOT ANALYSIS 113

- KEY STRATEGY 114

-

ETHIMO 115

- COMPANY OVERVIEW 115

- FINANCIAL OVERVIEW 115

- PRODUCTS OFFERED 116

- KEY DEVELOPMENTS 117

- SWOT ANALYSIS 118

- KEY STRATEGY 119

-

COCO WOLF 120

- COMPANY OVERVIEW 120

- FINANCIAL OVERVIEW 120

- PRODUCTS OFFERED 121

- KEY DEVELOPMENTS 122

- SWOT ANALYSIS 123

- KEY STRATEGY 124

-

ARMADILLO SUN 125

- COMPANY OVERVIEW 125

- FINANCIAL OVERVIEW 125

- PRODUCTS OFFERED 126

- KEY DEVELOPMENTS 126

- SWOT ANALYSIS 127

- KEY STRATEGY 127

-

FLEXFORM 128

- COMPANY OVERVIEW 128

- FINANCIAL OVERVIEW 128

- PRODUCTS OFFERED 129

- KEY DEVELOPMENTS 130

- SWOT ANALYSIS 131

- KEY STRATEGY 132

-

ARTIE 133

- COMPANY OVERVIEW 133

- FINANCIAL OVERVIEW 133

- PRODUCT OFFERED 134

- KEY DEVELOPMENTS 135

- SWOT ANALYSIS 136

- KEY STRATEGY 136

-

TOPIA 137

- COMPANY OVERVIEW 137

- FINANCIAL OVERVIEW 137

- PRODUCT OFFERED 137

- KEY DEVELOPMENTS 138

- SWOT ANALYSIS 139

- KEY STRATEGY 139

-

VINEKO LIMITED 140

- COMPANY OVERVIEW 140

- FINANCIAL OVERVIEW 140

- PRODUCT OFFERED 141

- KEY DEVELOPMENTS 143

- SWOT ANALYSIS 144

- KEY STRATEGY 144

-

HIGOLD GROUP CO., LTD 145

- COMPANY OVERVIEW 145

- FINANCIAL OVERVIEW 145

- PRODUCT OFFERED 146

- KEY DEVELOPMENTS 147

- SWOT ANALYSIS 147

- KEY STRATEGY 148

-

ZHEJIANG HENGFENG TOP LEISURE CO. 149

- COMPANY OVERVIEW 149

- FINANCIAL OVERVIEW 149

- PRODUCT OFFERED 150

- KEY DEVELOPMENTS 150

- SWOT ANALYSIS 151

- KEY STRATEGY 151

-

COUTURE JARDIN 152

- COMPANY OVERVIEW 152

- FINANCIAL OVERVIEW 152

- PRODUCT PORTFOLIO 153

- KEY DEVELOPMENTS 157

- SWOT ANALYSIS 157

- KEY STRATEGY 158

-

MINDO 159

- COMPANY OVERVIEW 159

- FINANCIAL OVERVIEW 160

- PRODUCT PORTFOLIO 160

- KEY DEVELOPMENTS 165

- SWOT ANALYSIS 165

- KEY STRATEGY 166

-

AGIO INTERNATIONAL COMPANY, LTD 167

- COMPANY OVERVIEW 167

- FINANCIAL OVERVIEW 167

- PRODUCT PORTFOLIO 168

- KEY DEVELOPMENTS 171

- SWOT ANALYSIS 171

- KEY STRATEGY 172

-

DIVANOLOUNGE 173

- COMPANY OVERVIEW 173

- FINANCIAL OVERVIEW 173

- PRODUCT PORTFOLIO 174

- KEY DEVELOPMENTS 175

- SWOT ANALYSIS 175

- KEY STRATEGY 176

-

TOPMAX 177

- COMPANY OVERVIEW 177

- FINANCIAL OVERVIEW 177

- PRODUCT PORTFOLIO 178

- KEY DEVELOPMENTS 179

- SWOT ANALYSIS 180

- KEY STRATEGY 180

-

SUNNYFEEL CAMPING 181

- COMPANY OVERVIEW 181

- FINANCIAL OVERVIEW 181

- PRODUCT PORTFOLIO 181

- KEY DEVELOPMENTS 187

- SWOT ANALYSIS 188

- KEY STRATEGY 188

-

YOTRIO CORPORATION 189

- COMPANY OVERVIEW 189

- FINANCIAL OVERVIEW 189

- PRODUCT PORTFOLIO 189

- KEY DEVELOPMENTS 191

- SWOT ANALYSIS 192

- KEY STRATEGY 192

-

PEBL FURNITURE 193

- COMPANY OVERVIEW 193

- FINANCIAL OVERVIEW 193

- PRODUCT PORTFOLIO 194

- KEY DEVELOPMENTS 194

- SWOT ANALYSIS 195

- KEY STRATEGY 195

-

MANO.LEISURE LIFE 196

- COMPANY OVERVIEW 196

- FINANCIAL OVERVIEW 196

- PRODUCT PORTFOLIO 196

- KEY DEVELOPMENTS 198

- SWOT ANALYSIS 199

- KEY STRATEGY 199

-

DATA CITATIONS 202

-

-

LIST OF TABLES

-

QFD MODELING FOR MARKET SHARE ASSESSMENT 42

-

DISTRIBUTION CHANNELS FOR THE KEY COMPANIES 118

-

GLOBAL OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (USD MILLION) 34

-

GLOBAL OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (MILLION UNITS) 35

-

GLOBAL OUTDOOR FURNITURE MARKET, BY SEATING, 2019-2035 (USD MILLION) 37

-

GLOBAL OUTDOOR FURNITURE MARKET, BY SEATING, 2019-2035 (MILLION UNITS) 38

-

GLOBAL OUTDOOR FURNITURE MARKET, BY CHAIRS, 2019-2035 (USD MILLION) 39

-

GLOBAL OUTDOOR FURNITURE MARKET, BY CHAIRS, 2019-2035 (MILLION UNITS) 39

-

GLOBAL OUTDOOR FURNITURE MARKET, BY BENCHES, 2019-2035 (USD MILLION) 40

-

GLOBAL OUTDOOR FURNITURE MARKET, BY BENCHES, 2019-2035 (MILLION UNITS) 41

-

GLOBAL OUTDOOR FURNITURE MARKET, BY SOFAS, 2019-2035 (USD MILLION) 42

-

GLOBAL OUTDOOR FURNITURE MARKET, BY SOFAS, 2019-2035 (MILLION UNITS) 42

-

GLOBAL OUTDOOR FURNITURE MARKET, BY CORNER SOFAS, 2019-2035 (USD MILLION) 43

-

GLOBAL OUTDOOR FURNITURE MARKET, BY CORNER SOFAS, 2019-2035 (MILLION UNITS) 44

-

GLOBAL OUTDOOR FURNITURE MARKET, BY CHAT SOFAS, 2019-2035 (USD MILLION) 45

