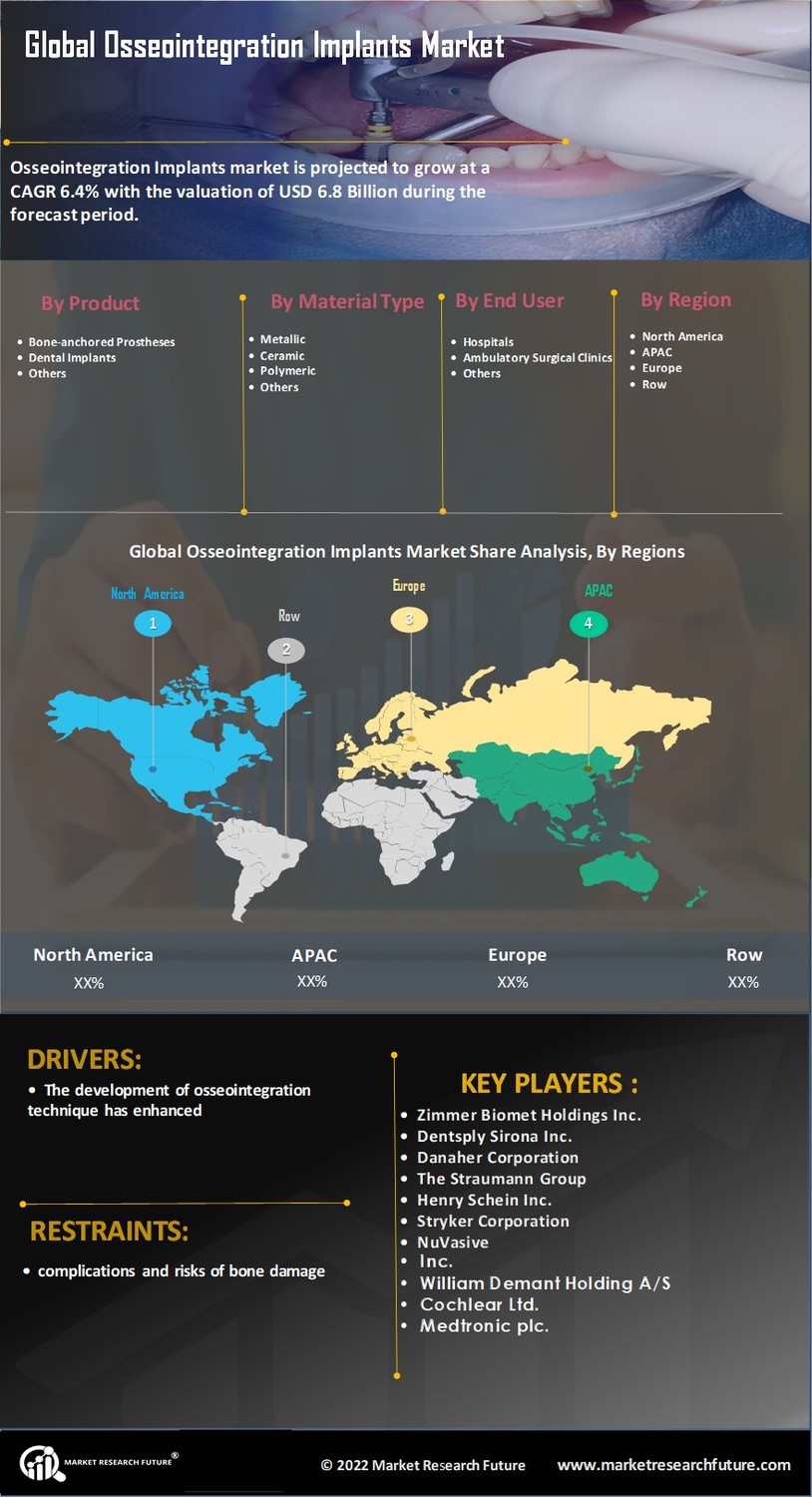

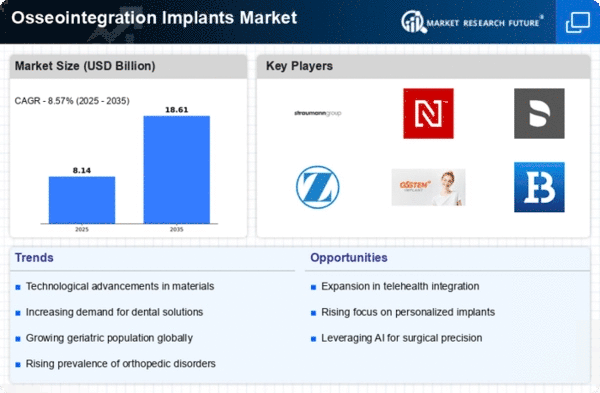

Market Growth Projections

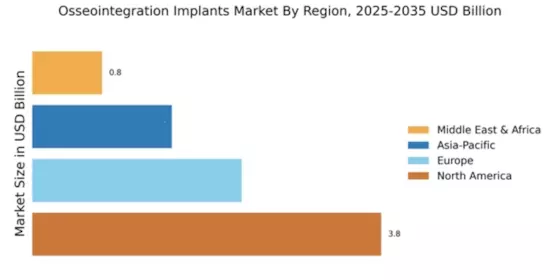

The Global Osseointegration Implants Market Industry is projected to grow significantly over the next decade. With a market value of 12.5 USD Billion in 2024, it is expected to reach 25 USD Billion by 2035, indicating a substantial increase. The compound annual growth rate of 6.5% from 2025 to 2035 reflects the ongoing advancements in technology, increasing demand for dental implants, and the rising geriatric population. This growth trajectory suggests a dynamic market landscape, characterized by innovation and evolving consumer preferences. Stakeholders are likely to focus on research and development to meet the changing needs of patients.

Expansion of Dental Tourism

The Global Osseointegration Implants Market Industry is experiencing growth due to the expansion of dental tourism. Patients are increasingly traveling to countries with advanced dental care facilities and competitive pricing for osseointegration implants. This trend is particularly prominent in regions such as Southeast Asia and Eastern Europe, where high-quality dental services are available at lower costs. As a result, the market is likely to benefit from an influx of international patients seeking affordable yet effective dental solutions. This phenomenon not only boosts local economies but also encourages the development of specialized dental practices catering to global clientele.

Rising Geriatric Population

The Global Osseointegration Implants Market Industry is significantly influenced by the rising geriatric population, which is more susceptible to dental issues and tooth loss. By 2035, the market is anticipated to reach 25 USD Billion, reflecting the increasing need for dental implants among older adults. As the global population ages, healthcare systems are adapting to address the specific needs of this demographic, including the provision of osseointegration implants. This trend underscores the importance of targeted marketing strategies and product development aimed at older patients, who often require specialized care and support in dental health.

