Market Share

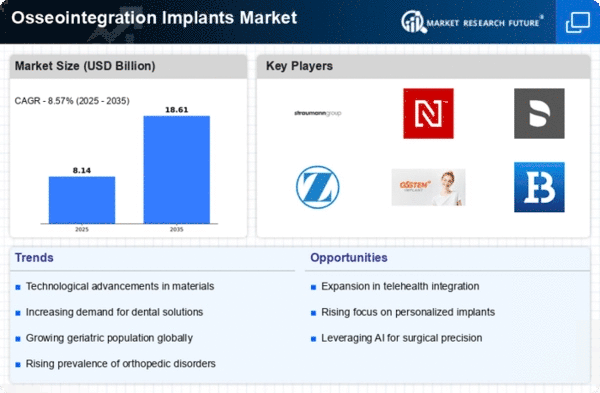

Osseointegration Implants Market Share Analysis

The Osseointegration Implants Market, a fluid and swiftly advancing sector in medical implants industry is a highly competitive sector that perpetually keeps on innovating. How companies position themselves within the market plays an important part in determining their level of success. One such common strategy is differentiation where companies strive to make their products distinct from those of competitors either through different product features, technological advancements or superior quality. For instance, some Osseointegration implant manufacturers focus on developing cutting-edge materials that enhance bone integration or offer innovative designs that optimize patient comfort and functionality. By emphasizing these differentiating factors, they try to create room for their brands in the market place while attracting specific customers who value such qualities.

Another way of separating one’s product from others is by using cost leadership as a strategy for positioning market share. In this case, businesses concentrate on producing Osseointegration implants more efficiently and at a lower price than their rivals. This makes the firms’ products more affordable hence giving them edge over other competitors in terms of pricing. The strategy can be realized through scale economies, process optimization as well as strategic alliances with suppliers. Companies can therefore successfully tap into markets by offering low-cost alternatives without compromising quality especially where costs are main determinant factors among healthcare providers and patients.

Furthermore, besides differentiation and cost leadership strategies also embraced are those based on focus concept by organizations operating within the Osseointegration Implants Market.This entails concentrating only on one particular market segment or geographical area.For example,a firm may choose to concentrate solely in osseo-integrating implants for special medical specialty like orthopedic or pediatric involving pediatric population.Having been known as major players in a specialized market companies will be able to build strong relationships with customers by gaining insights about their target segment better than generalized competitors.

Additionally,the issue of collaborative undertakings as a method of increasing its own brand value forms another component which affects market share gains within Osseointegration Implants Market. It is common for companies to enter into partnerships with researchers, healthcare providers or other industry participants in order to tap on complementary skills and resources. These alliances can facilitate the process of product development and speed up regulatory approvals while also enhancing market expansion. Conversely, organizations that have good relationships with main interest groups are properly placed in the market to succeed.

Lastly, the most recent invention as far as market share positioning is concerned is by basing it sustainability and responsibility issues. As customers and all those in healthcare sector become more conscious of environmental impacts caused by medical products; Osseointegration Implants Market has brought in strategies supporting eco-friendliness. Among others, this may involve use of recyclable materials, minimal waste during production or indulgence in programs aimed at promoting sustainable healthcare services. By doing this companies do not only differentiate themselves but also expand into a bigger proportion of their target market which includes environmentally friendly customers as well.”

Leave a Comment