-

GLOBAL OUTDOOR FURNITURE MARKET, BY CHAT SOFAS, 2019-2035 (MILLION UNITS) 45

-

GLOBAL OUTDOOR FURNITURE MARKET, BY SWINGS AND HAMMOCKS, 2019-2035 (USD MILLION) 46

-

GLOBAL OUTDOOR FURNITURE MARKET, BY SWINGS AND HAMMOCKS, 2019-2035 (MILLION UNITS) 47

-

GLOBAL OUTDOOR FURNITURE MARKET, BY ROCKING CHAIRS, 2019-2035 (USD MILLION) 48

-

GLOBAL OUTDOOR FURNITURE MARKET, BY ROCKING CHAIRS, 2019-2035 (MILLION UNITS) 48

-

GLOBAL OUTDOOR FURNITURE MARKET, BY POUFS AND OTTOMANS, 2019-2035 (USD MILLION) 49

-

GLOBAL OUTDOOR FURNITURE MARKET, BY POUFS AND OTTOMANS, 2019-2035 (MILLION UNITS) 50

-

GLOBAL OUTDOOR FURNITURE MARKET, BY TABLES, 2019-2035 (USD MILLION) 51

-

GLOBAL OUTDOOR FURNITURE MARKET, BY TABLES, 2019-2035 (MILLION UNITS) 51

-

GLOBAL OUTDOOR FURNITURE MARKET, BY DINING TABLES, 2019-2035 (USD MILLION) 52

-

GLOBAL OUTDOOR FURNITURE MARKET, BY DINING TABLES, 2019-2035 (MILLION UNITS) 53

-

GLOBAL OUTDOOR FURNITURE MARKET, BY COFFEE TABLES, 2019-2035 (USD MILLION) 54

-

GLOBAL OUTDOOR FURNITURE MARKET, BY COFFEE TABLES, 2019-2035 (MILLION UNITS) 54

-

GLOBAL OUTDOOR FURNITURE MARKET, BY SIDE TABLES, 2019-2035 (USD MILLION) 55

-

GLOBAL OUTDOOR FURNITURE MARKET, BY SIDE TABLES, 2019-2035 (MILLION UNITS) 56

-

GLOBAL OUTDOOR FURNITURE MARKET, BY BAR TABLES, 2019-2035 (USD MILLION) 57

-

GLOBAL OUTDOOR FURNITURE MARKET, BY BAR TABLES, 2019-2035 (MILLION UNITS) 57

-

GLOBAL OUTDOOR FURNITURE MARKET, BY FIRE PIT TABLES, 2019-2035 (USD MILLION) 58

-

GLOBAL OUTDOOR FURNITURE MARKET, BY FIRE PIT TABLES, 2019-2035 (MILLION UNITS) 59

-

GLOBAL OUTDOOR FURNITURE MARKET, BY DINING SETS, 2019-2035 (USD MILLION) 60

-

GLOBAL OUTDOOR FURNITURE MARKET, BY DINING SETS, 2019-2035 (MILLION UNITS) 60

-

GLOBAL OUTDOOR FURNITURE MARKET, BY 2 SEATER SETS, 2019-2035 (USD MILLION) 61

-

GLOBAL OUTDOOR FURNITURE MARKET, BY 2 SEATER SETS, 2019-2035 (MILLION UNITS) 62

-

GLOBAL OUTDOOR FURNITURE MARKET, BY 4-SEATER SETS, 2019-2035 (USD MILLION) 63

-

GLOBAL OUTDOOR FURNITURE MARKET, BY 4-SEATER SETS, 2019-2035 (MILLION UNITS) 63

-

GLOBAL OUTDOOR FURNITURE MARKET, BY 6-SEATER SETS, 2019-2035 (USD MILLION) 64

-

GLOBAL OUTDOOR FURNITURE MARKET, BY 6-SEATER SETS, 2019-2035 (MILLION UNITS) 65

-

GLOBAL OUTDOOR FURNITURE MARKET, BY 8-SEATER SETS, 2019-2035 (USD MILLION) 66

-

GLOBAL OUTDOOR FURNITURE MARKET, BY 8-SEATER SETS, 2019-2035 (MILLION UNITS) 66

-

GLOBAL OUTDOOR FURNITURE MARKET, BY BISTRO SETS, 2019-2035 (USD MILLION) 67

-

GLOBAL OUTDOOR FURNITURE MARKET, BY BISTRO SETS, 2019-2035 (MILLION UNITS) 68

-

GLOBAL OUTDOOR FURNITURE MARKET, BY LOUNGERS AND DAYBEDS, 2019-2035 (USD MILLION) 69

-

GLOBAL OUTDOOR FURNITURE MARKET, BY LOUNGERS AND DAYBEDS, 2019-2035 (MILLION UNITS) 69

-

GLOBAL OUTDOOR FURNITURE MARKET, BY SUN LOUNGERS, 2019-2035 (USD MILLION) 70

-

GLOBAL OUTDOOR FURNITURE MARKET, BY SUN LOUNGERS, 2019-2035 (MILLION UNITS) 71

-

GLOBAL OUTDOOR FURNITURE MARKET, BY CHAISE LOUNGES, 2019-2035 (USD MILLION) 72

-

GLOBAL OUTDOOR FURNITURE MARKET, BY CHAISE LOUNGES, 2019-2035 (MILLION UNITS) 72

-

GLOBAL OUTDOOR FURNITURE MARKET, BY RECLINERS, 2019-2035 (USD MILLION) 73

-

GLOBAL OUTDOOR FURNITURE MARKET, BY RECLINERS, 2019-2035 (MILLION UNITS) 74

-

GLOBAL OUTDOOR FURNITURE MARKET, BY DAYBEDS, 2019-2035 (USD MILLION) 75

-

GLOBAL OUTDOOR FURNITURE MARKET, BY DAYBEDS, 2019-2035 (MILLION UNITS) 75

-

GLOBAL OUTDOOR FURNITURE MARKET, BY UMBRELLAS AND SHADE PRODUCTS, 2019-2035 (USD MILLION) 76

-

GLOBAL OUTDOOR FURNITURE MARKET, BY UMBRELLAS AND SHADE PRODUCTS, 2019-2035 (MILLION UNITS) 77

-

GLOBAL OUTDOOR FURNITURE MARKET, BY PATIO UMBRELLAS, 2019-2035 (USD MILLION) 78

-

GLOBAL OUTDOOR FURNITURE MARKET, BY PATIO UMBRELLAS, 2019-2035 (MILLION UNITS) 78

-

GLOBAL OUTDOOR FURNITURE MARKET, BY CANTILEVER UMBRELLAS, 2019-2035 (USD MILLION) 79

-

GLOBAL OUTDOOR FURNITURE MARKET, BY CANTILEVER UMBRELLAS, 2019-2035 (MILLION UNITS) 80

-

GLOBAL OUTDOOR FURNITURE MARKET, BY GAZEBOS, 2019-2035 (USD MILLION) 81

-

