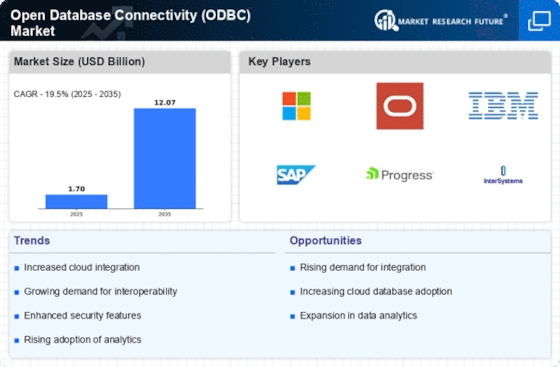

The open database connectivity (ODBC) market will continue to grow due to major companies in the industry making significant R&D investments to extend their product ranges. Significant market developments include new product releases, contractual agreements, mergers and acquisitions, greater investments, and cooperation with other organizations. Market participants also engage in various strategic actions to broaden their global footprint. The open database connectivity (ODBC) sector must provide affordable products & services to grow and thrive in a more cutthroat and dynamic market. One of the main strategies manufacturers use in the worldwide open database connectivity (ODBC) market is local manufacturing, which expands the market sector and helps customers by lowering operating costs. Some of the biggest medical benefits in recent years have come from the open database connectivity (ODBC) sector. Major players in the open database connectivity (ODBC) market, including Microsoft, Oracle, SAP, IBM Corporation, CData Software, Inc., Devart, Databricks, MariaDB, Progress Software Corporation, Skills and Services GmbH, and others, are making investments in R&D activities in an effort to boost market demand. Software products, services, and gadgets are developed and provided by Microsoft Corp. The company provides a wide range of operating systems, video games, desktop and server management tools, business solution programs, productivity apps for many devices, server applications, software development tools, and training and certification services. In addition, it creates, produces, and markets hardware goods, including tablets, PCs, gaming consoles, and other smart gadgets. The business provides an extensive range of services, such as consultancy, cloud-based solutions, and solution support. Microsoft uses it to market, distribute, and sell its products. In January 2023, Microsoft fixed a known bug that affected Windows programs using ODBC database connections after downloading the November 2022 patches. Windows versions as recent as Windows 11 and Windows Server 2022, as well as Windows 7 SP1 and Windows Server 2008 SP2, are affected by this issue. Information technology products and services are offered by International Business Machines Corp. (IBM). The company provides infrastructure, hosting, and consulting services in addition to producing and distributing system software and hardware. In terms of analytics, AI, blockchain, automation, cloud computing, IT management, and IT infrastructure, IBM's product line includes software development tools and cybersecurity. Additionally, the business provides services in the areas of cloud computing, security, networking, application development, technology consulting, business resilience, and technology support. It provides services to the following industries: automotive, retail and consumer goods, life sciences, healthcare, insurance, electronics, energy and utilities, manufacturing, metals and mining, and telecommunication.