Increased Mobile Workforce

The Mobile Data Protection Market is witnessing growth fueled by the expansion of the mobile workforce. As more employees work remotely and utilize mobile devices for business operations, the need for effective data protection solutions becomes paramount. Recent studies suggest that nearly 70% of organizations have adopted mobile work policies, leading to a surge in mobile device usage. This shift necessitates the implementation of robust mobile data protection measures to secure sensitive information accessed and transmitted via mobile devices. Consequently, the Mobile Data Protection Market is likely to experience increased investment as organizations seek to protect their data assets in a mobile-centric work environment.

Rising Cybersecurity Threats

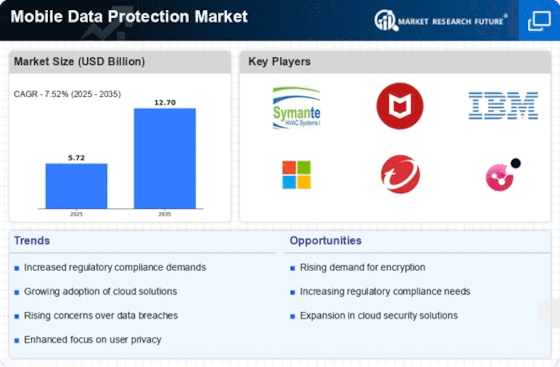

The Mobile Data Protection Market is experiencing heightened demand due to the increasing frequency and sophistication of cyber threats. Organizations are compelled to invest in robust mobile data protection solutions to safeguard sensitive information from breaches and unauthorized access. According to recent statistics, cyberattacks targeting mobile devices have surged by over 30% in the past year, prompting businesses to prioritize mobile security. This trend indicates a growing recognition of the vulnerabilities associated with mobile data, leading to a significant uptick in the adoption of protective measures. As a result, the Mobile Data Protection Market is likely to witness substantial growth as companies seek to mitigate risks and ensure compliance with data protection regulations.

Growing Awareness of Data Privacy

The Mobile Data Protection Market is benefiting from a heightened awareness of data privacy among consumers and businesses alike. As data breaches and privacy violations become more prevalent, stakeholders are increasingly prioritizing the protection of personal information. This awareness is prompting organizations to invest in mobile data protection solutions to build trust with customers and comply with privacy expectations. Recent surveys indicate that over 75% of consumers are concerned about their data privacy, influencing businesses to adopt more stringent data protection measures. This trend is likely to drive growth in the Mobile Data Protection Market as organizations seek to align their practices with consumer expectations and regulatory requirements.

Regulatory Compliance Requirements

The Mobile Data Protection Market is significantly influenced by stringent regulatory frameworks that mandate the protection of personal and sensitive data. Regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) impose heavy penalties for non-compliance, driving organizations to implement comprehensive mobile data protection strategies. As businesses strive to adhere to these regulations, the demand for mobile data protection solutions is expected to rise. In fact, a recent survey indicated that over 60% of organizations consider regulatory compliance as a primary driver for investing in mobile data protection technologies. This trend underscores the critical role of compliance in shaping the Mobile Data Protection Market.

Technological Advancements in Security Solutions

The Mobile Data Protection Market is being propelled by rapid advancements in security technologies. Innovations such as artificial intelligence, machine learning, and encryption techniques are enhancing the effectiveness of mobile data protection solutions. These technologies enable organizations to detect and respond to threats in real-time, thereby improving overall security posture. For instance, the integration of AI-driven analytics in mobile data protection solutions has shown to reduce response times to security incidents by up to 50%. As organizations increasingly adopt these advanced technologies, the Mobile Data Protection Market is poised for significant growth, driven by the demand for more sophisticated and efficient security measures.