GLOBAL OUTDOOR FURNITURE MARKET, BY GAZEBOS, 2019-2035 (MILLION UNITS) 81

-

GLOBAL OUTDOOR FURNITURE MARKET, BY PERGOLAS, 2019-2035 (USD MILLION) 82

-

GLOBAL OUTDOOR FURNITURE MARKET, BY PERGOLAS, 2019-2035 (MILLION UNITS) 83

-

GLOBAL OUTDOOR FURNITURE MARKET, BY AWNINGS, 2019-2035 (USD MILLION) 84

-

GLOBAL OUTDOOR FURNITURE MARKET, BY AWNINGS, 2019-2035 (MILLION UNITS) 84

-

GLOBAL OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (USD MILLION) 86

-

GLOBAL OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (MILLION UNITS) 86

-

GLOBAL OUTDOOR FURNITURE MARKET, BY ALUMINUM, 2019-2035 (USD MILLION) 87

-

GLOBAL OUTDOOR FURNITURE MARKET, BY ALUMINUM, 2019-2035 (MILLION UNITS) 88

-

GLOBAL OUTDOOR FURNITURE MARKET, BY PE RATTAN, 2019-2035 (USD MILLION) 89

-

GLOBAL OUTDOOR FURNITURE MARKET, BY PE RATTAN, 2019-2035 (MILLION UNITS) 89

-

GLOBAL OUTDOOR FURNITURE MARKET, BY STEEL, 2019-2035 (USD MILLION) 90

-

GLOBAL OUTDOOR FURNITURE MARKET, BY STEEL, 2019-2035 (MILLION UNITS) 91

-

GLOBAL OUTDOOR FURNITURE MARKET, BY SOLID WOOD, 2019-2035 (USD MILLION) 92

-

GLOBAL OUTDOOR FURNITURE MARKET, BY SOLID WOOD, 2019-2035 (MILLION UNITS) 92

-

GLOBAL OUTDOOR FURNITURE MARKET, BY TEAK, 2019-2035 (USD MILLION) 93

-

GLOBAL OUTDOOR FURNITURE MARKET, BY TEAK, 2019-2035 (MILLION UNITS) 94

-

GLOBAL OUTDOOR FURNITURE MARKET, BY ACACIA, 2019-2035 (USD MILLION) 95

-

GLOBAL OUTDOOR FURNITURE MARKET, BY ACACIA, 2019-2035 (MILLION UNITS) 95

-

GLOBAL OUTDOOR FURNITURE MARKET, BY FABRIC, 2019-2035 (USD MILLION) 96

-

GLOBAL OUTDOOR FURNITURE MARKET, BY FABRIC, 2019-2035 (MILLION UNITS) 97

-

GLOBAL OUTDOOR FURNITURE MARKET, BY POLYESTER, 2019-2035 (USD MILLION) 98

-

GLOBAL OUTDOOR FURNITURE MARKET, BY POLYESTER, 2019-2035 (MILLION UNITS) 98

-

GLOBAL OUTDOOR FURNITURE MARKET, BY OLEFIN, 2019-2035 (USD MILLION) 99

-

GLOBAL OUTDOOR FURNITURE MARKET, BY OLEFIN, 2019-2035 (MILLION UNITS) 100

-

GLOBAL OUTDOOR FURNITURE MARKET, BY TEMPERED GLASS, 2019-2035 (USD MILLION) 101

-

GLOBAL OUTDOOR FURNITURE MARKET, BY TEMPERED GLASS, 2019-2035 (MILLION UNITS) 101

-

GLOBAL OUTDOOR FURNITURE MARKET, BY WICKER (SYNTHETIC OR RESIN WICKER), 2019-2035 (USD MILLION) 102

-

GLOBAL OUTDOOR FURNITURE MARKET, BY WICKER (SYNTHETIC OR RESIN WICKER), 2019-2035 (MILLION UNITS) 103

-

GLOBAL OUTDOOR FURNITURE MARKET, BY OTHERS, 2019-2035 (USD MILLION) 104

-

GLOBAL OUTDOOR FURNITURE MARKET, BY OTHERS, 2019-2035 (MILLION UNITS) 104

-

GLOBAL OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (USD MILLION) 106

-

GLOBAL OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (MILLION UNITS) 106

-

GLOBAL OUTDOOR FURNITURE MARKET, BY MODERNEARTHY NEUTRALS (BEIGE, TAUPE, SAND, STONE), 2019-2035 (USD MILLION) 108

-

GLOBAL OUTDOOR FURNITURE MARKET, BY MODERNEARTHY NEUTRALS (BEIGE, TAUPE, SAND, STONE), 2019-2035 (MILLION UNITS) 108

-

GLOBAL OUTDOOR FURNITURE MARKET, BY MATTE BLACK AND CHARCOAL, 2019-2035 (USD MILLION) 109

-

GLOBAL OUTDOOR FURNITURE MARKET, BY MATTE BLACK AND CHARCOAL, 2019-2035 (MILLION UNITS) 110

-

GLOBAL OUTDOOR FURNITURE MARKET, BY GREENS AND OLIVE TONES, 2019-2035 (USD MILLION) 111

-

GLOBAL OUTDOOR FURNITURE MARKET, BY GREENS AND OLIVE TONES, 2019-2035 (MILLION UNITS) 111

-

GLOBAL OUTDOOR FURNITURE MARKET, BY TERRACOTTA AND RUST, 2019-2035 (USD MILLION) 112

-

GLOBAL OUTDOOR FURNITURE MARKET, BY TERRACOTTA AND RUST, 2019-2035 (MILLION UNITS) 113

-

GLOBAL OUTDOOR FURNITURE MARKET, BY WHITE AND OFF-WHITE, 2019-2035 (USD MILLION) 114

-

GLOBAL OUTDOOR FURNITURE MARKET, BY WHITE AND OFF-WHITE, 2019-2035 (MILLION UNITS) 114

-

GLOBAL OUTDOOR FURNITURE MARKET, BY NAVY AND DEEP BLUES, 2019-2035 (USD MILLION) 115

-

GLOBAL OUTDOOR FURNITURE MARKET, BY NAVY AND DEEP BLUES, 2019-2035 (MILLION UNITS) 116

-

GLOBAL OUTDOOR FURNITURE MARKET, BY NATURAL WOOD FINISHES, 2019-2035 (USD MILLION) 117

-

GLOBAL OUTDOOR FURNITURE MARKET, BY NATURAL WOOD FINISHES, 2019-2035 (MILLION UNITS) 117

-

GLOBAL OUTDOOR FURNITURE MARKET, BY SOFT PASTELS (FOR CUSHIONS/FABRICS – SAGE, BLUSH, SKY BLUE), 2019-2035 (USD MILLION) 118

