Rising Demand in Automotive Sector

The Global Organosilicon Polymers (Polysiloxane) Market Industry experiences a notable surge in demand driven by the automotive sector. Polysiloxanes are increasingly utilized in automotive applications due to their excellent thermal stability and resistance to environmental factors. As the automotive industry shifts towards lightweight materials to enhance fuel efficiency, the incorporation of organosilicon polymers is becoming more prevalent. In 2024, the market is projected to reach 1.35 USD Billion, reflecting the growing preference for advanced materials in vehicle manufacturing. This trend is expected to continue, with the market potentially expanding as automotive manufacturers seek innovative solutions to meet regulatory standards and consumer expectations.

Advancements in Medical Applications

The Global Organosilicon Polymers (Polysiloxane) Market Industry is witnessing growth due to advancements in medical applications. Polysiloxanes are utilized in various medical devices and implants owing to their biocompatibility and flexibility. The increasing focus on healthcare innovation and the development of new medical technologies drive the demand for organosilicon polymers. As the healthcare sector continues to evolve, the need for materials that can withstand sterilization processes while maintaining performance is paramount. This trend suggests a promising future for polysiloxanes, as they are likely to play a crucial role in the development of next-generation medical devices, further solidifying their market presence.

Diverse Applications Across Industries

The Global Organosilicon Polymers (Polysiloxane) Market Industry benefits from the versatility of polysiloxanes across various applications. These polymers are employed in industries ranging from construction to personal care, showcasing their adaptability. In construction, polysiloxanes are used in sealants and coatings due to their durability and weather resistance. In personal care, they enhance product performance in cosmetics and skincare formulations. This broad applicability is likely to fuel market growth as industries increasingly recognize the benefits of incorporating organosilicon polymers into their products. The diverse application spectrum positions polysiloxanes as a critical component in numerous sectors, potentially driving the market to new heights.

Sustainability and Eco-Friendly Solutions

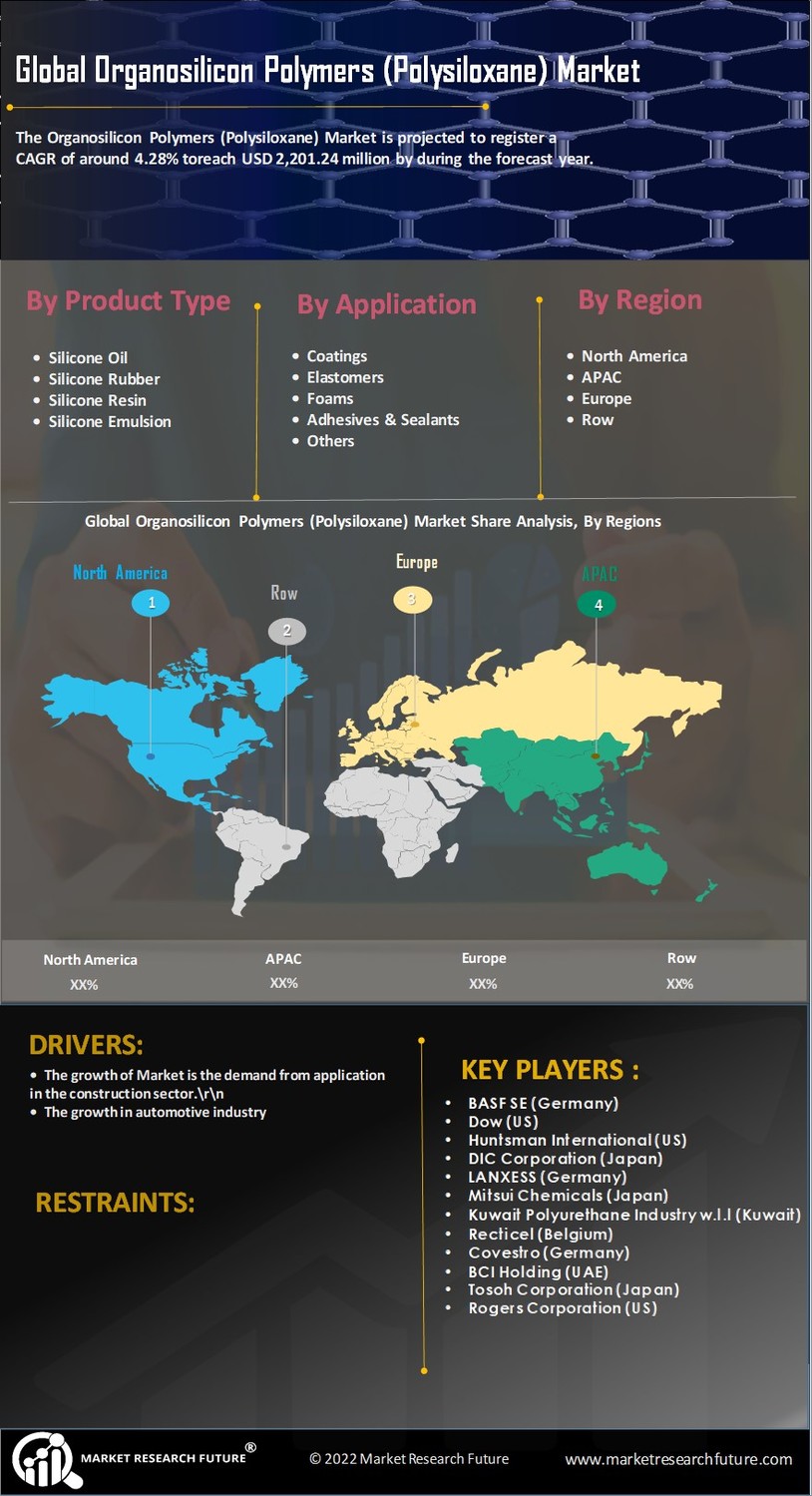

The Global Organosilicon Polymers (Polysiloxane) Market Industry is increasingly shaped by the demand for sustainable and eco-friendly materials. As industries strive to reduce their environmental footprint, polysiloxanes are emerging as a viable alternative due to their low toxicity and potential for recyclability. This shift towards sustainability is prompting manufacturers to explore organosilicon polymers as part of their green initiatives. The market is expected to grow at a CAGR of 6.58% from 2025 to 2035, indicating a robust interest in environmentally responsible materials. This trend not only aligns with global sustainability goals but also enhances the competitive edge of companies adopting these innovative solutions.

Growth in Electronics and Electrical Applications

The Global Organosilicon Polymers (Polysiloxane) Market Industry is significantly influenced by the expansion of the electronics and electrical sectors. Polysiloxanes are favored for their dielectric properties and thermal stability, making them ideal for insulation and encapsulation in electronic devices. As the demand for consumer electronics continues to rise, manufacturers are increasingly adopting organosilicon polymers to enhance product performance and reliability. This trend is likely to contribute to the market's growth, with projections indicating a market size of 2.71 USD Billion by 2035. The increasing complexity of electronic components further underscores the importance of polysiloxanes in ensuring device longevity and efficiency.