Geopolitical Factors

Geopolitical influences are significantly impacting the Europe Octg Market, as regional stability and international relations play a crucial role in energy supply and demand. Tensions in Eastern Europe, particularly concerning energy supply routes, have led to increased scrutiny of OCTG sourcing and procurement strategies. Countries are seeking to diversify their energy sources to mitigate risks associated with geopolitical uncertainties. This shift may result in increased investments in domestic oil and gas production, thereby driving demand for OCTG products. Additionally, the European Union's efforts to enhance energy independence could lead to a rise in exploration activities, further stimulating the Europe Octg Market. Stakeholders must remain vigilant to geopolitical developments that could influence market dynamics.

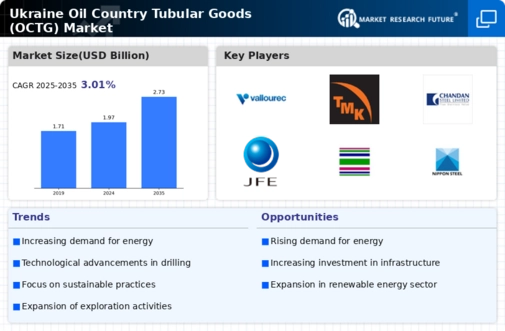

Increasing Energy Demand

The Europe Octg Market is currently experiencing a surge in energy demand, driven by the region's growing population and industrial activities. As countries strive to meet their energy needs, the demand for oil and gas exploration and production is likely to increase. This trend is particularly evident in Eastern Europe, where investments in energy infrastructure are on the rise. According to recent data, the European Union aims to enhance its energy security, which may lead to increased drilling activities. Consequently, the demand for oil country tubular goods (OCTG) is expected to grow, as these products are essential for drilling and production operations. The Europe Octg Market must adapt to this increasing demand by ensuring the availability of high-quality OCTG products to support the energy sector.

Technological Innovations

Technological advancements are transforming the Europe Octg Market, enhancing efficiency and reducing costs in oil and gas exploration and production. Innovations such as advanced drilling techniques, including horizontal drilling and hydraulic fracturing, are becoming increasingly prevalent. These technologies require specialized OCTG products that can withstand higher pressures and temperatures. As a result, manufacturers in the Europe Octg Market are investing in research and development to produce high-performance OCTG solutions. Furthermore, the integration of digital technologies, such as data analytics and automation, is streamlining operations and improving decision-making processes. This technological evolution is likely to drive the demand for advanced OCTG products, positioning the Europe Octg Market for growth in the coming years.

Investment in Infrastructure

Investment in energy infrastructure is a key driver for the Europe Octg Market, as countries seek to modernize and expand their oil and gas capabilities. Significant funding is being allocated to enhance pipeline networks, drilling facilities, and processing plants across Europe. For instance, the European Commission has identified energy infrastructure as a priority area for investment, with plans to allocate substantial resources to support projects that enhance energy security. This influx of capital is likely to stimulate demand for OCTG products, as new drilling projects require high-quality tubular goods. Furthermore, the ongoing transition towards cleaner energy sources may also necessitate the development of new infrastructure, creating additional opportunities for the Europe Octg Market. As such, infrastructure investment is poised to play a pivotal role in shaping the future of the OCTG market in Europe.

Regulatory Framework and Policies

The regulatory landscape surrounding the Europe Octg Market plays a crucial role in shaping market dynamics. Governments across Europe are implementing stringent regulations aimed at ensuring environmental sustainability and safety in oil and gas operations. For instance, the European Union's Green Deal emphasizes reducing carbon emissions, which may influence the types of OCTG products used in drilling operations. Compliance with these regulations is essential for companies operating in the OCTG sector, as non-compliance could lead to significant penalties. Moreover, the introduction of policies promoting renewable energy sources may also impact the demand for traditional OCTG products. Therefore, understanding and navigating the regulatory framework is vital for stakeholders in the Europe Octg Market to remain competitive and compliant.