-

GLOBAL OUTDOOR FURNITURE MARKET, BY SOFT PASTELS (FOR CUSHIONS/FABRICS – SAGE, BLUSH, SKY BLUE), 2019-2035 (MILLION UNITS) 119

-

GLOBAL OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (USD MILLION) 121

-

GLOBAL OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (MILLION UNITS) 121

-

GLOBAL OUTDOOR FURNITURE MARKET, BY MODULARITY, 2019-2035 (USD MILLION) 122

-

GLOBAL OUTDOOR FURNITURE MARKET, BY MODULARITY, 2019-2035 (MILLION UNITS) 123

-

GLOBAL OUTDOOR FURNITURE MARKET, BY MULTIFUNCTIONALITY, 2019-2035 (USD MILLION) 124

-

GLOBAL OUTDOOR FURNITURE MARKET, BY MULTIFUNCTIONALITY, 2019-2035 (MILLION UNITS) 124

-

GLOBAL OUTDOOR FURNITURE MARKET, BY INTEGRATED STORAGE, 2019-2035 (USD MILLION) 125

-

GLOBAL OUTDOOR FURNITURE MARKET, BY INTEGRATED STORAGE, 2019-2035 (MILLION UNITS) 126

-

GLOBAL OUTDOOR FURNITURE MARKET, BY BUILT-IN SHADE OR CANOPY OPTIONS, 2019-2035 (USD MILLION) 127

-

GLOBAL OUTDOOR FURNITURE MARKET, BY BUILT-IN SHADE OR CANOPY OPTIONS, 2019-2035 (MILLION UNITS) 128

-

GLOBAL OUTDOOR FURNITURE MARKET, BY EASY TO CLEAN MATERIALS, 2019-2035 (USD MILLION) 129

-

GLOBAL OUTDOOR FURNITURE MARKET, BY EASY TO CLEAN MATERIALS, 2019-2035 (MILLION UNITS) 129

-

GLOBAL OUTDOOR FURNITURE MARKET, BY WEATHER RESISTANCE, 2019-2035 (USD MILLION) 130

-

GLOBAL OUTDOOR FURNITURE MARKET, BY WEATHER RESISTANCE, 2019-2035 (MILLION UNITS) 131

-

GLOBAL OUTDOOR FURNITURE MARKET, BY UV PROTECTION, 2019-2035 (USD MILLION) 131

-

GLOBAL OUTDOOR FURNITURE MARKET, BY UV PROTECTION, 2019-2035 (MILLION UNITS) 132

-

GLOBAL OUTDOOR FURNITURE MARKET, BY RUST RESISTANCE (ESP. METAL FURNITURE), 2019-2035 (USD MILLION) 133

-

GLOBAL OUTDOOR FURNITURE MARKET, BY RUST RESISTANCE (ESP. METAL FURNITURE), 2019-2035 (MILLION UNITS) 133

-

GLOBAL OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (USD MILLION) 134

-

GLOBAL OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (MILLION UNITS) 135

-

GLOBAL OUTDOOR FURNITURE MARKET, BY ECONOMY, 2019-2035 (USD MILLION) 136

-

GLOBAL OUTDOOR FURNITURE MARKET, BY ECONOMY, 2019-2035 (MILLION UNITS) 136

-

GLOBAL OUTDOOR FURNITURE MARKET, BY MID-RANGE, 2019-2035 (USD MILLION) 137

-

GLOBAL OUTDOOR FURNITURE MARKET, BY MID-RANGE, 2019-2035 (MILLION UNITS) 138

-

GLOBAL OUTDOOR FURNITURE MARKET, BY PREMIUM, 2019-2035 (USD MILLION) 139

-

GLOBAL OUTDOOR FURNITURE MARKET, BY PREMIUM, 2019-2035 (MILLION UNITS) 139

-

GLOBAL OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (USD MILLION) 140

-

GLOBAL OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (MILLION UNITS) 141

-

GLOBAL OUTDOOR FURNITURE MARKET, BY RESIDENTIAL, 2019-2035 (USD MILLION) 142

-

GLOBAL OUTDOOR FURNITURE MARKET, BY RESIDENTIAL, 2019-2035 (MILLION UNITS) 142

-

GLOBAL OUTDOOR FURNITURE MARKET, BY COMMERCIAL, 2019-2035 (USD MILLION) 143

-

GLOBAL OUTDOOR FURNITURE MARKET, BY COMMERCIAL, 2019-2035 (MILLION UNITS) 144

-

GLOBAL OUTDOOR FURNITURE MARKET, BY RESORTS, 2019-2035 (USD MILLION) 145

-

GLOBAL OUTDOOR FURNITURE MARKET, BY RESORTS, 2019-2035 (MILLION UNITS) 145

-

GLOBAL OUTDOOR FURNITURE MARKET, BY RESTAURANTS, 2019-2035 (USD MILLION) 146

-

GLOBAL OUTDOOR FURNITURE MARKET, BY RESTAURANTS, 2019-2035 (MILLION UNITS) 147

-

GLOBAL OUTDOOR FURNITURE MARKET, BY CAMPSITES, 2019-2035 (USD MILLION) 148

-

GLOBAL OUTDOOR FURNITURE MARKET, BY CAMPSITES, 2019-2035 (MILLION UNITS) 148

-

GLOBAL OUTDOOR FURNITURE MARKET, BY HOTELS (PROCUREMENT DEPARTMENTS), 2019-2035 (USD MILLION) 149

-

GLOBAL OUTDOOR FURNITURE MARKET, BY HOTELS (PROCUREMENT DEPARTMENTS), 2019-2035 (MILLION UNITS) 150

-

GLOBAL OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION) 151

-

GLOBAL OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (MILLION UNITS) 152

-

GLOBAL OUTDOOR FURNITURE MARKET, BY ONLINE, 2019-2035 (USD MILLION) 153

-

GLOBAL OUTDOOR FURNITURE MARKET, BY ONLINE, 2019-2035 (MILLION UNITS) 153

-

GLOBAL OUTDOOR FURNITURE MARKET, BY BRAND WEBSITE, 2019-2035 (USD MILLION) 154

-

GLOBAL OUTDOOR FURNITURE MARKET, BY BRAND WEBSITE, 2019-2035 (MILLION UNITS) 155

-

GLOBAL OUTDOOR FURNITURE MARKET, BY E-COMMERCE, 2019-2035 (USD MILLION) 156

-

GLOBAL OUTDOOR FURNITURE MARKET, BY E-COMMERCE, 2019-2035 (MILLION UNITS) 156

-

GLOBAL OUTDOOR FURNITURE MARKET, BY OFFLINE, 2019-2035 (USD MILLION) 157

-

GLOBAL OUTDOOR FURNITURE MARKET, BY OFFLINE, 2019-2035 (MILLION UNITS) 158

-

GLOBAL OUTDOOR FURNITURE MARKET, BY SUPERMARKETS AND HYPERMARKETS, 2019-2035 (USD MILLION) 159

-

GLOBAL OUTDOOR FURNITURE MARKET, BY SUPERMARKETS AND HYPERMARKETS, 2019-2035 (MILLION UNITS) 160

-

GLOBAL OUTDOOR FURNITURE MARKET, BY SPECIALTY STORES, 2019-2035 (USD MILLION) 161

-

GLOBAL OUTDOOR FURNITURE MARKET, BY SPECIALTY STORES, 2019-2035 (MILLION UNITS) 161

-

GLOBAL OUTDOOR FURNITURE MARKET, BY HOME IMPROVEMENT STORES, 2019-2035 (USD MILLION) 162

-

GLOBAL OUTDOOR FURNITURE MARKET, BY HOME IMPROVEMENT STORES, 2019-2035 (MILLION UNITS) 163

-

GLOBAL OUTDOOR FURNITURE MARKET, BY OTHERS, 2019-2035 (USD MILLION) 164

-

GLOBAL OUTDOOR FURNITURE MARKET, BY OTHERS, 2019-2035 (MILLION UNITS) 164

-

GLOBAL OUTDOOR FURNITURE, BY REGION, 2019-2035 (USD MILLION) 165

-

GLOBAL OUTDOOR FURNITURE, BY REGION, 2019-2035 (MILLION UNITS) 166

-

NORTH AMERICA OUTDOOR FURNITURE, BY COUNTRY, 2019-2035 (USD MILLION) 168

-

NORTH AMERICA OUTDOOR FURNITURE, BY COUNTRY, 2019-2035 (MILLION UNITS) 168

-

NORTH AMERICA OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (USD MILLION) 169

-

NORTH AMERICA OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (MILLION UNITS) 170

-

NORTH AMERICA OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (USD MILLION) 171

-

NORTH AMERICA OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (MILLION UNITS) 171

-

NORTH AMERICA OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (USD MILLION) 172

-

NORTH AMERICA OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (MILLION UNITS) 172

-

NORTH AMERICA OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (USD MILLION) 172

-

NORTH AMERICA OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (MILLION UNITS) 173

-

NORTH AMERICA OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (USD MILLION) 173

-

NORTH AMERICA OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (MILLION UNITS) 173

-

NORTH AMERICA OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (USD MILLION) 174

-

NORTH AMERICA OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (MILLION UNITS) 174

-

NORTH AMERICA OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION) 174

-

NORTH AMERICA OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (MILLION UNITS) 175

-

US OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (USD MILLION) 175

-

US OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (MILLION UNITS) 176

