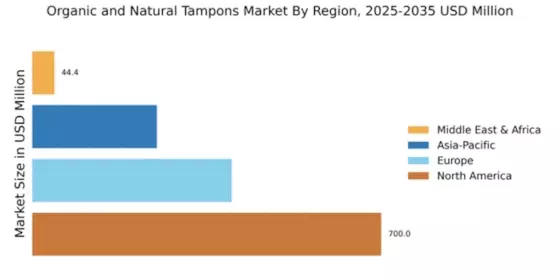

North America : Market Leader in Organic Products

North America is the largest market for organic and natural tampons, holding a significant share of 700.0M in 2024. The growth is driven by increasing consumer awareness regarding health and environmental sustainability, alongside a shift towards organic products. Regulatory support for organic certifications and eco-friendly practices further fuels demand, making this region a hub for innovation in menstrual products.

The competitive landscape is robust, with key players like Cora, Seventh Generation, and Rael leading the market. The U.S. is the primary contributor, supported by a growing trend of women seeking safer, chemical-free options. The presence of brands like Natracare and Lola highlights the diverse offerings available, catering to a wide range of consumer preferences.

Europe : Emerging Market with Growth Potential

Europe is witnessing a growing demand for organic and natural tampons, with a market size of 400.0M. Factors such as increasing health consciousness and stringent regulations on product safety are driving this trend. The European Union's commitment to sustainability and eco-friendly products is a significant catalyst, encouraging brands to innovate and meet consumer expectations for organic options.

Leading countries in this region include Germany, France, and the UK, where brands like Organyc and Natracare are making significant inroads. The competitive landscape is evolving, with new entrants focusing on organic certifications and sustainable practices. This shift is expected to enhance market growth as consumers increasingly prioritize health and environmental impact in their purchasing decisions.

Asia-Pacific : Emerging Powerhouse in Organic Market

Asia-Pacific is emerging as a significant player in the organic and natural tampons market, with a market size of 250.0M. The region is experiencing a shift in consumer behavior, with more women opting for organic products due to rising health awareness and environmental concerns. Government initiatives promoting sustainable practices are also contributing to market growth, making this region a focal point for future expansion.

Countries like Australia and Japan are leading the charge, with local brands and international players like Cora and Rael gaining traction. The competitive landscape is becoming increasingly dynamic, with a focus on product innovation and marketing strategies that resonate with health-conscious consumers. This trend is expected to continue as awareness of organic products grows across the region.

Middle East and Africa : Niche Market with Growth Opportunities

The Middle East and Africa region represents a niche market for organic and natural tampons, with a market size of 44.38M. Despite being smaller compared to other regions, there is a growing interest in organic products driven by increasing awareness of health and hygiene. Regulatory frameworks are gradually evolving to support organic certifications, which could enhance market growth in the coming years.

Countries like South Africa and the UAE are showing potential for expansion, with local brands beginning to emerge. The competitive landscape is still developing, but there is an opportunity for international players to enter the market. As consumer preferences shift towards organic and sustainable options, this region could see significant growth in the organic tampon segment.