Increasing Energy Demand

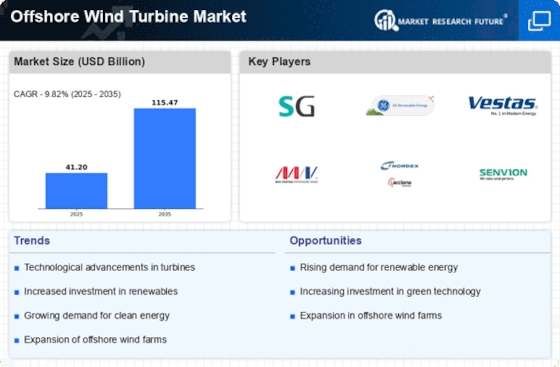

The Offshore Wind Turbine Market is experiencing a surge in demand for renewable energy sources, driven by the global shift towards sustainable energy solutions. As populations grow and economies expand, the need for clean energy becomes more pressing. According to recent data, energy consumption is projected to rise by approximately 30% by 2040. This increasing energy demand is likely to propel investments in offshore wind projects, as they offer a viable solution to meet future energy needs while reducing carbon emissions. The Offshore Wind Turbine Market is thus positioned to benefit from this trend, as more countries seek to diversify their energy portfolios and enhance energy security.

Technological Innovations

Technological advancements in turbine design and efficiency are transforming the Offshore Wind Turbine Market. Innovations such as larger rotor diameters and improved materials are enhancing energy capture and reducing costs. For instance, the latest turbine models can generate power even in lower wind conditions, which expands the operational viability of offshore wind farms. Furthermore, advancements in floating turbine technology are enabling installations in deeper waters, where wind resources are often more abundant. These innovations not only improve the economic feasibility of offshore wind projects but also contribute to the overall growth of the Offshore Wind Turbine Market, as they attract investment and facilitate larger-scale deployments.

Government Incentives and Policies

Supportive government policies and incentives are crucial drivers for the Offshore Wind Turbine Market. Many countries have established ambitious renewable energy targets, often backed by financial incentives such as tax credits, grants, and subsidies for offshore wind projects. For example, several nations aim to achieve net-zero emissions by 2050, which necessitates a significant increase in renewable energy capacity. This regulatory environment encourages private investment and fosters innovation within the Offshore Wind Turbine Market. As governments continue to prioritize clean energy initiatives, the market is likely to see accelerated growth and development, paving the way for a more sustainable energy future.

Rising Investment in Renewable Energy

The Offshore Wind Turbine Market is witnessing a notable increase in investment as stakeholders recognize the long-term benefits of renewable energy. Financial institutions and private investors are increasingly allocating funds to offshore wind projects, driven by the potential for stable returns and the growing demand for clean energy. Recent reports indicate that investments in offshore wind are expected to reach over 200 billion dollars by 2030. This influx of capital not only supports the development of new projects but also enhances research and development efforts within the Offshore Wind Turbine Market, fostering innovation and efficiency improvements that can further drive market growth.

Environmental and Climate Change Concerns

The growing awareness of environmental issues and climate change is significantly influencing the Offshore Wind Turbine Market. As the impacts of climate change become more evident, there is an increasing urgency to transition to renewable energy sources. Offshore wind energy is viewed as a key solution to mitigate greenhouse gas emissions and combat climate change. The Offshore Wind Turbine Market is thus positioned to play a vital role in achieving international climate goals, as countries commit to reducing their carbon footprints. This heightened focus on sustainability is likely to drive further investments and policy support, reinforcing the market's growth trajectory.

.png)