Regulatory Pressures and Compliance

The Opacifying Ingredient Market faces increasing regulatory pressures that necessitate compliance with stringent safety and environmental standards. Regulatory bodies are implementing more rigorous guidelines regarding the use of certain chemicals in cosmetic and personal care products, which directly impacts the formulation of opacifying agents. Manufacturers are compelled to invest in research and development to ensure that their products meet these evolving regulations. This has led to a surge in the demand for compliant and safe opacifying ingredients, as companies seek to avoid potential legal repercussions and maintain consumer trust. The ongoing evolution of regulatory frameworks is likely to shape the future landscape of the Opacifying Ingredient Market, driving innovation and reformulation efforts.

Emerging Markets and Consumer Trends

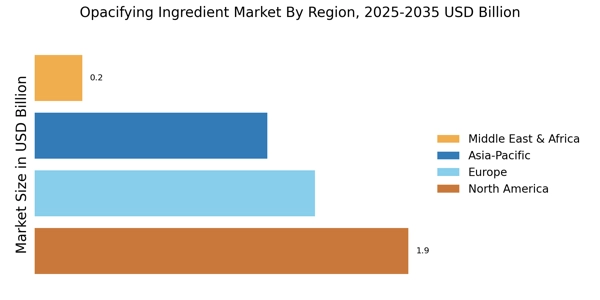

Emerging markets are becoming increasingly influential in the Opacifying Ingredient Market, as rising disposable incomes and changing consumer preferences drive demand for personal care products. In regions such as Asia-Pacific and Latin America, there is a growing appetite for beauty and personal care items that utilize opacifying agents to enhance product performance. Market analysts project that these regions will witness a compound annual growth rate of over 7% in the coming years, fueled by urbanization and a burgeoning middle class. This trend presents significant opportunities for manufacturers to expand their reach and cater to the unique needs of consumers in these markets. As a result, the Opacifying Ingredient Market is likely to see increased competition and innovation as companies strive to capture market share.

Rising Demand for Sustainable Products

The Opacifying Ingredient Market is experiencing a notable shift towards sustainability, driven by consumer preferences for eco-friendly products. As awareness of environmental issues grows, manufacturers are increasingly incorporating sustainable practices into their production processes. This trend is reflected in the rising demand for natural and biodegradable opacifying agents, which are perceived as safer alternatives to synthetic counterparts. According to recent data, the market for sustainable personal care products is projected to grow at a compound annual growth rate of 8.5% over the next five years. This shift not only influences product formulation but also encourages innovation in sourcing and production methods, thereby reshaping the competitive landscape of the Opacifying Ingredient Market.

Technological Advancements in Formulation

Technological innovations are playing a pivotal role in the Opacifying Ingredient Market, enhancing the efficacy and application of opacifying agents. Advances in formulation technologies allow for the development of more effective and versatile ingredients that cater to diverse consumer needs. For instance, the introduction of microencapsulation techniques has improved the stability and performance of opacifying agents in various applications, including cosmetics and personal care products. This has led to an increase in product offerings that utilize these advanced ingredients, thereby expanding market opportunities. Furthermore, the integration of digital technologies in product development processes is streamlining operations and reducing time-to-market, which is crucial in the fast-paced Opacifying Ingredient Market.

Growth in the Cosmetics and Personal Care Sector

The Opacifying Ingredient Market is significantly influenced by the robust growth of the cosmetics and personal care sector. As consumers increasingly prioritize aesthetics and product performance, the demand for opacifying agents in formulations such as creams, lotions, and makeup products is on the rise. Market data indicates that the cosmetics industry is expected to reach a valuation of over 800 billion by 2025, with a substantial portion attributed to the use of opacifying ingredients. This growth is driven by trends such as the increasing popularity of premium and luxury beauty products, which often utilize opacifying agents to enhance visual appeal and texture. Consequently, the Opacifying Ingredient Market is poised for expansion as it aligns with the evolving preferences of consumers.