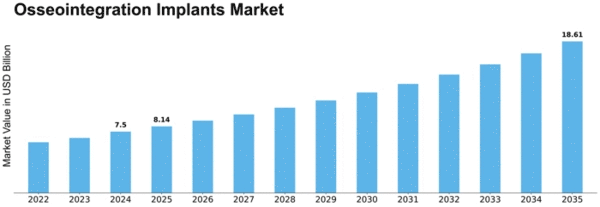

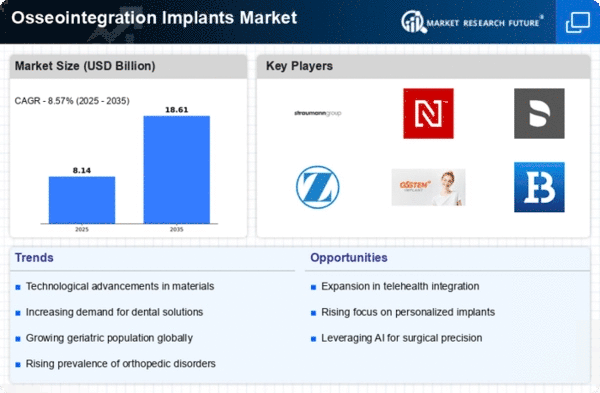

Osseointegration Implants Size

Osseointegration Implants Market Growth Projections and Opportunities

Factors affecting the Osseointegration Implants Market are enormous in number and play a vital role in shaping its growth trajectory. Modern implantology has made osseointegration an important aspect, which is direct structural and functional connection between living bone and surface of load-bearing implant. One of the main reasons for the growth of Osseointegration Implants Market is increasing prevalence of dental disorders and orthopedic diseases. With global population aging, there has been a significant increase in incidents such as tooth loss, joint problems requiring implants surgeries. This demographic shift has created significant market demand for osseointegration implants that effectively address these conditions’ consequences on functions and quality life.

The market for Osseointegration Implants also benefits from technological advancements and innovations. Research and development done over time have led to introduction of advanced materials and new designs that make osseointegration procedures more effective cum successful. Technologies like 3D printing among others have improved precision resulting into customized Osseointegration Implants to meet patients’ specific needs. They have not only enhanced patient experience but also increased general acceptance as well as contributed towards the growth of osseointegration implants within medical community.

Another major element influencing the Osseointegration Implants Market is growing awareness and acceptance levels about oral implant surgeries among people suffering from dental or orthopedicrelated issues. Patients now understand durability, functionability and aesthetics benefits associated with osseointegrated implants better than before unlike in earlier years of my work experience when I had to explain them in details so that they could be convinced to go for this option instead of other types available then; moreover other health professionals including dentists or orthopedic surgeons who are now much interested this way because it is becoming more popular type on account all these positive factors make it important expanding adoption process taking place within industry continuously supports further development market overall favoring possibilities wide access new technologies.

Reimbursment policies and healthcare infrastructure on the economic front are critical to determining the market dynamics of Osseointegration Implants. Reimbursement policies that are favorable to implant procedures can significantly improve access to these treatments for a broader population. Additionally, presence of well-established medical facilities is critical in facilitating seamless integration of osseointegration implantation as main stream medical processes.

Global collaborations and partnerships between key industry players also contribute to the growth of the Osseointegration Implants Market. Joint research and development, marketing and distribution activities facilitate wider access to osseointegrated implants. This has created competitive situation that promotes innovation ensuring continual arrival new improved versions.

However, there are barriers against market growth such as expensive nature of osseointegrated implant procedures, hazards and complications related to it. To overcome these hindrances and sustain market growth rate, it is important for continuous research with cost effective manufacturing techniques coupled with stringent quality control procedures to be put in place."

Leave a Comment