-

US OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (USD MILLION) 177

-

US OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (MILLION UNITS) 178

-

US OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (USD MILLION) 178

-

US OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (MILLION UNITS) 179

-

US OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (USD MILLION) 179

-

US OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (MILLION UNITS) 179

-

US OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (USD MILLION) 180

-

US OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (MILLION UNITS) 180

-

US OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (USD MILLION) 180

-

US OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (MILLION UNITS) 181

-

US OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION) 181

-

US OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (MILLION UNITS) 182

-

CANADA OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (USD MILLION) 182

-

CANADA OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (MILLION UNITS) 183

-

CANADA OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (USD MILLION) 184

-

CANADA OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (MILLION UNITS) 185

-

CANADA OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (USD MILLION) 185

-

CANADA OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (MILLION UNITS) 186

-

CANADA OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (USD MILLION) 186

-

CANADA OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (MILLION UNITS) 187

-

CANADA OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (USD MILLION) 187

-

CANADA OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (MILLION UNITS) 187

-

CANADA OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (USD MILLION) 188

-

CANADA OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (MILLION UNITS) 188

-

CANADA OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION) 188

-

CANADA OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (MILLION UNITS) 189

-

EUROPE OUTDOOR FURNITURE, BY COUNTRY, 2019-2035 (USD MILLION) 191

-

EUROPE OUTDOOR FURNITURE, BY COUNTRY, 2019-2035 (MILLION UNITS) 192

-

EUROPE OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (USD MILLION) 194

-

EUROPE OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (MILLION UNITS) 195

-

EUROPE OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (USD MILLION) 196

-

EUROPE OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (MILLION UNITS) 197

-

EUROPE OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (USD MILLION) 197

-

EUROPE OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (MILLION UNITS) 198

-

EUROPE OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (USD MILLION) 198

-

EUROPE OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (MILLION UNITS) 198

-

EUROPE OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (USD MILLION) 199

-

EUROPE OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (MILLION UNITS) 199

-

EUROPE OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (USD MILLION) 199

-

EUROPE OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (MILLION UNITS) 200

-

EUROPE OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION) 200

-

EUROPE OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (MILLION UNITS) 201

-

FRANCE OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (USD MILLION) 201

-

FRANCE OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (MILLION UNITS) 203

-

FRANCE OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (USD MILLION) 204

-

FRANCE OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (MILLION UNITS) 204

-

FRANCE OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (USD MILLION) 205

-

FRANCE OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (MILLION UNITS) 205

-

FRANCE OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (USD MILLION) 205

-

FRANCE OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (MILLION UNITS) 206

-

FRANCE OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (USD MILLION) 206

-

FRANCE OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (MILLION UNITS) 206

-

FRANCE OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (USD MILLION) 207

-

FRANCE OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (MILLION UNITS) 207

-

FRANCE OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION) 207

-

FRANCE OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (MILLION UNITS) 208

-

NORDIC OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (USD MILLION) 208

-

NORDIC OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (MILLION UNITS) 209

-

NORDIC OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (USD MILLION) 211

-

NORDIC OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (MILLION UNITS) 211

-

NORDIC OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (USD MILLION) 212

-

NORDIC OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (MILLION UNITS) 212

-

NORDIC OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (USD MILLION) 212

-

NORDIC OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (MILLION UNITS) 213

-

NORDIC OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (USD MILLION) 213

-

NORDIC OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (MILLION UNITS) 214

-

NORDIC OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (USD MILLION) 214

-

NORDIC OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (MILLION UNITS) 214

-

NORDIC OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION) 214

-

NORDIC OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (MILLION UNITS) 215

-

DENMARK OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (USD MILLION) 215

-

DENMARK OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (MILLION UNITS) 216

-

DENMARK OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (USD MILLION) 218

-

DENMARK OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (MILLION UNITS) 218

-

DENMARK OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (USD MILLION) 219

-

DENMARK OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (MILLION UNITS) 219

-

DENMARK OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (USD MILLION) 219

-

DENMARK OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (MILLION UNITS) 220

-

DENMARK OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (USD MILLION) 220

-

DENMARK OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (MILLION UNITS) 220

-

DENMARK OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (USD MILLION) 221

-

DENMARK OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (MILLION UNITS) 221

