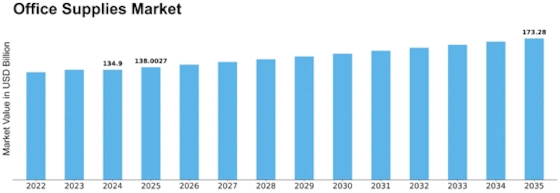

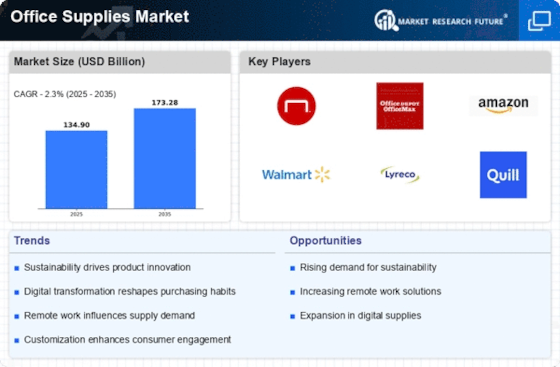

Office Supplies Size

Office Supplies Market Growth Projections and Opportunities

The office supplies market is driven by several factors that cumulatively dictates its dynamics. One important element is general economic performance of the region or country. During periods of relative economic stability, companies grow and hence more office supplies are needed. On the contrary, in times of economic recession organizations may lead to minimize their budgets and therefore have a negative effect on market. The evolution of technology is also a fundamental contributor towards the development of global office supplies. Digitalization has caused a reduction in paper and pen as office commodities while the accessory to electronic equipment increased its demand. The development of the remote work phenomenon, additionally accelerated by communication technology improvements has increased demand for home office supplies. Another contributing factor is global supply chain dynamics. The market for office supplies is very resource-dependent in terms of raw materials and efficient supply chains. Disruptions, including natural disasters or similar effects of geopolitical nature may induce shortages and price fluctuations affecting both the suppliers as well consumers. One of the major factors that influence market trends is consumer preference and behavior. With sustainability gaining momentum in consumers’ concerns, there is rising popularity of eco-friendly office supplies. Companies that make environmentally friendly products have an edge in this dynamic market. Government laws and policies also influence the market for office supplies. The legislative regulations regarding environmental standards, product safety and under trade agreements can affect the production, distribution, and price of office supplies. This is obligatory for those businesses that run in this industry to comply with these regulations. The office supplies market competition is fierce, with several competitors fighting for a share of the market. Major firms adopt strategies such as pricing, product innovation and marketing clearly define the dynamics of market trends. Furth One of the most important market factors is consumer buying power. Economic inequality and variations in the amount of disposal income available between individual consumers, as well as businesses determine their buying decisions. These variations must be understood and incorporated into businesses within the office supplies industry. The use of e-commerce and online stores is changing the retail aspect in the world market for office supplies. This means that there is improved accessibility and convenience of consumers in purchasing office supplies online leading to a change from the fixed retail structure. And this change should be for businesses to remain competitive and meet the changing customer needs.

Leave a Comment