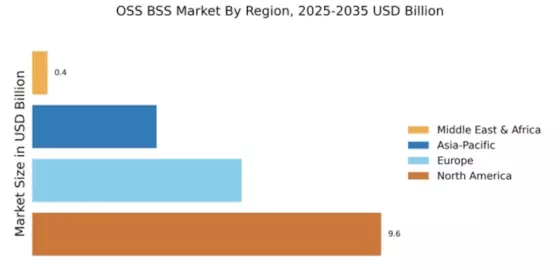

North America : Market Leader in OSS BSS

North America continues to lead the OSS BSS market, holding a significant share of 9.62 in 2024. The region's growth is driven by rapid technological advancements, increasing demand for digital transformation, and supportive regulatory frameworks. The push for 5G deployment and cloud-based solutions further fuels market expansion, as businesses seek to enhance operational efficiency and customer experience.

Key players like Oracle, Amdocs, and Ciena dominate the competitive landscape, leveraging their innovative solutions to capture market share. The U.S. remains the largest contributor, with Canada also showing promising growth. The presence of major telecom operators and a robust IT infrastructure solidify North America's position as a hub for OSS BSS solutions.

Europe : Emerging OSS BSS Hub

Europe's OSS BSS market is poised for growth, with a market size of 5.77. The region benefits from a strong emphasis on regulatory compliance and digital transformation initiatives. The European Union's focus on enhancing connectivity and promoting 5G technology acts as a catalyst for market expansion, driving demand for advanced OSS BSS solutions.

Leading countries such as Germany, the UK, and France are at the forefront, with key players like Ericsson and Nokia actively participating in the market. The competitive landscape is characterized by a mix of established firms and innovative startups, fostering a dynamic environment for OSS BSS development. The region's commitment to sustainability and digital innovation further enhances its attractiveness for investment.

Asia-Pacific : Rapid Growth in OSS BSS

The Asia-Pacific OSS BSS market, valued at 3.43, is experiencing rapid growth driven by increasing mobile penetration and digital transformation initiatives. Countries like China and India are leading the charge, with significant investments in telecommunications infrastructure and a growing demand for cloud-based solutions. Regulatory support for 5G rollout and smart city initiatives further propels market expansion.

The competitive landscape features major players like Huawei and ZTE, alongside local firms that are innovating to meet regional demands. The presence of a large consumer base and a shift towards digital services are key factors driving the OSS BSS market in this region. As businesses adapt to changing consumer behaviors, the demand for integrated solutions continues to rise.

Middle East and Africa : Emerging OSS BSS Opportunities

The OSS BSS market in the Middle East and Africa is valued at 0.42, with significant growth potential driven by increasing mobile connectivity and digital transformation efforts. Governments in the region are investing heavily in telecommunications infrastructure, aiming to enhance service delivery and customer experience. Regulatory initiatives aimed at promoting competition and innovation are also key growth drivers.

Countries like South Africa and the UAE are leading the way, with key players such as Comarch and local telecom operators actively participating in the market. The competitive landscape is evolving, with a focus on adopting advanced technologies to meet the growing demand for OSS BSS solutions. As the region continues to develop, opportunities for growth and investment are becoming increasingly attractive.