Growth of E-commerce and Online Retail

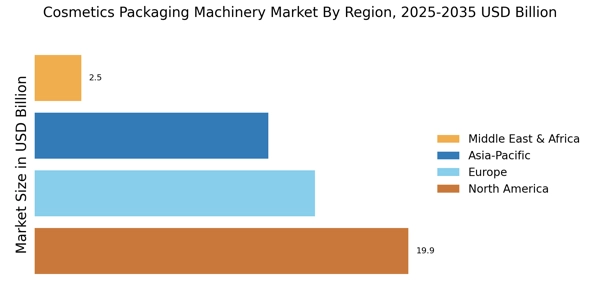

The Cosmetics Packaging Machinery Market is being propelled by the rapid growth of e-commerce and online retail channels. As more consumers turn to online shopping for cosmetics, the demand for efficient and attractive packaging solutions is increasing. Packaging plays a crucial role in the online shopping experience, as it must ensure product safety during transit while also appealing to consumers visually. Recent statistics indicate that e-commerce sales in the cosmetics sector have surged by over 20% in the past year. This trend necessitates the development of packaging machinery that can accommodate various sizes and shapes, catering to the diverse needs of online retailers. Consequently, manufacturers are focusing on creating versatile packaging solutions that enhance the consumer experience and meet the logistical challenges posed by e-commerce.

Consumer Preference for Personalization

The Cosmetics Packaging Machinery Market is witnessing a surge in consumer preference for personalized products. As consumers seek unique and tailored experiences, brands are responding by offering customizable packaging options. This trend is particularly evident in the cosmetics sector, where personalized packaging can significantly enhance brand identity and consumer engagement. Data indicates that nearly 30% of consumers are willing to pay a premium for personalized products, which is driving brands to invest in packaging machinery that can accommodate small batch production and customization. This shift not only allows brands to differentiate themselves in a crowded market but also fosters a deeper connection with consumers, ultimately leading to increased sales and brand loyalty.

Technological Advancements in Machinery

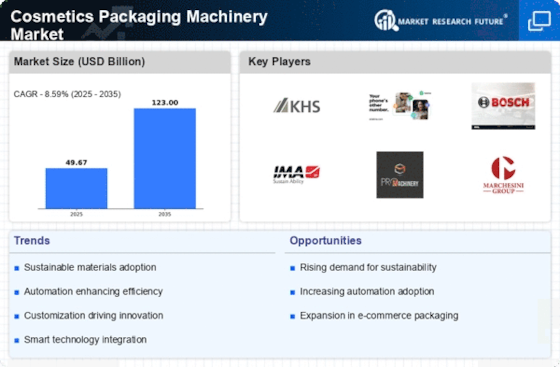

Technological advancements are significantly influencing the Cosmetics Packaging Machinery Market. The integration of automation and smart technologies is enhancing production efficiency and reducing operational costs. For instance, the adoption of robotics in packaging processes allows for higher precision and speed, which is crucial in meeting the increasing demand for cosmetics products. Furthermore, the market is witnessing a rise in the use of artificial intelligence to optimize packaging designs and processes. Data suggests that the market for advanced packaging machinery is expected to grow by approximately 5% annually, driven by these technological innovations. As a result, companies that invest in state-of-the-art machinery are likely to gain a competitive edge in the cosmetics sector.

Rising Demand for Eco-Friendly Packaging

The Cosmetics Packaging Machinery Market is experiencing a notable shift towards eco-friendly packaging solutions. As consumers become increasingly aware of environmental issues, brands are compelled to adopt sustainable practices. This trend is reflected in the growing demand for biodegradable and recyclable materials in packaging. According to recent data, the market for sustainable packaging is projected to grow at a compound annual growth rate of approximately 7.5% over the next five years. Consequently, manufacturers of cosmetics packaging machinery are innovating to meet these demands, integrating technologies that facilitate the use of sustainable materials. This shift not only aligns with consumer preferences but also enhances brand loyalty, as companies that prioritize sustainability are often viewed more favorably by their customers.

Regulatory Compliance and Safety Standards

The Cosmetics Packaging Machinery Market is increasingly influenced by stringent regulatory compliance and safety standards. Governments and regulatory bodies are imposing stricter guidelines on packaging materials and processes to ensure consumer safety and environmental protection. This has led to a heightened demand for machinery that can produce compliant packaging solutions. Manufacturers are now required to invest in advanced technologies that can meet these regulations while maintaining efficiency. Recent reports suggest that the compliance-related costs in the cosmetics sector have risen by approximately 10% over the past few years. As a result, companies that prioritize regulatory compliance in their packaging processes are likely to enhance their market position and build consumer trust.