Rising Data Integration Needs

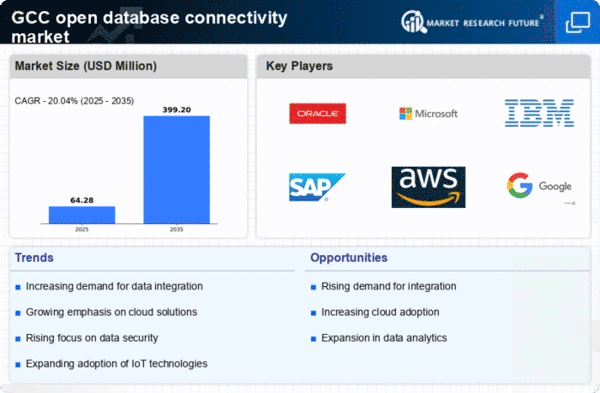

The open database-connectivity market is experiencing a surge in demand for seamless data integration across various platforms. Organizations in the GCC are increasingly recognizing the necessity of integrating disparate data sources to enhance operational efficiency. This trend is driven by the need for real-time analytics and decision-making capabilities. As businesses strive to remain competitive, the ability to connect and analyze data from multiple databases becomes paramount. According to recent estimates, the market for data integration solutions is projected to grow at a CAGR of 15% through 2027 in the GCC region. This growth indicates a robust appetite for open database-connectivity solutions that facilitate smooth data flow and interoperability.

Adoption of Advanced Analytics

The adoption of advanced analytics tools is driving growth in the open database-connectivity market. Organizations in the GCC are leveraging data analytics to gain insights and improve decision-making processes. The integration of open database-connectivity solutions with advanced analytics platforms enables businesses to extract valuable insights from their data. This trend is supported by the increasing availability of big data technologies and machine learning algorithms. As companies aim to harness the power of data, the demand for open database-connectivity solutions that facilitate advanced analytics is expected to rise. The market for analytics solutions in the GCC is projected to reach $5 billion by 2025, indicating a robust growth trajectory.

Growing Emphasis on Data Security

In the open database-connectivity market, the growing emphasis on data security is becoming a significant driver. Organizations in the GCC are increasingly aware of the risks associated with data breaches and cyber threats. As a result, there is a heightened focus on implementing secure database connectivity solutions that protect sensitive information. This trend is reflected in the rising investments in cybersecurity measures, with the GCC expected to allocate over $30 billion towards cybersecurity by 2026. The demand for secure open database-connectivity solutions is likely to rise as businesses seek to comply with stringent regulations and safeguard their data assets.

Government Initiatives and Support

Government initiatives in the GCC are playing a crucial role in fostering the open database-connectivity market. Various national strategies emphasize digital transformation and the adoption of advanced technologies. For instance, the UAE's Vision 2021 and Saudi Arabia's Vision 2030 aim to enhance data-driven decision-making across sectors. These initiatives often include funding and support for technology adoption, which encourages organizations to invest in open database-connectivity solutions. The backing from government entities not only accelerates the implementation of these technologies but also promotes a culture of innovation. As a result, the open database-connectivity market is likely to benefit from increased public sector investments and collaborative projects.

Shift Towards Cloud-Based Solutions

The shift towards cloud-based solutions is significantly impacting the open database-connectivity market. Organizations in the GCC are increasingly migrating their data and applications to the cloud, driven by the need for scalability and flexibility. This transition necessitates the use of open database-connectivity solutions that can seamlessly connect cloud-based databases with on-premises systems. The cloud services market in the GCC is anticipated to grow at a CAGR of 20% through 2026, highlighting the potential for open database-connectivity solutions to thrive in this environment. As businesses seek to optimize their operations and reduce costs, the demand for cloud-compatible database connectivity solutions is likely to increase.