Geopolitical Factors

Geopolitical factors significantly impact the Global OCTG Market Industry, as political stability in oil-producing regions directly influences supply chains and market dynamics. Tensions in key regions can lead to fluctuations in oil prices, which in turn affect investment in OCTG Market products. For instance, instability in the Middle East has historically resulted in supply disruptions, prompting companies to seek alternative sources. As the global energy landscape evolves, understanding these geopolitical influences will be crucial for stakeholders in the OCTG Market. The interplay between politics and energy supply is expected to remain a critical driver of market trends.

Rising Demand for Energy

The Global OCTG Market Industry is experiencing heightened demand driven by the increasing need for energy resources. As countries strive to secure energy independence, investments in oil and gas exploration and production are surging. This trend is particularly evident in regions such as North America and the Middle East, where significant reserves are being tapped. The market is projected to reach 20.9 USD Billion in 2024, reflecting a robust growth trajectory. The push for energy security is likely to sustain this demand, thereby bolstering the OCTG Market sector as it supplies essential products for drilling and extraction activities.

Environmental Regulations

The Global OCTG Market Industry is increasingly influenced by stringent environmental regulations aimed at reducing the carbon footprint of energy production. Governments worldwide are implementing policies that require the use of advanced OCTG Market products that comply with environmental standards. This shift is prompting manufacturers to innovate and develop more sustainable solutions, such as products that minimize leakage and enhance energy efficiency. While these regulations may pose challenges, they also present opportunities for growth in the market as companies adapt to meet new standards. The focus on sustainability is likely to shape the future landscape of the OCTG industry.

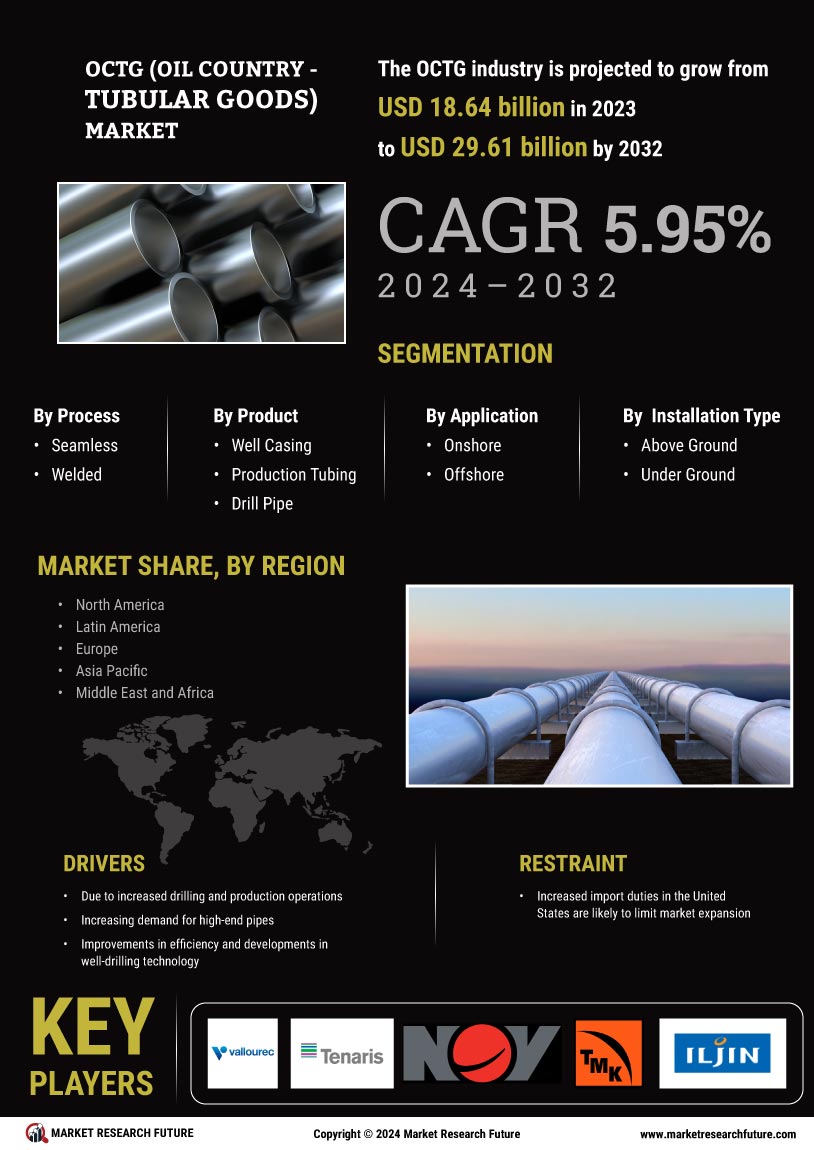

Market Growth Projections

The Global OCTG Market Industry is on a growth trajectory, with projections indicating a market size of 20.9 USD Billion in 2024 and an anticipated increase to 39.5 USD Billion by 2035. This growth is underpinned by a compound annual growth rate of 5.95% from 2025 to 2035. The increasing demand for energy resources, coupled with technological advancements and infrastructure development, is likely to propel the market forward. Stakeholders should closely monitor these trends, as they will shape investment strategies and operational decisions in the coming years.

Infrastructure Development

Infrastructure development plays a pivotal role in the Global OCTG Market Industry, particularly in emerging economies. The expansion of pipelines, refineries, and processing facilities necessitates a steady supply of OCTG Market products. Countries such as India and Brazil are investing heavily in their energy infrastructure, which is anticipated to create substantial demand for OCTG Market. This trend is likely to be further amplified by government initiatives aimed at boosting domestic production capabilities. As a result, the market is poised for sustained growth, with a compound annual growth rate of 5.95% projected from 2025 to 2035.

Technological Advancements

Technological innovations are reshaping the Global OCTG Market Industry, enhancing the efficiency and safety of oil and gas operations. Advanced materials and manufacturing techniques are leading to the production of stronger and more durable OCTG Market products. For instance, the introduction of premium connections and corrosion-resistant alloys has improved performance in challenging environments. These advancements not only reduce operational costs but also extend the lifespan of OCTG Market products. As the industry evolves, the adoption of these technologies is expected to drive market growth, contributing to the projected increase to 39.5 USD Billion by 2035.