North America : Growing Renewable Energy Sector

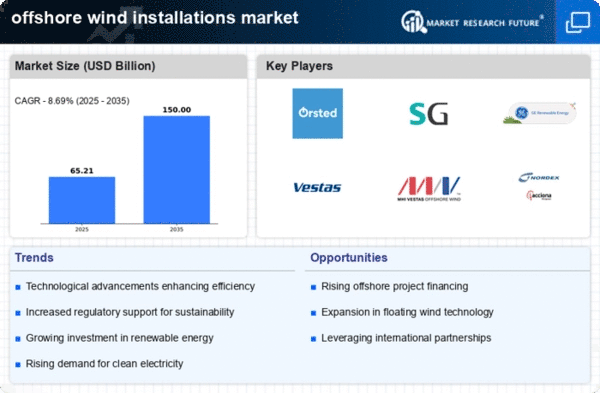

The offshore wind installations market in North America is poised for significant growth, driven by increasing demand for renewable energy and supportive regulatory frameworks. With a market size of $10.0 billion, the region is witnessing a surge in investments aimed at achieving sustainability goals. The U.S. government has set ambitious targets for offshore wind capacity, which is expected to catalyze further development and innovation in this sector. Leading the charge in North America are the United States and Canada, where states like New York and California are implementing aggressive policies to expand offshore wind capacity. Key players such as GE Renewable Energy and Siemens Gamesa are actively involved in projects, enhancing competition and technological advancements. The presence of established companies and new entrants is expected to drive market dynamics, positioning North America as a significant player in the global offshore wind landscape.

Europe : Global Leader in Offshore Wind

Europe continues to dominate the offshore wind installations market, holding a substantial market share of $35.0 billion. The region benefits from strong governmental support, ambitious climate targets, and a well-established supply chain. Countries like Germany, the UK, and Denmark are at the forefront, implementing policies that encourage investment and innovation in renewable energy technologies. The European Green Deal aims to significantly increase offshore wind capacity, further driving market growth. The competitive landscape in Europe is robust, featuring key players such as Orsted, Vestas, and Siemens Gamesa. These companies are leading the charge in technological advancements and project development, ensuring Europe remains a global leader in offshore wind. The region's commitment to sustainability and renewable energy is reflected in its investments and regulatory frameworks, making it an attractive market for both domestic and international investors. "The European Union aims to have at least 300 GW of offshore wind capacity by 2050," European Commission.

Asia-Pacific : Emerging Market Potential

The Asia-Pacific region is rapidly emerging as a significant player in the offshore wind installations market, with a market size of $12.0 billion. Driven by increasing energy demands and government initiatives to reduce carbon emissions, countries like China and Japan are investing heavily in offshore wind projects. The region's growth is further supported by favorable policies and incentives aimed at promoting renewable energy sources, positioning it as a key market for future investments. China is leading the charge in the Asia-Pacific region, with ambitious targets for offshore wind capacity and significant investments in technology and infrastructure. Other countries, including Japan and South Korea, are also making strides in this sector, fostering a competitive landscape. Key players such as MHI Vestas and Nordex are actively participating in the market, contributing to technological advancements and project development, which are essential for meeting the region's growing energy needs.

Middle East and Africa : Untapped Renewable Resources

The offshore wind installations market in the Middle East and Africa is still in its infancy, with a market size of $3.0 billion. However, the region is beginning to recognize the potential of offshore wind as a viable energy source. Governments are increasingly focusing on diversifying their energy portfolios and investing in renewable energy projects to meet growing energy demands and sustainability goals. Regulatory frameworks are gradually evolving to support offshore wind development, indicating a positive trend for future growth. Countries like South Africa and Morocco are exploring offshore wind projects, aiming to harness their vast coastal resources. The competitive landscape is still developing, with few key players currently involved. However, as awareness and investment in renewable energy increase, the region is expected to attract more international players and investments, paving the way for a more robust offshore wind market.