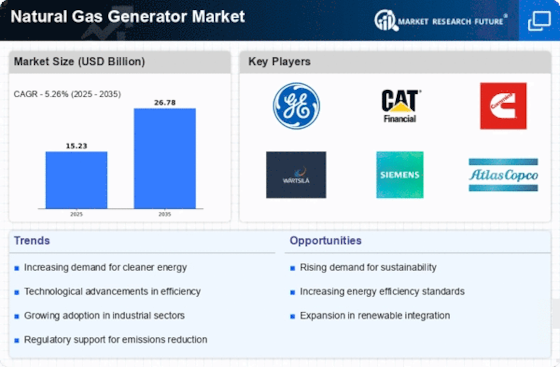

Economic Viability of Natural Gas

The economic advantages of natural gas are significantly influencing the Natural Gas Generator Market. As natural gas prices remain relatively stable compared to other fuels, businesses are increasingly turning to natural gas generators as a cost-effective energy solution. In 2025, the market is projected to expand as companies seek to reduce operational costs while maintaining energy reliability. The lower fuel costs associated with natural gas, combined with the efficiency of modern generators, contribute to a favorable return on investment. Additionally, the availability of natural gas infrastructure in many regions further enhances its appeal. This economic viability positions the Natural Gas Generator Market as a competitive alternative to traditional energy sources, potentially leading to increased adoption across various sectors.

Government Policies and Incentives

Government policies and incentives are pivotal in shaping the Natural Gas Generator Market. Many governments are implementing policies that promote the use of cleaner energy sources, including natural gas. In 2025, these initiatives are expected to drive market growth as financial incentives, such as tax credits and grants, encourage businesses to invest in natural gas generators. Furthermore, regulatory frameworks that support the transition to cleaner energy are likely to enhance the attractiveness of natural gas as a fuel source. The alignment of government objectives with industry needs creates a conducive environment for the Natural Gas Generator Market to thrive. As policies evolve to support sustainable energy practices, the market is poised for expansion, reflecting a broader commitment to reducing greenhouse gas emissions.

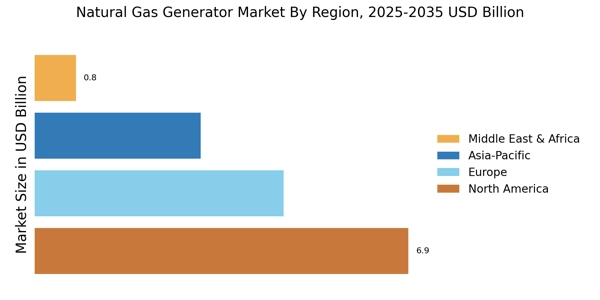

Rising Infrastructure Development Projects

Infrastructure development projects are a significant driver for the Natural Gas Generator Market. As countries invest in upgrading their infrastructure, the demand for reliable power sources increases. Natural gas generators are often deployed in construction sites, remote locations, and temporary facilities due to their portability and efficiency. In 2025, the market is likely to see a surge in demand as governments and private sectors embark on large-scale infrastructure initiatives. The ability of natural gas generators to provide consistent power in areas lacking grid connectivity makes them an essential component of these projects. Furthermore, the trend towards urbanization and the need for resilient energy solutions in developing regions are expected to bolster the Natural Gas Generator Market, creating new opportunities for growth.

Increasing Demand for Clean Energy Solutions

The Natural Gas Generator Market is experiencing a notable shift towards cleaner energy solutions. As environmental regulations tighten, industries are increasingly seeking alternatives to traditional fossil fuels. Natural gas generators, known for their lower emissions compared to diesel or coal, are becoming a preferred choice. In 2025, the demand for natural gas generators is projected to rise significantly, driven by the need for sustainable energy sources. This trend is further supported by government incentives aimed at reducing carbon footprints. The transition to cleaner energy not only aligns with regulatory requirements but also appeals to consumers who are increasingly environmentally conscious. As a result, the Natural Gas Generator Market is likely to witness robust growth, as businesses and municipalities invest in cleaner technologies.

Technological Innovations in Generator Design

Technological advancements are playing a crucial role in shaping the Natural Gas Generator Market. Innovations in generator design, such as improved efficiency and enhanced control systems, are making natural gas generators more attractive to end-users. For instance, the integration of smart technologies allows for real-time monitoring and optimization of generator performance. This not only enhances operational efficiency but also reduces maintenance costs. In 2025, the market is expected to benefit from these advancements, as manufacturers continue to invest in research and development. The introduction of hybrid systems that combine natural gas with renewable energy sources further exemplifies the potential for innovation in this sector. Consequently, the Natural Gas Generator Market is poised for growth as these technological improvements become more prevalent.