North America : Market Leader in Innovation

North America is poised to maintain its leadership in the Optical Manufacturing Equipment Repair and MRO Services Market, holding a market size of $1.75B in 2025. Key growth drivers include a robust technological infrastructure, increasing demand for precision optics, and supportive regulatory frameworks. The region's focus on R&D and innovation further fuels market expansion, with a significant share attributed to advancements in semiconductor manufacturing and photonics technologies.

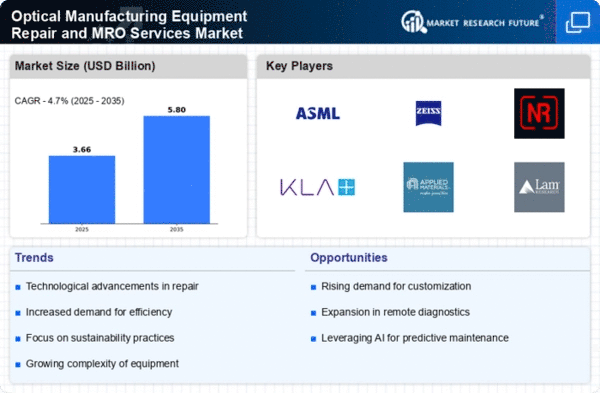

The competitive landscape is characterized by the presence of major players such as KLA Corporation, Applied Materials, and Lam Research, which are instrumental in driving market dynamics. The U.S. leads the region, supported by a strong manufacturing base and a high concentration of optical technology firms. This competitive environment fosters collaboration and innovation, ensuring that North America remains at the forefront of optical manufacturing advancements.

Europe : Emerging Hub for Optical Services

Europe is emerging as a significant player in the Optical Manufacturing Equipment Repair and MRO Services Market, with a market size of $1.0B in 2025. The region benefits from stringent regulatory standards that promote high-quality manufacturing and repair services. Increasing investments in renewable energy and advanced manufacturing technologies are driving demand for optical equipment, enhancing the market's growth potential. The European market is also witnessing a shift towards sustainable practices, aligning with global environmental goals.

Germany and France are leading countries in this sector, hosting key players like Zeiss and Nikon. The competitive landscape is marked by a mix of established firms and innovative startups, fostering a dynamic environment for growth. The European market is characterized by collaboration between industry and academia, which enhances technological advancements and ensures compliance with regulatory standards. "The European optical industry is committed to innovation and sustainability, driving growth in the MRO services sector."

Asia-Pacific : Rapidly Growing Market Potential

Asia-Pacific is witnessing rapid growth in the Optical Manufacturing Equipment Repair and MRO Services Market, with a market size of $0.9B in 2025. The region's growth is driven by increasing demand for consumer electronics, advancements in manufacturing technologies, and a growing focus on quality assurance. Countries like Japan and South Korea are at the forefront, supported by government initiatives aimed at enhancing technological capabilities and fostering innovation in optical manufacturing.

Japan, with its strong presence of companies like Nikon and Tokyo Electron, plays a crucial role in the competitive landscape. The region is characterized by a mix of established players and emerging firms, creating a vibrant ecosystem for optical services. The focus on R&D and collaboration among industry stakeholders is expected to propel market growth, ensuring that Asia-Pacific remains a key player in the global optical manufacturing landscape.

Middle East and Africa : Emerging Market with Potential

The Middle East and Africa region is gradually emerging in the Optical Manufacturing Equipment Repair and MRO Services Market, with a market size of $0.75B in 2025. The growth is primarily driven by increasing investments in technology and infrastructure, alongside a rising demand for high-quality optical products. Governments in the region are focusing on diversifying their economies, which includes enhancing the manufacturing sector, thereby creating opportunities for optical services and repair.

Countries like South Africa and the UAE are leading the way, with a growing number of local and international players entering the market. The competitive landscape is evolving, with an increasing emphasis on partnerships and collaborations to enhance service offerings. As the region continues to develop its technological capabilities, the optical repair services market is expected to expand significantly, providing a platform for growth and innovation.