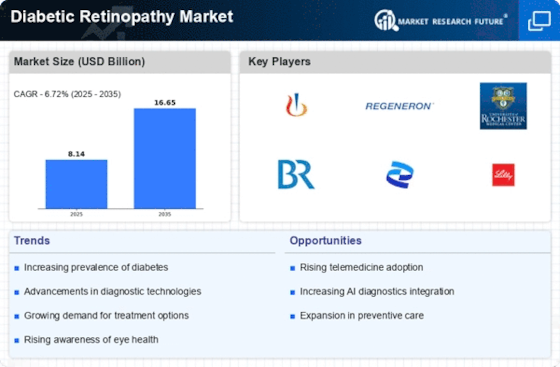

Rising Prevalence of Diabetes

The increasing prevalence of diabetes is a primary driver of the Diabetic Retinopathy Market. As the number of individuals diagnosed with diabetes continues to rise, the incidence of diabetic retinopathy, a common complication, is also expected to increase. According to recent statistics, approximately 463 million adults are living with diabetes, and this number is projected to reach 700 million by 2045. This alarming trend underscores the urgent need for effective screening and treatment options within the Diabetic Retinopathy Market. Healthcare providers are likely to invest more in innovative therapies and diagnostic tools to address this growing patient population, thereby propelling market growth.

Growing Awareness and Education

There is a notable increase in awareness and education regarding diabetic retinopathy, which serves as a crucial driver for the Diabetic Retinopathy Market. Public health campaigns and initiatives aimed at educating patients about the risks associated with diabetes and the importance of regular eye examinations are gaining traction. This heightened awareness is likely to lead to earlier diagnosis and treatment, ultimately improving patient outcomes. As more individuals become informed about the potential complications of diabetes, the demand for screening and therapeutic interventions within the Diabetic Retinopathy Market is expected to rise.

Advancements in Treatment Modalities

Innovations in treatment modalities are significantly influencing the Diabetic Retinopathy Market. Recent developments in pharmacological therapies, such as anti-VEGF injections and corticosteroids, have shown promising results in managing the condition. The introduction of these advanced treatments has the potential to improve patient outcomes and reduce the risk of vision loss. Furthermore, the market is witnessing the emergence of combination therapies that enhance efficacy. As healthcare professionals increasingly adopt these novel approaches, the demand for effective treatment options is likely to surge, thereby driving the growth of the Diabetic Retinopathy Market.

Increased Investment in Healthcare Infrastructure

The ongoing investment in healthcare infrastructure is a significant factor propelling the Diabetic Retinopathy Market. Governments and private entities are allocating substantial resources to enhance healthcare facilities, particularly in regions with high diabetes prevalence. This investment is likely to improve access to eye care services, including screening and treatment for diabetic retinopathy. Enhanced infrastructure facilitates the adoption of advanced diagnostic technologies and treatment options, which could lead to better management of the condition. As healthcare systems evolve, the Diabetic Retinopathy Market is poised for growth, driven by improved service delivery.

Integration of Artificial Intelligence in Diagnostics

The integration of artificial intelligence (AI) in diagnostic processes is emerging as a transformative driver for the Diabetic Retinopathy Market. AI technologies are being utilized to enhance the accuracy and efficiency of diabetic retinopathy screenings. Machine learning algorithms can analyze retinal images with remarkable precision, enabling earlier detection of the disease. This technological advancement not only streamlines the diagnostic process but also reduces the burden on healthcare professionals. As AI continues to evolve, its application in the Diabetic Retinopathy Market is likely to expand, fostering innovation and improving patient care.