Growth in E-commerce

The rapid expansion of the e-commerce sector is significantly influencing the Global Packaging Machinery Market Industry. As online shopping continues to grow, the demand for efficient and secure packaging solutions is escalating. Companies are increasingly investing in packaging machinery that can accommodate diverse product sizes and ensure safe delivery. This trend is expected to drive market growth, as businesses seek to enhance customer satisfaction through improved packaging. The projected compound annual growth rate of 5.13% from 2025 to 2035 indicates a robust market response to the evolving needs of e-commerce logistics and packaging requirements.

Technological Advancements

The Global Packaging Machinery Market Industry is experiencing a surge in technological advancements, which enhances efficiency and productivity. Innovations such as automation, robotics, and artificial intelligence are being integrated into packaging processes, allowing for faster production rates and reduced labor costs. For instance, the adoption of smart packaging solutions is expected to streamline operations and improve supply chain management. As a result, the market is projected to reach 49.2 USD Billion in 2024, reflecting the industry's response to the demand for more sophisticated machinery. These advancements not only optimize production but also contribute to sustainability efforts by minimizing waste.

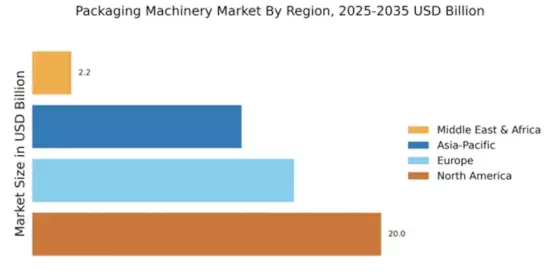

Market Trends and Projections

The Global Packaging Machinery Market Industry is characterized by various trends and projections that indicate its future trajectory. The market is expected to reach 49.2 USD Billion in 2024, with a robust growth forecast leading to 85.4 USD Billion by 2035. The compound annual growth rate of 5.13% from 2025 to 2035 suggests a sustained demand for innovative packaging solutions. Key trends include the integration of automation and sustainability in packaging processes, reflecting the industry's adaptability to changing consumer preferences and technological advancements. These projections highlight the dynamic nature of the market and its potential for continued expansion.

Globalization of Supply Chains

The globalization of supply chains is reshaping the Global Packaging Machinery Market Industry. As companies expand their operations internationally, the need for standardized packaging solutions that comply with various regulations becomes paramount. This trend is fostering the development of versatile machinery capable of adapting to different markets and consumer preferences. The increasing complexity of global logistics necessitates innovative packaging solutions that ensure product integrity during transit. Consequently, the market is poised for growth as businesses invest in machinery that can meet these diverse requirements, thereby enhancing operational efficiency and competitiveness.

Consumer Preferences for Convenience

Consumer preferences are shifting towards convenience, which is a significant driver in the Global Packaging Machinery Market Industry. As lifestyles become busier, there is a growing demand for packaging that offers ease of use, portability, and quick access to products. This trend is prompting manufacturers to develop innovative packaging solutions that cater to these needs, such as resealable pouches and single-serve containers. The market's evolution in response to these preferences is likely to contribute to its growth trajectory, as companies strive to enhance user experience while maintaining product quality and safety.

Rising Demand for Sustainable Packaging

Sustainability is becoming a pivotal driver in the Global Packaging Machinery Market Industry. As consumers increasingly prefer eco-friendly products, manufacturers are compelled to adopt sustainable packaging solutions. This shift is prompting investments in machinery that supports biodegradable and recyclable materials. The market is likely to benefit from this trend, as companies seek to align with environmental regulations and consumer preferences. By 2035, the market is anticipated to expand to 85.4 USD Billion, driven by the need for sustainable practices. This transition not only addresses environmental concerns but also opens new avenues for innovation in packaging technologies.