Market Trends

Key Emerging Trends in the Osseointegration Implants Market

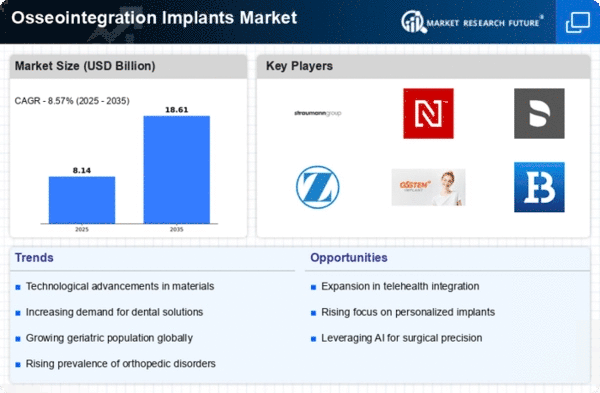

Osseointegration Implants Market is going through a period of significant growth and evolution in current market trends for various reasons including technological advancements, increase in the prevalence of dental disorders, and rising aging population. Dentists’ choice has shifted towards osseointegration as a method to fuse implants with natural bone due to its improved stability and resilience.

Unending progress in implant materials and designs rank among the most notable tendencies molding Osseointegration Implants Market. Manufacturers spend a lot of money on R&D projects which aim at designing biocompatible implants that will serve them for long time. Titanium implants have commonly been used due to their great property of osseointegration but new materials such as zirconia are showing up because they are more esthetically appealing and probably more biocompatible. This can also be attributed to market expansion by patient specific type of incisions.

More prevalence associated with dental disorders besides increasing consciousness about oral health are driving demand for inclusion implants. They provide better alternative than traditional dentures being more lifelike and functional. Moreover, older people are leading this trend since they suffer from tooth decay at higher rates than others; hence, they seek ways to improve their living standard such as dental implantation.

Technological advancements have played an important role in shaping market trends especially in digital dentistry imaging technologies. Like CAD/CAM technology allows accurate planning and placement of these devices thus improving outcomes, saving human life during operation process by reducing surgical risks involved while performing surgery procedures. Also, 3D printing is now widely accepted in the Osseointegration Implants Market that permits intricate patterned custom made implants fabrication. These improvements help not only make surgeries efficient but also grow markets globally.

The market is witnessing a surge in strategic collaborations and partnerships among key players aimed at strengthening their position within the industry as well as expanding their product offerings by large stakes acquisitions processes or obtaining rights for innovative medical products. They collaborate with dentistry professional and research institutions to come up with new implant designs. By pooling the expertise of various industry players, these partnerships are expected to spur market growth.

Developed and developing regions alike have seen strong growth in Osseointegration Implants Market on a geographical basis. The market leaders remain North America and Europe because they enjoy superior healthcare infrastructure and systems as well as higher Medicare funding policies. Conversely, Asia Pacific has shown rapid progress thanks to improved public awareness concerning quality health services, increased purchasing power for most households and the number of elderly people rising fast.

Leave a Comment