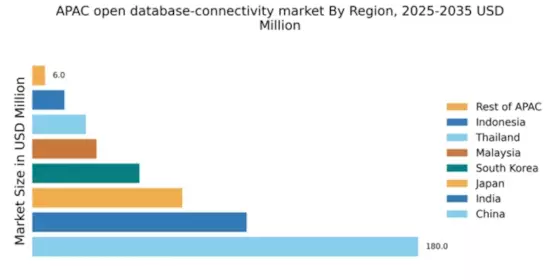

China : Unmatched Growth and Innovation

Key markets include major cities like Beijing, Shanghai, and Shenzhen, which are hubs for technology and innovation. The competitive landscape features strong players such as Alibaba Cloud, Tencent, and Huawei, alongside global giants like Oracle and Microsoft. Local market dynamics are characterized by a robust startup ecosystem and increasing collaboration between tech firms and government agencies. Industries such as finance, healthcare, and e-commerce are rapidly adopting open database connectivity solutions to enhance operational efficiency and customer engagement.

India : Emerging Market with High Demand

Key markets include Bengaluru, Hyderabad, and Mumbai, which are known for their tech-savvy populations and vibrant business environments. The competitive landscape features major players like TCS, Infosys, and Wipro, alongside international firms such as IBM and SAP. Local dynamics are influenced by a strong emphasis on innovation and collaboration between tech companies and educational institutions. Sectors like fintech, e-commerce, and healthcare are increasingly leveraging open database connectivity for improved service delivery.

Japan : Innovation and Quality Drive Growth

Key markets include Tokyo, Osaka, and Nagoya, which are centers for technology and finance. The competitive landscape is dominated by local players like Fujitsu and NEC, alongside global firms such as Microsoft and Oracle. The business environment is characterized by a focus on quality and customer satisfaction, with industries like manufacturing, automotive, and finance increasingly adopting open database connectivity solutions to enhance operational efficiency and innovation.

South Korea : Innovation Fuels Competitive Edge

Key markets include Seoul, Busan, and Incheon, which are known for their technological advancements and innovation hubs. The competitive landscape features major players like Samsung SDS and LG CNS, alongside international firms such as IBM and Amazon Web Services. Local market dynamics are characterized by a strong emphasis on R&D and collaboration between tech firms and academic institutions. Industries such as telecommunications, finance, and healthcare are increasingly adopting open database connectivity solutions to drive efficiency and innovation.

Malaysia : Strategic Location and Development

Key markets include Kuala Lumpur, Penang, and Johor, which are emerging as technology hubs. The competitive landscape features local players like Axiata and Maxis, alongside international firms such as Oracle and Microsoft. The business environment is characterized by a focus on innovation and collaboration between government and private sectors. Industries such as finance, telecommunications, and e-commerce are increasingly leveraging open database connectivity to enhance service delivery and operational efficiency.

Thailand : Digital Transformation on the Rise

Key markets include Bangkok, Chiang Mai, and Pattaya, which are becoming technology hubs. The competitive landscape features local players like True Corporation and Advanced Info Service, alongside international firms such as IBM and SAP. The business environment is characterized by a focus on innovation and collaboration between tech firms and government agencies. Industries such as tourism, finance, and retail are increasingly adopting open database connectivity solutions to enhance operational efficiency and customer engagement.

Indonesia : Emerging Market with Opportunities

Key markets include Jakarta, Surabaya, and Bandung, which are becoming technology hubs. The competitive landscape features local players like Telkom Indonesia and Gojek, alongside international firms such as Amazon Web Services and Microsoft. The business environment is characterized by a focus on innovation and collaboration between tech firms and government agencies. Industries such as e-commerce, finance, and telecommunications are increasingly leveraging open database connectivity solutions to enhance operational efficiency and customer engagement.

Rest of APAC : Varied Growth Across Sub-regions

Key markets include emerging economies in Southeast Asia and the Pacific Islands. The competitive landscape features a mix of local and international players, with varying degrees of market penetration. Local dynamics are influenced by economic conditions, regulatory environments, and technological readiness. Industries such as agriculture, tourism, and small-scale manufacturing are increasingly adopting open database connectivity solutions to improve efficiency and competitiveness.