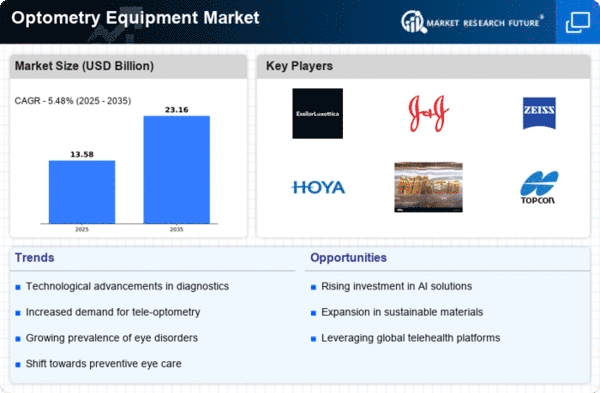

Market Growth Projections

The Global Optometry Equipment Market Industry is on a trajectory of substantial growth, with projections indicating a rise from 12.9 USD Billion in 2024 to 23.2 USD Billion by 2035. This growth reflects the increasing demand for advanced diagnostic and therapeutic equipment in the field of optometry. The anticipated CAGR of 5.49% from 2025 to 2035 highlights the market's potential as it adapts to evolving consumer needs and technological advancements. As the industry continues to innovate and expand, stakeholders are likely to benefit from the growing emphasis on eye health and the importance of regular eye examinations.

Regulatory Support and Funding

Government initiatives and funding aimed at improving eye care services are pivotal in driving the Global Optometry Equipment Market Industry. Policies that promote eye health and allocate resources for advanced equipment acquisition foster a conducive environment for market growth. Regulatory bodies are increasingly recognizing the importance of investing in optometry services, leading to enhanced funding opportunities for clinics and hospitals. This support not only facilitates the adoption of innovative technologies but also encourages the establishment of new facilities. As a result, the market is likely to experience sustained growth, aligning with the projected CAGR of 5.49% from 2025 to 2035.

Growing Awareness of Eye Health

There is a notable increase in public awareness regarding the importance of eye health and regular eye examinations. Campaigns promoting eye care are gaining traction, leading to higher patient engagement and demand for optometry services. This trend significantly impacts the Global Optometry Equipment Market Industry, as more individuals seek professional eye care. Enhanced awareness is likely to result in increased utilization of advanced diagnostic equipment, thereby driving market growth. As consumers become more proactive about their eye health, the industry is poised for expansion, aligning with the projected growth trajectory towards 23.2 USD Billion by 2035.

Expansion of Eye Care Facilities

The proliferation of eye care facilities worldwide is a crucial driver of the Global Optometry Equipment Market Industry. As healthcare infrastructure improves, more clinics and hospitals are equipped with modern optometry tools. This expansion is particularly evident in developing regions, where access to eye care services is increasing. The establishment of specialized eye care centers enhances the availability of comprehensive eye examinations and treatments, thereby boosting the demand for optometry equipment. This trend aligns with the overall market growth, as the industry is expected to reach 23.2 USD Billion by 2035, reflecting the rising need for effective eye care solutions.

Rising Prevalence of Eye Disorders

The increasing incidence of eye disorders globally drives demand for advanced optometry equipment. Conditions such as myopia, hyperopia, and age-related macular degeneration are becoming more prevalent, necessitating enhanced diagnostic tools. In 2024, the Global Optometry Equipment Market Industry is valued at 12.9 USD Billion, reflecting the urgent need for effective eye care solutions. As populations age and lifestyle factors contribute to vision problems, the market is expected to expand significantly, with projections indicating a growth to 23.2 USD Billion by 2035. This trend underscores the critical role of optometry equipment in managing eye health.

Technological Advancements in Equipment

Innovations in optometry equipment, such as digital imaging and tele-optometry, are transforming the landscape of eye care. These advancements enhance diagnostic accuracy and patient experience, making eye examinations more efficient. The Global Optometry Equipment Market Industry benefits from these technological improvements, as they facilitate early detection and treatment of eye conditions. The integration of artificial intelligence in diagnostic tools is particularly noteworthy, as it streamlines processes and improves outcomes. As the market evolves, the demand for cutting-edge equipment is likely to increase, contributing to a projected CAGR of 5.49% from 2025 to 2035.