-

DENMARK OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD MILLION) 221

-

DENMARK OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (MILLION UNITS) 222

-

FINLAND OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (USD BILLION) 222

-

FINLAND OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (MILLION UNITS) 223

-

FINLAND OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (USD BILLION) 225

-

FINLAND OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (MILLION UNITS) 225

-

FINLAND OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (USD BILLION) 226

-

FINLAND OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (MILLION UNITS) 226

-

FINLAND OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (USD BILLION) 226

-

FINLAND OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (MILLION UNITS) 227

-

FINLAND OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (USD BILLION) 227

-

FINLAND OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (MILLION UNITS) 227

-

FINLAND OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (USD BILLION) 228

-

FINLAND OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (MILLION UNITS) 228

-

FINLAND OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION) 228

-

FINLAND OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (MILLION UNITS) 229

-

ICELAND OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (USD BILLION) 229

-

ICELAND OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (MILLION UNITS) 230

-

ICELAND OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (USD BILLION) 232

-

ICELAND OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (MILLION UNITS) 232

-

ICELAND OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (USD BILLION) 233

-

ICELAND OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (MILLION UNITS) 233

-

ICELAND OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (USD BILLION) 233

-

ICELAND OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (MILLION UNITS) 234

-

ICELAND OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (USD BILLION) 234

-

ICELAND OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (MILLION UNITS) 235

-

ICELAND OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (USD BILLION) 235

-

ICELAND OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (MILLION UNITS) 235

-

ICELAND OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION) 235

-

ICELAND OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (MILLION UNITS) 236

-

NORWAY OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (USD BILLION) 236

-

NORWAY OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (MILLION UNITS) 237

-

NORWAY OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (USD BILLION) 239

-

NORWAY OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (MILLION UNITS) 239

-

NORWAY OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (USD BILLION) 240

-

NORWAY OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (MILLION UNITS) 240

-

NORWAY OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (USD BILLION) 240

-

NORWAY OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (MILLION UNITS) 241

-

NORWAY OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (USD BILLION) 241

-

NORWAY OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (MILLION UNITS) 241

-

NORWAY OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (USD BILLION) 242

-

NORWAY OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (MILLION UNITS) 242

-

NORWAY OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION) 242

-

NORWAY OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (MILLION UNITS) 243

-

SWEDEN OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (USD BILLION) 243

-

SWEDEN OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (MILLION UNITS) 244

-

SWEDEN OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (USD BILLION) 246

-

SWEDEN OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (MILLION UNITS) 246

-

SWEDEN OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (USD BILLION) 247

-

SWEDEN OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (MILLION UNITS) 247

-

SWEDEN OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (USD BILLION) 247

-

SWEDEN OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (MILLION UNITS) 248

-

SWEDEN OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (USD BILLION) 248

-

SWEDEN OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (MILLION UNITS) 248

-

SWEDEN OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (USD BILLION) 249

-

SWEDEN OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (MILLION UNITS) 249

-

SWEDEN OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION) 249

-

SWEDEN OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (MILLION UNITS) 250

-

SOUTHERN EUROPE OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (USD BILLION) 250

-

SOUTHERN EUROPE OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (MILLION UNITS) 251

-

SOUTHERN EUROPE OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (USD BILLION) 252

-

SOUTHERN EUROPE OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (MILLION UNITS) 253

-

SOUTHERN EUROPE OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (USD BILLION) 253

-

SOUTHERN EUROPE OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (MILLION UNITS) 254

-

SOUTHERN EUROPE OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (USD BILLION) 254

-

SOUTHERN EUROPE OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (MILLION UNITS) 255

-

SOUTHERN EUROPE OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (USD BILLION) 255

-

SOUTHERN EUROPE OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (MILLION UNITS) 255

-

SOUTHERN EUROPE OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (USD BILLION) 256

-

SOUTHERN EUROPE OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (MILLION UNITS) 256

-

SOUTHERN EUROPE OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION) 256

-

SOUTHERN EUROPE OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (MILLION UNITS) 257

-

SPAIN OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (USD BILLION) 257

-

SPAIN OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (MILLION UNITS) 258

-

SPAIN OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (USD BILLION) 259

-

SPAIN OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (MILLION UNITS) 260

-

SPAIN OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (USD BILLION) 260

-

SPAIN OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (MILLION UNITS) 261

-

SPAIN OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (USD BILLION) 261

-

SPAIN OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (MILLION UNITS) 262

-

SPAIN OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (USD BILLION) 262

-

SPAIN OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (MILLION UNITS) 262

-

SPAIN OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (USD BILLION) 262

-

SPAIN OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (MILLION UNITS) 263

-

SPAIN OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION) 263

-

SPAIN OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (MILLION UNITS) 264

-

ITALY OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (USD BILLION) 264

-

ITALY OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (MILLION UNITS) 265

-

ITALY OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (USD BILLION) 266

-

ITALY OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (MILLION UNITS) 267

-

ITALY OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (USD BILLION) 267

-

ITALY OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (MILLION UNITS) 268

-

ITALY OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (USD BILLION) 268

-

ITALY OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (MILLION UNITS) 268

-

ITALY OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (USD BILLION) 269

-

ITALY OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (MILLION UNITS) 269

-

ITALY OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (USD BILLION) 269

-

ITALY OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (MILLION UNITS) 270

-

ITALY OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION) 270

-

ITALY OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (MILLION UNITS) 270

-

GREECE OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (USD BILLION) 271

-

GREECE OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (MILLION UNITS) 272

-

GREECE OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (USD BILLION) 273

-

GREECE OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (MILLION UNITS) 274

-

GREECE OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (USD BILLION) 274

-

GREECE OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (MILLION UNITS) 275

-

GREECE OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (USD BILLION) 275

-

GREECE OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (MILLION UNITS) 275

-

GREECE OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (USD BILLION) 276

-

GREECE OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (MILLION UNITS) 276

-

GREECE OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (USD BILLION) 276

-

GREECE OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (MILLION UNITS) 277

-

GREECE OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION) 277

-

GREECE OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (MILLION UNITS) 277

-

PORTUGAL OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (USD BILLION) 278

-

PORTUGAL OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (MILLION UNITS) 279

-

PORTUGAL OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (USD BILLION) 280

-

PORTUGAL OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (MILLION UNITS) 281

-

PORTUGAL OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (USD BILLION) 281

-

PORTUGAL OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (MILLION UNITS) 282

-

PORTUGAL OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (USD BILLION) 282

-

PORTUGAL OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (MILLION UNITS) 282

-

PORTUGAL OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (USD BILLION) 283

-

PORTUGAL OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (MILLION UNITS) 283

-

PORTUGAL OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (USD BILLION) 283

-

PORTUGAL OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (MILLION UNITS) 284

-

PORTUGAL OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION) 284

-

PORTUGAL OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (MILLION UNITS) 284

