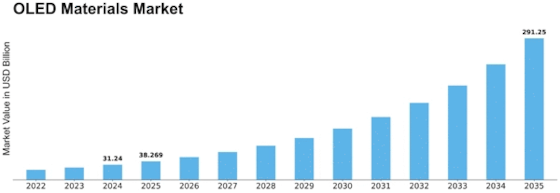

Oled Materials Size

OLED Materials Market Growth Projections and Opportunities

The market factors influencing the OLED (Organic Light-Emitting Diode) materials market are multifaceted, shaping its growth trajectory and dynamics. One significant factor is technological advancements. As OLED technology continues to evolve, demand for materials with improved performance and efficiency escalates. Manufacturers strive to develop materials capable of enhancing display quality, reducing power consumption, and extending device lifespan, thereby driving market growth.

OLED Materials Market Size was valued at USD 20.8 Billion in 2022. The OLED Materials market is projected to grow from USD 25.5 Billion in 2023 to USD 129.2 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 22.50% during the forecast period (2023 - 2032)

Moreover, the expanding consumer electronics sector plays a pivotal role. With the proliferation of smartphones, tablets, televisions, and wearable devices, the demand for OLED displays surges. These displays offer vibrant colors, high contrast ratios, and flexible form factors, aligning with the preferences of modern consumers. As a result, the demand for OLED materials, such as organic compounds and conductive polymers, experiences a steady rise.

Market factors also encompass environmental considerations. OLED technology is renowned for its energy efficiency and eco-friendliness compared to traditional LCD displays. Governments worldwide are enforcing stringent regulations to curb carbon emissions and promote sustainable practices. Consequently, industries are transitioning towards OLED technology, fostering the demand for materials that facilitate environmentally conscious manufacturing processes.

Additionally, market dynamics are influenced by competitive forces. As the OLED materials market expands, competition among suppliers intensifies. Companies endeavor to gain a competitive edge by innovating new materials, optimizing production processes, and establishing strategic partnerships. This competition fosters innovation and drives down costs, making OLED technology more accessible to a broader range of applications.

Furthermore, macroeconomic factors such as GDP growth, consumer spending, and industrialization exert a significant influence. Economic prosperity correlates with increased consumer purchasing power, driving demand for electronic devices equipped with OLED displays. Emerging economies, in particular, present lucrative opportunities for market expansion, as rising disposable incomes propel the adoption of premium electronic products.

Supply chain dynamics also impact the OLED materials market. Material availability, sourcing, and manufacturing capabilities influence market dynamics. Fluctuations in raw material prices, geopolitical tensions, and disruptions in supply chains can disrupt market equilibrium and affect pricing strategies. Companies must adopt robust supply chain management practices to mitigate risks and ensure uninterrupted material supply.

Moreover, regulatory policies and standards shape market dynamics. Compliance with industry regulations regarding product safety, performance, and environmental impact is imperative for market players. Stringent regulatory requirements may necessitate investments in research and development to develop compliant materials and manufacturing processes. Conversely, regulatory initiatives promoting innovation and sustainability can stimulate market growth by incentivizing investments in OLED technology.

Consumer preferences and trends also drive market evolution. As consumers demand sleeker, more immersive displays with enhanced functionality, manufacturers must continually innovate to meet these expectations. Trends such as foldable displays, transparent screens, and augmented reality interfaces present opportunities for OLED technology, driving demand for specialized materials tailored to these applications.

Leave a Comment