Rising Cancer Incidence

The oncology information-systems market is experiencing growth due to the increasing incidence of cancer in the UK. According to recent statistics, cancer cases are projected to rise by approximately 2.5% annually, leading to a heightened demand for advanced information systems that can manage patient data effectively. This trend necessitates the implementation of sophisticated oncology information systems to streamline treatment processes and enhance patient outcomes. As healthcare providers seek to improve their capabilities in managing cancer care, the oncology information-systems market is likely to expand significantly. The integration of these systems allows for better tracking of patient progress and treatment efficacy, which is crucial in a landscape where timely and accurate data is paramount. Consequently, the rising cancer incidence is a key driver for the oncology information-systems market, pushing for innovation and investment in this sector.

Technological Advancements

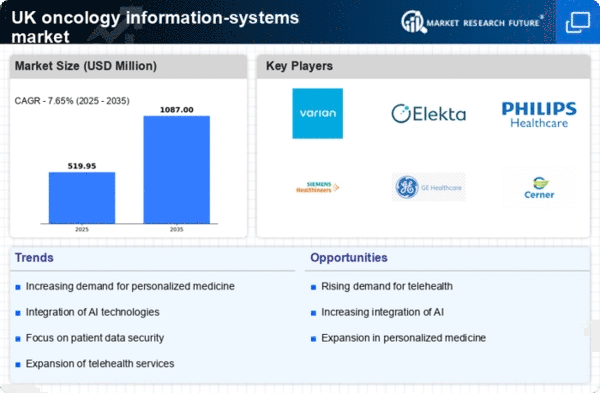

Technological advancements play a pivotal role in shaping the oncology information-systems market. Innovations in data analytics, cloud computing, and machine learning are transforming how healthcare providers manage cancer treatment. For instance, the adoption of cloud-based solutions is expected to increase by over 30% in the coming years, facilitating real-time data access and collaboration among healthcare professionals. These advancements enable more efficient patient management, allowing for personalized treatment plans based on comprehensive data analysis. Furthermore, the integration of telemedicine within oncology information systems is enhancing patient engagement and follow-up care. As technology continues to evolve, the oncology information-systems market is likely to benefit from these developments, leading to improved patient outcomes and operational efficiencies in cancer care.

Growing Demand for Data Security

Data security concerns are increasingly influencing the oncology information-systems market. With the rise in cyber threats and data breaches, healthcare organizations in the UK are prioritizing the protection of sensitive patient information. The oncology information-systems market is responding to this demand by integrating advanced security features, such as encryption and multi-factor authentication, into their platforms. According to industry reports, nearly 40% of healthcare organizations have experienced a data breach in the past year, underscoring the need for robust security measures. As regulations surrounding data protection become more stringent, the oncology information-systems market is likely to see a surge in demand for solutions that ensure compliance and safeguard patient data. This focus on data security is essential for maintaining trust and integrity within the healthcare system.

Government Initiatives and Funding

Government initiatives and funding are crucial drivers for the oncology information-systems market. The UK government has committed substantial resources to enhance cancer care, with funding allocations reaching £600 million for cancer services in recent years. This financial support is aimed at improving diagnostic capabilities and treatment options, which directly influences the demand for advanced oncology information systems. By investing in digital health technologies, the government seeks to streamline cancer care processes and improve patient outcomes. Additionally, initiatives promoting the adoption of electronic health records (EHRs) are likely to bolster the oncology information-systems market, as these systems facilitate better data management and interoperability among healthcare providers. As a result, government support is a significant factor driving the growth of the oncology information-systems market.

Increased Focus on Patient-Centric Care

The oncology information-systems market is increasingly driven by a focus on patient-centric care. Healthcare providers in the UK are prioritizing patient engagement and satisfaction, leading to a demand for systems that enhance communication and support personalized treatment plans. The shift towards patient-centric models is reflected in the growing adoption of oncology information systems that facilitate shared decision-making and provide patients with access to their health data. This trend is likely to continue, as studies indicate that patient involvement in their care can lead to improved treatment adherence and outcomes. Consequently, the emphasis on patient-centric care is shaping the oncology information-systems market, prompting the development of tools that empower patients and enhance their overall experience in cancer treatment.