Increasing Demand for Dental Implants

The Global Osseointegration Implants Market Industry experiences a robust demand for dental implants, driven by an aging population and rising awareness of oral health. As individuals seek solutions for tooth loss, the market is projected to reach 12.5 USD Billion in 2024. This growth is fueled by advancements in implant technology and materials, which enhance the success rates of procedures. Moreover, the increasing prevalence of dental diseases necessitates effective treatment options, further propelling market expansion. The integration of digital technologies in dental practices also contributes to improved patient outcomes, thereby stimulating demand for osseointegration implants.

Growing Awareness of Aesthetic Dentistry

There is a notable increase in the awareness of aesthetic dentistry, which is a driving force in the Global Osseointegration Implants Market Industry. Patients are increasingly seeking dental solutions that not only restore functionality but also enhance appearance. This trend is particularly evident in urban areas, where cosmetic concerns are paramount. As a result, the demand for osseointegration implants is on the rise, as they provide a natural look and feel. Dental professionals are responding to this demand by offering more aesthetic options, thereby expanding the market. The intersection of aesthetics and functionality is likely to shape future product offerings.

Technological Advancements in Implant Design

Technological innovations are pivotal in shaping the Global Osseointegration Implants Market Industry. Recent developments in implant design, such as surface modifications and 3D printing, enhance osseointegration and reduce healing times. These advancements not only improve patient satisfaction but also increase the efficiency of dental procedures. As a result, the market is expected to witness a compound annual growth rate of 6.5% from 2025 to 2035. Enhanced implant designs allow for better customization and adaptability to individual patient needs, which is crucial in a diverse global market. This trend indicates a shift towards more personalized dental care solutions.