Research Methodology on Online Meeting Software Market

1. Introduction

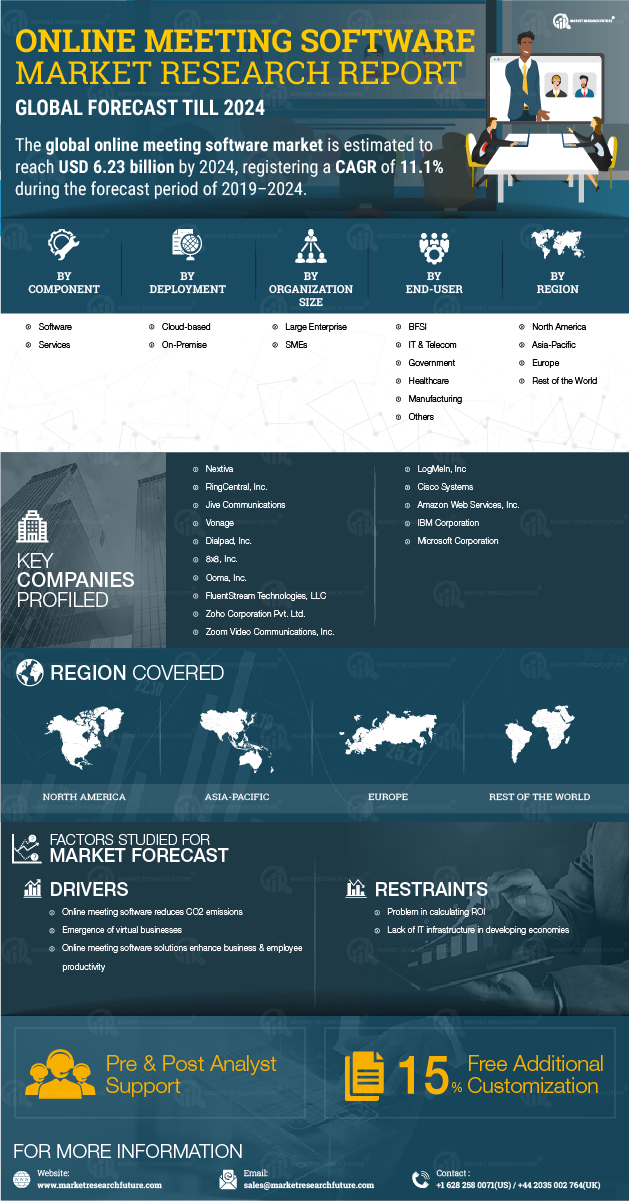

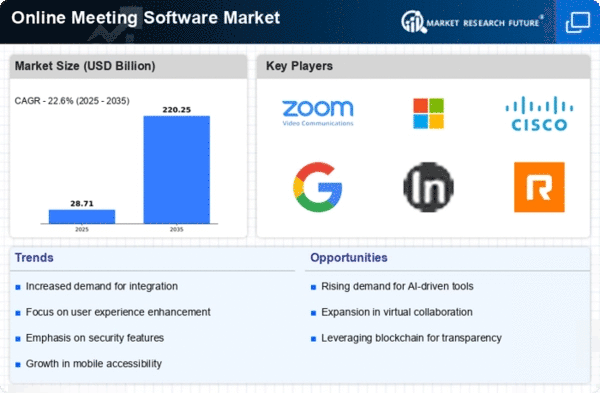

This research study aims to provide a comprehensive analysis of the Online Meeting Software Market. To achieve this, the research report analyzes the relevant market data and statistics and identifies the key trends in the market. We have used a combination of primary and secondary data sources for this study, including interviews with industry experts, market research papers, and annual reports.

2. Objectives

The primary objective of this research report is to provide an in-depth analysis of the market for online meeting software and understand the current market dynamics and identify the major drivers and constraints.

3. Scope of the Report

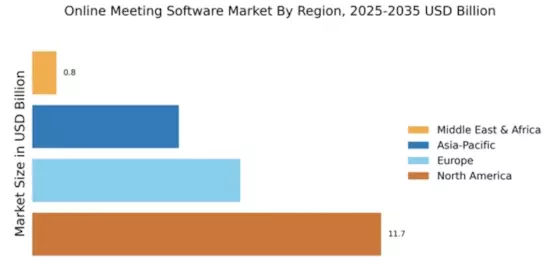

The scope this research report covers the size, scope, and growth of the Online Meeting Software Market. Additionally, the report covers the analysis of the market dynamics, key players, and regional markets.

4. Research Design

The research design used in this research will be qualitative in nature. We will be collecting data from multiple sources such as interviews with experts, market research papers, annual reports, and secondary sources such as the Internet. Additionally, we will be using primary data to analyze the key market dynamics, such as drivers, restraints, and opportunities.

5. Research Approach

The research approach adopted for this study is exploratory in nature. We will be conducting primary research to gather data about the market and to understand the current market dynamics. This data will then be analyzed to identify the key trends and drivers and their effects on the market.

6. Data Sources

a. Primary Data Sources

- Interviews with experts in the industry

- Focus group interviews with customers and industry stakeholders

iii. Surveys with industry stakeholders

b. Secondary Data Sources

- Market research reports

- Annual reports

iii. Industry Database

7. Data Analysis

The data collected from primary and secondary sources will be analyzed using both descriptive and inferential statistics. Descriptive statistics will be used to summarize the data and inferential statistics will be used to conclude the data.

8. Sample Size

The sample size for this research report will consist of both primary and secondary sources. Specifically, we will be conducting primary research through interviews with 20 industry experts, 5 focus groups consisting of customers and industry stakeholders, and 10 surveys with industry stakeholders. Furthermore, secondary sources such as market research papers, annual reports, and industry databases will be used to form the sample size for the research report.

Conclusion

In conclusion, this research report aims to provide an in-depth analysis of the global Online Meeting Software Market. We have used a combination of primary and secondary data sources to ensure a comprehensive analysis of the market. We have also adopted a qualitative research approach and analyzed the data using both descriptive and inferential statistics. We hope that this research report will be a valuable resource for understanding the current dynamics of the Online Meeting Software Market.