-

SERBIA OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (USD BILLION) 285

-

SERBIA OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (MILLION UNITS) 286

-

SERBIA OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (USD BILLION) 287

-

SERBIA OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (MILLION UNITS) 288

-

SERBIA OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (USD BILLION) 288

-

SERBIA OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (MILLION UNITS) 288

-

SERBIA OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (USD BILLION) 289

-

SERBIA OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (MILLION UNITS) 289

-

SERBIA OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (USD BILLION) 290

-

SERBIA OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (MILLION UNITS) 290

-

SERBIA OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (USD BILLION) 290

-

SERBIA OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (MILLION UNITS) 290

-

SERBIA OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION) 291

-

SERBIA OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (MILLION UNITS) 291

-

REST OF SOUTHERN EUROPE OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (USD BILLION) 292

-

REST OF SOUTHERN EUROPE OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (MILLION UNITS) 293

-

REST OF SOUTHERN EUROPE OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (USD BILLION) 294

-

REST OF SOUTHERN EUROPE OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (MILLION UNITS) 295

-

REST OF SOUTHERN EUROPE OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (USD BILLION) 295

-

REST OF SOUTHERN EUROPE OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (MILLION UNITS) 295

-

REST OF SOUTHERN EUROPE OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (USD BILLION) 296

-

REST OF SOUTHERN EUROPE OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (MILLION UNITS) 296

-

REST OF SOUTHERN EUROPE OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (USD BILLION) 297

-

REST OF SOUTHERN EUROPE OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (MILLION UNITS) 297

-

REST OF SOUTHERN EUROPE OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (USD BILLION) 297

-

REST OF SOUTHERN EUROPE OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (MILLION UNITS) 298

-

REST OF SOUTHERN EUROPE OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION) 298

-

REST OF SOUTHERN EUROPE OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (MILLION UNITS) 298

-

CENTRAL EUROPE OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (USD BILLION) 299

-

CENTRAL EUROPE OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (MILLION UNITS) 300

-

CENTRAL EUROPE OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (USD BILLION) 301

-

CENTRAL EUROPE OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (MILLION UNITS) 302

-

CENTRAL EUROPE OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (USD BILLION) 302

-

CENTRAL EUROPE OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (MILLION UNITS) 302

-

CENTRAL EUROPE OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (USD BILLION) 303

-

CENTRAL EUROPE OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (MILLION UNITS) 303

-

CENTRAL EUROPE OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (USD BILLION) 304

-

CENTRAL EUROPE OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (MILLION UNITS) 304

-

CENTRAL EUROPE OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (USD BILLION) 304

-

CENTRAL EUROPE OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (MILLION UNITS) 304

-

CENTRAL EUROPE OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION) 305

-

CENTRAL EUROPE OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (MILLION UNITS) 305

-

GERMANY OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (USD BILLION) 306

-

GERMANY OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (MILLION UNITS) 307

-

GERMANY OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (USD BILLION) 308

-

GERMANY OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (MILLION UNITS) 308

-

GERMANY OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (USD BILLION) 309

-

GERMANY OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (MILLION UNITS) 309

-

GERMANY OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (USD BILLION) 310

-

GERMANY OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (MILLION UNITS) 310

-

GERMANY OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (USD BILLION) 310

-

GERMANY OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (MILLION UNITS) 311

-

GERMANY OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (USD BILLION) 311

-

GERMANY OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (MILLION UNITS) 311

-

GERMANY OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION) 311

-

GERMANY OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (MILLION UNITS) 312

-

CZECH REPUBLIC OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (USD BILLION) 312

-

CZECH REPUBLIC OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (MILLION UNITS) 313

-

CZECH REPUBLIC OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (USD BILLION) 315

-

CZECH REPUBLIC OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (MILLION UNITS) 315

-

CZECH REPUBLIC OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (USD BILLION) 316

-

CZECH REPUBLIC OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (MILLION UNITS) 316

-

CZECH REPUBLIC OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (USD BILLION) 316

-

CZECH REPUBLIC OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (MILLION UNITS) 317

-

CZECH REPUBLIC OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (USD BILLION) 317

-

CZECH REPUBLIC OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (MILLION UNITS) 317

-

CZECH REPUBLIC OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (USD BILLION) 318

-

CZECH REPUBLIC OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (MILLION UNITS) 318

-

CZECH REPUBLIC OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION) 318

-

CZECH REPUBLIC OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (MILLION UNITS) 319

-

HUNGARY OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (USD BILLION) 319

-

HUNGARY OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (MILLION UNITS) 321

-

HUNGARY OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (USD BILLION) 322

-

HUNGARY OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (MILLION UNITS) 322

-

HUNGARY OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (USD BILLION) 323

-

HUNGARY OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (MILLION UNITS) 323

-

HUNGARY OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (USD BILLION) 323

-

HUNGARY OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (MILLION UNITS) 324

-

HUNGARY OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (USD BILLION) 324

-

HUNGARY OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (MILLION UNITS) 324

-

HUNGARY OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (USD BILLION) 325

-

HUNGARY OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (MILLION UNITS) 325

-

HUNGARY OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION) 325

-

HUNGARY OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (MILLION UNITS) 326

-

AUSTRIA OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (USD BILLION) 326

-

AUSTRIA OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (MILLION UNITS) 327

-

AUSTRIA OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (USD BILLION) 329

-

AUSTRIA OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (MILLION UNITS) 329

-

AUSTRIA OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (USD BILLION) 330

-

AUSTRIA OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (MILLION UNITS) 330

-

AUSTRIA OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (USD BILLION) 330

-

AUSTRIA OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (MILLION UNITS) 331

-

AUSTRIA OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (USD BILLION) 331

-

AUSTRIA OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (MILLION UNITS) 331

-

AUSTRIA OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (USD BILLION) 332

-

AUSTRIA OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (MILLION UNITS) 332

-

AUSTRIA OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION) 332

-

AUSTRIA OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (MILLION UNITS) 333

-

SLOVAKIA OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (USD BILLION) 333

-

SLOVAKIA OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (MILLION UNITS) 334

-

SLOVAKIA OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (USD BILLION) 335

-

SLOVAKIA OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (MILLION UNITS) 336

-

SLOVAKIA OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (USD BILLION) 337

-

SLOVAKIA OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (MILLION UNITS) 337

-

SLOVAKIA OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (USD BILLION) 337

-

SLOVAKIA OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (MILLION UNITS) 338

-

SLOVAKIA OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (USD BILLION) 338

-

SLOVAKIA OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (MILLION UNITS) 338

-

SLOVAKIA OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (USD BILLION) 339

-

SLOVAKIA OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (MILLION UNITS) 339

-

SLOVAKIA OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION) 339

-

SLOVAKIA OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (MILLION UNITS) 340

-

REST OF CENTRAL EUROPE OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (USD BILLION) 340

-

REST OF CENTRAL EUROPE OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (MILLION UNITS) 341

