Health and Wellness Trends

The Spain Organic And Natural Tampons Market is significantly influenced by the growing health and wellness trends among consumers. Many women are becoming more discerning about the products they use, seeking options that are free from harmful chemicals and synthetic materials. Reports suggest that around 60% of women in Spain are concerned about the potential health risks associated with conventional tampons. This concern is propelling the demand for organic and natural alternatives, which are perceived as safer and healthier. Consequently, brands that emphasize the health benefits of their products are likely to thrive in the Spain Organic And Natural Tampons Market, catering to this health-conscious demographic.

Shift Towards Subscription Services

The Spain Organic And Natural Tampons Market is witnessing a shift towards subscription services, which cater to the evolving preferences of consumers. Many women are seeking convenience and reliability in their menstrual product purchases, leading to the rise of subscription models that deliver organic and natural tampons directly to their doorsteps. This trend is supported by data indicating that subscription services in the personal care sector have grown by over 25% in Spain. As consumers increasingly prioritize convenience, brands that offer subscription options are likely to capture a larger share of the Spain Organic And Natural Tampons Market, appealing to busy lifestyles.

Government Regulations and Initiatives

The Spain Organic And Natural Tampons Market is also shaped by government regulations and initiatives aimed at promoting sustainable practices. The Spanish government has introduced various measures to encourage the use of organic products, including tax incentives for manufacturers of eco-friendly goods. Additionally, educational campaigns are being launched to inform consumers about the benefits of choosing organic and natural tampons. These initiatives not only support the growth of the market but also align with broader European Union goals for sustainability. As a result, companies operating in the Spain Organic And Natural Tampons Market may find new opportunities for growth and innovation.

Rising Awareness of Environmental Issues

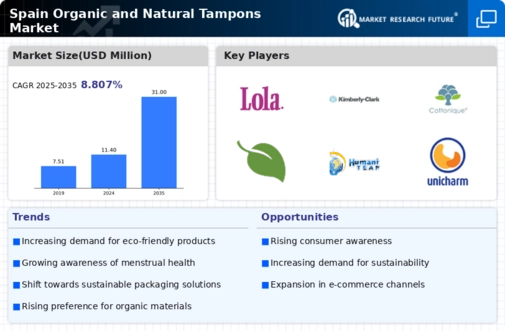

The Spain Organic And Natural Tampons Market is experiencing a notable shift as consumers become increasingly aware of environmental issues. This heightened awareness is driving demand for eco-friendly products, including organic and natural tampons. According to recent surveys, approximately 70% of Spanish women express a preference for sustainable menstrual products, indicating a significant market potential. The Spanish government has also implemented policies aimed at reducing plastic waste, which further encourages the adoption of biodegradable alternatives. As a result, brands that prioritize sustainability are likely to gain a competitive edge in the Spain Organic And Natural Tampons Market, appealing to environmentally conscious consumers.

Influence of Social Media and Online Communities

The Spain Organic And Natural Tampons Market is increasingly influenced by social media and online communities that advocate for sustainable menstrual products. Platforms such as Instagram and Facebook have become vital channels for brands to engage with consumers, share information, and promote their organic offerings. Influencers and activists are actively raising awareness about the benefits of using natural tampons, which resonates with younger demographics. This trend is reflected in the growing online sales of organic products, which have seen a rise of approximately 30% in recent years. Consequently, brands that effectively leverage social media strategies are likely to enhance their visibility and market share in the Spain Organic And Natural Tampons Market.