Rising DIY Culture

The One Component Polyurethane Foam Market is witnessing a notable impact from the rising do-it-yourself (DIY) culture. As more individuals engage in home improvement projects, the demand for user-friendly and effective insulation materials has surged. One component polyurethane foam is particularly appealing to DIY enthusiasts due to its ease of use and quick curing time. Market data suggests that the DIY home improvement sector is expected to grow by approximately 6% annually, which directly correlates with the increased consumption of one component polyurethane foam. This trend is likely to encourage manufacturers to develop products tailored for the DIY market, further driving the One Component Polyurethane Foam Market. The intersection of DIY culture and the construction industry presents a unique opportunity for growth.

Technological Innovations

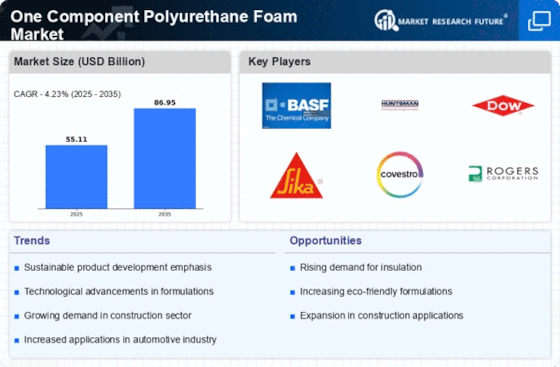

Technological advancements play a crucial role in shaping the One Component Polyurethane Foam Market. Innovations in formulation and application techniques have enhanced the performance characteristics of one component polyurethane foam, making it more versatile and user-friendly. For instance, the introduction of low-pressure dispensing systems has simplified the application process, allowing for more efficient use of the product. Additionally, advancements in chemical formulations have improved the foam's adhesion properties and durability. As a result, the market is witnessing an influx of new products that cater to specific applications, such as automotive and construction. This continuous evolution of technology is expected to drive growth in the One Component Polyurethane Foam Market, as manufacturers strive to meet the changing needs of consumers.

Rising Construction Activities

The One Component Polyurethane Foam Market is experiencing a surge due to increasing construction activities across various sectors. As urbanization continues to expand, the demand for efficient insulation materials has risen significantly. In 2025, the construction sector is projected to grow at a rate of approximately 5.5% annually, which directly influences the consumption of one component polyurethane foam. This material is favored for its ease of application and superior insulation properties, making it a preferred choice for both residential and commercial projects. Furthermore, the trend towards energy-efficient buildings is likely to bolster the market, as one component polyurethane foam contributes to reducing energy consumption. Thus, the growth in construction activities is a pivotal driver for the One Component Polyurethane Foam Market.

Growth in the Automotive Sector

The One Component Polyurethane Foam Market is also benefiting from the expansion of the automotive sector. As manufacturers increasingly focus on lightweight materials to enhance fuel efficiency, one component polyurethane foam is gaining traction due to its lightweight and insulating properties. The automotive industry is projected to grow at a compound annual growth rate of around 4%, which is likely to increase the demand for innovative materials like one component polyurethane foam. This foam is utilized in various applications, including soundproofing and thermal insulation, making it an attractive option for automotive manufacturers. The synergy between the automotive sector and the One Component Polyurethane Foam Market is expected to foster further growth and innovation.

Increased Demand for Energy Efficiency

The One Component Polyurethane Foam Market is significantly driven by the rising demand for energy-efficient solutions. As energy costs continue to escalate, consumers and businesses alike are seeking materials that enhance thermal insulation and reduce energy consumption. One component polyurethane foam is recognized for its excellent insulating properties, which can lead to substantial energy savings. Reports indicate that buildings insulated with this foam can achieve energy savings of up to 30% compared to traditional materials. This growing awareness of energy efficiency is prompting architects and builders to incorporate one component polyurethane foam into their designs, thereby propelling the market forward. The emphasis on sustainability and energy conservation is likely to remain a key factor influencing the One Component Polyurethane Foam Market.