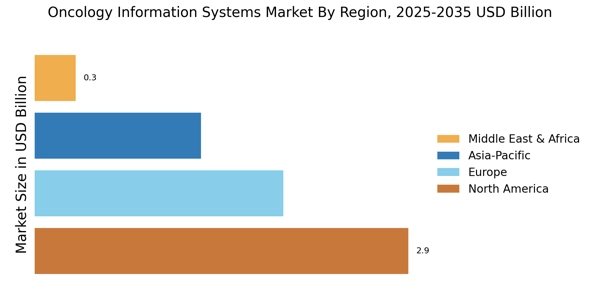

North America : Leading Innovation and Adoption

North America is the largest market for Oncology Information Systems Market, holding approximately 45% of the global market share. The region's growth is driven by advanced healthcare infrastructure, increasing cancer prevalence, and significant investments in healthcare technology. Regulatory support from agencies like the FDA further catalyzes innovation and adoption of new technologies, enhancing treatment options and patient outcomes.

The United States is the primary contributor to this market, with key players such as Varian Medical Systems, McKesson Corporation, and Cerner Corporation leading the competitive landscape. The presence of established healthcare systems and a focus on personalized medicine are pivotal in shaping market dynamics. Additionally, ongoing collaborations between technology firms and healthcare providers are expected to drive further advancements in oncology information systems.

Europe : Emerging Regulatory Frameworks

Europe is the second-largest market for Oncology Information Systems Market, accounting for approximately 30% of the global market share. The region's growth is fueled by increasing cancer incidence, a strong emphasis on research and development, and supportive regulatory frameworks. The European Medicines Agency (EMA) plays a crucial role in ensuring that innovative therapies are accessible, thereby enhancing market dynamics and patient care.

Leading countries in this region include Germany, France, and the UK, where significant investments in healthcare technology are evident. Key players like Siemens Healthineers and Philips Healthcare are actively involved in developing advanced oncology solutions. The competitive landscape is characterized by collaborations between public and private sectors, aiming to improve treatment outcomes and streamline healthcare delivery.

Asia-Pacific : Rapid Growth and Adoption

Asia-Pacific is witnessing rapid growth in the Oncology Information Systems Market, driven by increasing healthcare expenditure, rising cancer rates, and a growing awareness of advanced treatment options. The region holds approximately 20% of the global market share, with countries like China and India leading the charge. Government initiatives aimed at improving healthcare infrastructure and access to oncology services are significant growth catalysts.

China is emerging as a key player in this market, with substantial investments in healthcare technology and a focus on integrating digital solutions into oncology care. The competitive landscape features both local and international players, including Elekta and OncoOne, who are striving to meet the increasing demand for effective oncology information systems. The region's diverse healthcare needs present unique opportunities for innovation and collaboration.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa region is gradually emerging in the Oncology Information Systems Market, holding about 5% of the global market share. Growth is driven by increasing investments in healthcare infrastructure, rising cancer prevalence, and a focus on improving patient care. Governments are implementing policies to enhance healthcare access, which is expected to further stimulate market growth in the coming years.

Countries like South Africa and the UAE are leading the way in adopting advanced oncology solutions. The competitive landscape is characterized by a mix of local and international players, with a growing presence of companies like McKesson Corporation. As healthcare systems evolve, there is a significant opportunity for innovation and partnerships to address the unique challenges faced in oncology care across the region.