Advancements in Data Analytics

The evolution of data analytics technologies significantly influences the Operational Predictive Maintenance Market. With the ability to analyze vast amounts of data in real-time, organizations can identify potential equipment failures before they occur. This proactive approach not only enhances maintenance strategies but also contributes to cost savings. The market for data analytics in maintenance is projected to reach substantial figures, reflecting the growing reliance on data-driven decision-making. As industries increasingly adopt advanced analytics tools, the Operational Predictive Maintenance Market is likely to experience accelerated growth, driven by the need for actionable insights.

Growing Focus on Asset Longevity

The increasing emphasis on asset longevity and lifecycle management is shaping the Operational Predictive Maintenance Market. Organizations are recognizing the importance of extending the lifespan of their assets to maximize return on investment. Predictive maintenance plays a crucial role in achieving this goal by enabling timely maintenance interventions that prevent premature equipment failure. As industries strive to optimize asset utilization, the demand for predictive maintenance solutions is expected to rise. This focus on asset longevity not only enhances operational efficiency but also contributes to sustainability efforts, further driving the growth of the Operational Predictive Maintenance Market.

Integration of Smart Technologies

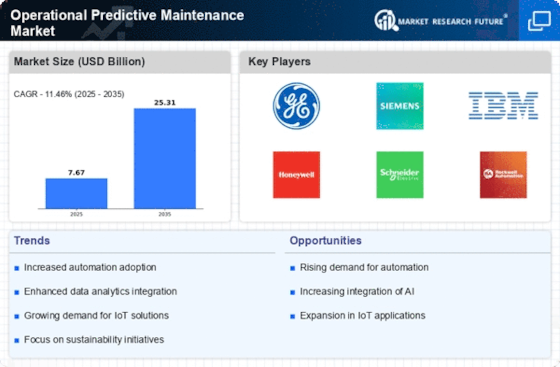

The integration of smart technologies, such as the Internet of Things (IoT) and artificial intelligence (AI), is a key driver of the Operational Predictive Maintenance Market. These technologies enable real-time monitoring and analysis of equipment performance, allowing for timely interventions. The adoption of IoT devices in maintenance practices is projected to grow, with estimates suggesting a significant increase in connected devices in industrial settings. This trend indicates a shift towards more intelligent maintenance solutions, which are likely to enhance the efficiency and effectiveness of predictive maintenance strategies, thereby bolstering the market.

Rising Demand for Operational Efficiency

The increasing need for operational efficiency across various industries drives the Operational Predictive Maintenance Market. Companies are striving to minimize downtime and enhance productivity, which necessitates the adoption of predictive maintenance solutions. According to recent estimates, organizations that implement predictive maintenance can reduce maintenance costs by up to 30%. This trend is particularly evident in sectors such as manufacturing and energy, where equipment reliability is paramount. As businesses seek to optimize their operations, the demand for predictive maintenance technologies is expected to grow, indicating a robust market trajectory for the Operational Predictive Maintenance Market.

Regulatory Compliance and Safety Standards

Stringent regulatory compliance and safety standards across various sectors propel the Operational Predictive Maintenance Market. Organizations are compelled to adhere to regulations that mandate regular equipment inspections and maintenance to ensure safety and operational integrity. This regulatory landscape fosters the adoption of predictive maintenance solutions, as they facilitate compliance by providing timely insights into equipment health. The market is expected to expand as companies prioritize safety and compliance, recognizing that predictive maintenance not only meets regulatory requirements but also enhances overall operational performance.