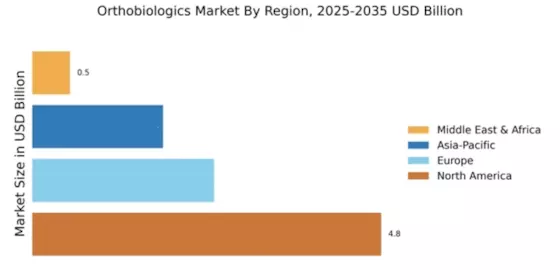

Market Growth Projections

The Global Orthobiologics Market Industry is projected to experience substantial growth over the next decade. With an estimated market value of 7.34 USD Billion in 2024, the industry is expected to reach 12.3 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate (CAGR) of 4.81% from 2025 to 2035. Such projections indicate a robust demand for orthobiologics, driven by advancements in medical technology, an aging population, and increasing acceptance of innovative treatment options. These figures underscore the potential for investment and development within the orthobiologics sector.

Increasing Geriatric Population

The Global Orthobiologics Market Industry is significantly impacted by the increasing geriatric population worldwide. As individuals age, the prevalence of orthopedic conditions such as osteoarthritis and fractures rises, leading to a higher demand for effective treatment options. This demographic shift is expected to drive market growth, with the industry projected to expand at a CAGR of 4.81% from 2025 to 2035. The aging population's need for innovative solutions that promote healing and recovery underscores the importance of orthobiologics in contemporary healthcare, thereby enhancing the market's potential.

Regulatory Support and Innovation

Regulatory support and innovation play a crucial role in shaping the Global Orthobiologics Market Industry. Governments and regulatory bodies are increasingly recognizing the potential of orthobiologics, leading to streamlined approval processes for new products. This supportive environment encourages research and development, fostering innovation in the field. As a result, the market is poised for growth, with new products entering the market that meet evolving clinical needs. The combination of regulatory facilitation and technological advancements is likely to enhance the competitive landscape, driving further investment and interest in orthobiologics.

Advancements in Regenerative Medicine

Advancements in regenerative medicine significantly influence the Global Orthobiologics Market Industry. Innovations in stem cell therapy, platelet-rich plasma, and bone graft substitutes are transforming treatment paradigms for musculoskeletal injuries. These technologies not only enhance healing but also reduce the need for more invasive surgical interventions. As a result, the market is expected to grow, with projections indicating a rise to 12.3 USD Billion by 2035. The integration of these advanced therapies into clinical practice reflects a broader trend towards personalized medicine, which may further propel the adoption of orthobiologics in various therapeutic applications.

Rising Demand for Minimally Invasive Procedures

The Global Orthobiologics Market Industry experiences a notable surge in demand for minimally invasive surgical procedures. These techniques, which often utilize orthobiologics for enhanced healing, are preferred due to their reduced recovery times and lower complication rates. As healthcare providers increasingly adopt these methods, the market is projected to reach 7.34 USD Billion in 2024. This shift towards less invasive options aligns with patient preferences for quicker recovery and less postoperative pain, thereby driving the growth of the orthobiologics sector. The increasing number of orthopedic surgeries globally further supports this trend, indicating a robust future for the industry.

Growing Awareness and Acceptance of Orthobiologics

Growing awareness and acceptance of orthobiologics among healthcare professionals and patients are pivotal for the Global Orthobiologics Market Industry. Educational initiatives and clinical evidence supporting the efficacy of these products contribute to their increasing utilization in orthopedic treatments. As more practitioners recognize the benefits of orthobiologics, including improved healing rates and reduced recovery times, the demand for these products is likely to rise. This trend is further supported by patient advocacy for advanced treatment options, which may lead to a broader acceptance of orthobiologics in clinical settings, ultimately fostering market growth.