Increasing Focus on Quality Control

Quality control remains a paramount concern in the Optical Sorter Market, driving the adoption of advanced sorting technologies. Industries are increasingly prioritizing the need for high-quality products, which necessitates the implementation of precise sorting solutions. Optical sorters provide a reliable means of ensuring that only the best products reach consumers, thereby enhancing brand reputation and customer satisfaction. The market is witnessing a shift towards more sophisticated sorting systems that can detect even the slightest defects. This trend is likely to continue, as companies strive to maintain competitive advantages through superior quality assurance processes.

Diverse Applications Across Industries

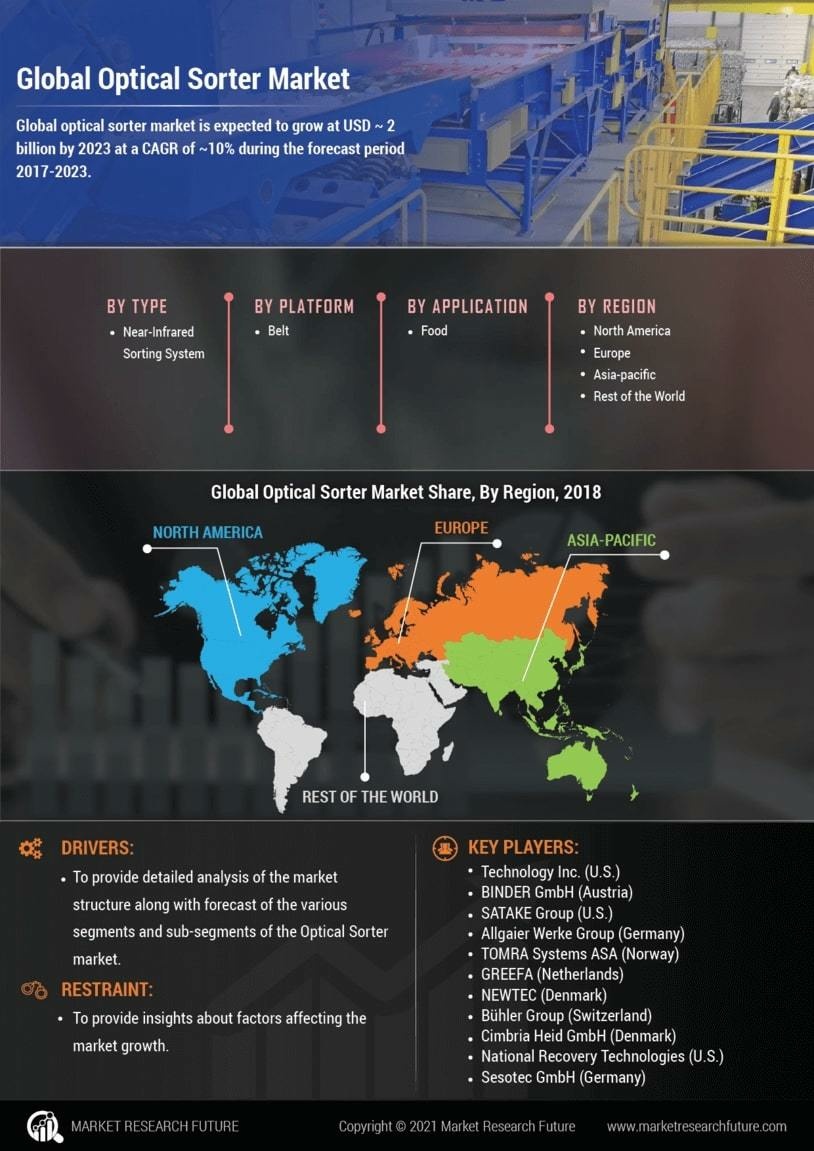

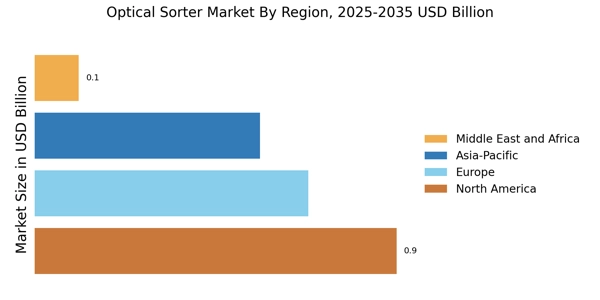

The Optical Sorter Market is characterized by its diverse applications across various sectors, including food, mining, and recycling. In the food industry, optical sorters are utilized to ensure product quality by removing defective items and foreign materials. In mining, these systems are employed to enhance mineral recovery rates by efficiently sorting valuable ores from waste. The versatility of optical sorters is a key driver of market growth, as they can be tailored to meet the specific needs of different industries. As businesses recognize the benefits of implementing optical sorting technology, the demand for these systems is expected to rise, further propelling market expansion.

Rising Labor Costs and Automation Needs

The Optical Sorter Market is significantly impacted by rising labor costs, prompting industries to seek automation solutions. As labor expenses continue to escalate, companies are increasingly turning to optical sorting technologies to reduce reliance on manual labor. These systems not only improve operational efficiency but also minimize human error in sorting processes. The trend towards automation is particularly evident in sectors such as food processing and recycling, where precision and speed are critical. As businesses aim to optimize their operations and reduce costs, the demand for optical sorters is expected to grow, indicating a robust future for the market.

Sustainability Initiatives Driving Demand

The Optical Sorter Market is increasingly influenced by sustainability initiatives aimed at reducing waste and promoting recycling. As environmental concerns gain prominence, industries are seeking efficient sorting solutions to minimize landfill contributions. Optical sorters play a vital role in recycling processes by accurately separating recyclable materials from waste. This capability not only enhances recycling rates but also supports the circular economy. Reports indicate that the recycling sector is expected to expand, with a notable increase in the adoption of optical sorting technologies. Companies are investing in these systems to meet regulatory requirements and consumer expectations for sustainable practices.

Technological Advancements in Optical Sorting

The Optical Sorter Market is experiencing rapid technological advancements that enhance sorting efficiency and accuracy. Innovations such as artificial intelligence and machine learning are being integrated into sorting systems, allowing for real-time data analysis and improved decision-making. These technologies enable optical sorters to identify and separate materials with greater precision, which is crucial in sectors like food processing and recycling. The market for optical sorters is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. This growth is driven by the increasing demand for automation and the need for high-quality sorting solutions across various industries.