-

REST OF CENTRAL EUROPE OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (USD BILLION) 342

-

REST OF CENTRAL EUROPE OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (MILLION UNITS) 343

-

REST OF CENTRAL EUROPE OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (USD BILLION) 343

-

REST OF CENTRAL EUROPE OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (MILLION UNITS) 344

-

REST OF CENTRAL EUROPE OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (USD BILLION) 344

-

REST OF CENTRAL EUROPE OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (MILLION UNITS) 345

-

REST OF CENTRAL EUROPE OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (USD BILLION) 345

-

REST OF CENTRAL EUROPE OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (MILLION UNITS) 345

-

REST OF CENTRAL EUROPE OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (USD BILLION) 346

-

REST OF CENTRAL EUROPE OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (MILLION UNITS) 346

-

REST OF CENTRAL EUROPE OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION) 346

-

REST OF CENTRAL EUROPE OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (MILLION UNITS) 347

-

EASTERN EUROPE OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (USD BILLION) 347

-

EASTERN EUROPE OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (MILLION UNITS) 348

-

EASTERN EUROPE OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (USD BILLION) 349

-

EASTERN EUROPE OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (MILLION UNITS) 350

-

EASTERN EUROPE OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (USD BILLION) 351

-

EASTERN EUROPE OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (MILLION UNITS) 351

-

EASTERN EUROPE OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (USD BILLION) 351

-

EASTERN EUROPE OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (MILLION UNITS) 352

-

EASTERN EUROPE OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (USD BILLION) 352

-

EASTERN EUROPE OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (MILLION UNITS) 352

-

EASTERN EUROPE OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (USD BILLION) 353

-

EASTERN EUROPE OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (MILLION UNITS) 353

-

EASTERN EUROPE OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION) 353

-

EASTERN EUROPE OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (MILLION UNITS) 354

-

RUSSIA OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (USD BILLION) 354

-

RUSSIA OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (MILLION UNITS) 355

-

RUSSIA OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (USD BILLION) 356

-

RUSSIA OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (MILLION UNITS) 357

-

RUSSIA OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (USD BILLION) 358

-

RUSSIA OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (MILLION UNITS) 358

-

RUSSIA OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (USD BILLION) 358

-

RUSSIA OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (MILLION UNITS) 359

-

RUSSIA OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (USD BILLION) 359

-

RUSSIA OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (MILLION UNITS) 359

-

RUSSIA OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (USD BILLION) 360

-

RUSSIA OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (MILLION UNITS) 360

-

RUSSIA OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION) 360

-

RUSSIA OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (MILLION UNITS) 361

-

UKRAINE OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (USD BILLION) 361

-

UKRAINE OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (MILLION UNITS) 362

-

UKRAINE OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (USD BILLION) 363

-

UKRAINE OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (MILLION UNITS) 364

-

UKRAINE OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (USD BILLION) 364

-

UKRAINE OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (MILLION UNITS) 365

-

UKRAINE OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (USD BILLION) 365

-

UKRAINE OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (MILLION UNITS) 366

-

UKRAINE OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (USD BILLION) 366

-

UKRAINE OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (MILLION UNITS) 366

-

UKRAINE OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (USD BILLION) 367

-

UKRAINE OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (MILLION UNITS) 367

-

UKRAINE OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION) 367

-

UKRAINE OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (MILLION UNITS) 368

-

POLAND OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (USD BILLION) 368

-

POLAND OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (MILLION UNITS) 369

-

POLAND OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (USD BILLION) 370

-

POLAND OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (MILLION UNITS) 371

-

POLAND OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (USD BILLION) 371

-

POLAND OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (MILLION UNITS) 372

-

POLAND OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (USD BILLION) 372

-

POLAND OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (MILLION UNITS) 373

-

POLAND OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (USD BILLION) 373

-

POLAND OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (MILLION UNITS) 373

-

POLAND OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (USD BILLION) 374

-

POLAND OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (MILLION UNITS) 374

-

POLAND OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION) 374

-

POLAND OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (MILLION UNITS) 375

-

ROMANIA OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (USD BILLION) 375

-

ROMANIA OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (MILLION UNITS) 376

-

ROMANIA OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (USD BILLION) 377

-

ROMANIA OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (MILLION UNITS) 378

-

ROMANIA OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (USD BILLION) 378

-

ROMANIA OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (MILLION UNITS) 379

-

ROMANIA OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (USD BILLION) 379

-

ROMANIA OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (MILLION UNITS) 380

-

ROMANIA OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (USD BILLION) 380

-

ROMANIA OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (MILLION UNITS) 380

-

ROMANIA OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (USD BILLION) 381

-

ROMANIA OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (MILLION UNITS) 381

-

ROMANIA OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION) 381

-

ROMANIA OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (MILLION UNITS) 382

-

REST OF EASTERN EUROPE OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (USD BILLION) 382

-

REST OF EASTERN EUROPE OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (MILLION UNITS) 383

-

REST OF EASTERN EUROPE OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (USD BILLION) 384

-

REST OF EASTERN EUROPE OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (MILLION UNITS) 385

-

REST OF EASTERN EUROPE OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (USD BILLION) 385

-

REST OF EASTERN EUROPE OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (MILLION UNITS) 386

-

REST OF EASTERN EUROPE OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (USD BILLION) 386

-

REST OF EASTERN EUROPE OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (MILLION UNITS) 387

-

REST OF EASTERN EUROPE OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (USD BILLION) 387

-

REST OF EASTERN EUROPE OUTDOOR FURNITURE MARKET, BY PRICING, 2019-2035 (MILLION UNITS) 387

-

REST OF EASTERN EUROPE OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (USD BILLION) 388

-

REST OF EASTERN EUROPE OUTDOOR FURNITURE MARKET, BY END USER, 2019-2035 (MILLION UNITS) 388

-

REST OF EASTERN EUROPE OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (USD BILLION) 388

-

REST OF EASTERN EUROPE OUTDOOR FURNITURE MARKET, BY DISTRIBUTION CHANNEL, 2019-2035 (MILLION UNITS) 389

-

BENELUX OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (USD BILLION) 389

-

BENELUX OUTDOOR FURNITURE MARKET, BY TYPE, 2019-2035 (MILLION UNITS) 390

-

BENELUX OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (USD BILLION) 392

-

BENELUX OUTDOOR FURNITURE MARKET, BY MATERIAL, 2019-2035 (MILLION UNITS) 392

-

BENELUX OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (USD BILLION) 393

-

BENELUX OUTDOOR FURNITURE MARKET, BY DOMINANT COLOR, 2019-2035 (MILLION UNITS) 393

-

BENELUX OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (USD BILLION) 393

-

BENELUX OUTDOOR FURNITURE MARKET, BY FEATURE OR FUNCTIONALITY, 2019-2035 (MILLION UNITS) 394

-